AMD - If you don't care to see a detailed analysis based on Elliott Wave, just move along. These charts are going to present the entire structure of AMD off it's ATL as a 5-wave impulsive pattern and attempting to project where the next levels can be along with we are today using key supports. If you don't like EW, or are one to scoff at it, that's totally fine. It's not the only thing I use to trade. But it is a fantastic outline when applied properly. It gives very clear support and resistance levels. But it's just that, an outline. Trading inside of it takes patience and a lot more technical and standard trading skills.

First, I will reiterate that if you aren't looking at stocks like this in log mode, you are doing yourself a disservice and not looking through the right lens. The channels, trend lines, and fibonacci levels are clear as day when you use log to smooth out the parabolic moves. Often times, the movement of stocks do not follow linear patterns. That would require them to never outperform the constrained structure they start their moves in. And when you factor in leveraged growth, it can make it even more pronounced.

Ok.. the 10 year chart showing where it started through where it is today.

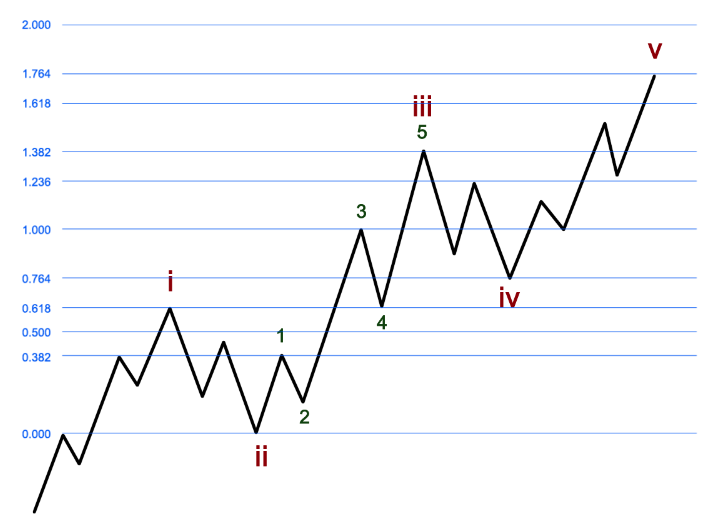

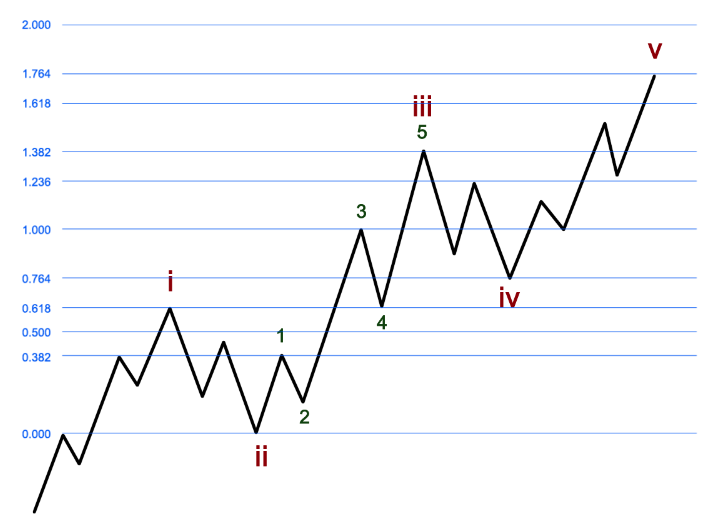

There is a long-term channel here, but it was crowding out other data on the chart so I left off all but the lower trendline. That's pretty much your point of no return if it breaks. There are also fibonacci calcs for every step of this chart, but presenting the chart with those on there can get very cumbersome and hinder an attempt to decipher the meat of what's actually going on. Unless you know, or plan to study and deeply learn Elliott Wave and Fibonacci Pinball, they really don't matter anyway until we get to a shorter term structure. Again, they will likely only confuse and cloud your view. Just know, they are there, and none of the EW rules have been broken. AMD is tracking almost exactly along the standardized path you expect when laying out an EW fib pinball chart after identifying the first and second waves. Here's a picture of fin pinball simplified with a link to learn it if you want to..

What Is Fibonacci Pinball, How Did It Predict the COVID Bust/Boom, and How Did It Predict The Bottoms In Gold & Silver? - ElliottWaveTrader

What Is Fibonacci Pinball, How Did It Predict the COVID Bust/Boom, and How Did It Predict The Bottoms In Gold & Silver? - ElliottWaveTraderAMD starts with 5 clearly visible waves up from 2016 to 2017. Each segment itself breaks down into 5-wave patterns which is the tell-tale sign. Waves are fractal in nature, so the same rules apply on every timeframe. I haven't shown the majority of corrective wave labels that make up 2nd and 4th waves along the way, again, because you should get the picture without them. But AMD came down in its 2nd wave bottoming in 2018.

The most robust wave that takes a stock parabolic is the 3rd wave. And this was no exception. AMD exploded off the Wave [2] (I use brackets for the waves that are outlined in circles on the chart) into the first wave inside of its long-term Wave [3]. Again, being fractal in nature, we expect the third wave to itself break down into 5-wave segments, so we can clearly see (1),(2),(3), and (4).. all making up 4/5ths of our Wave [3]. Notice inside of the (3)rd wave, it also broke down into 5 waves, and you can see the clearly defined channel with the midl-ine acting as incredible support and resistance along the way.

October 2022 marked the bottom of Wave (4) inside of the longer-term Wave [3]. It held above wave (1) of [3] which is an absolute must for any 4th wave to hold its preceding first wave. It happened in choppy fashion that I have labeled ABCDE. But however you want to label that fourth, it's clear that was a significant bottom. From there, it then had a choppy move up in 2023, but failed to retrace much at all following the mid-year top. That told us it was likely a Wave 1 and Wave 2 that had formed pointing to yet another huge move up to finish out the (5)th wave inside of the long-term [3]rd wave. So now let's look at a shorter-term chart and see what it has to do to keep this long-term structure alive and continue its bullishness.

With the overlapping nature of the waves inside of Wave 1, we can determine that this only counts if Wave 1 is a leading diagonal. Diagonals are the only structure allowed overlap within the standard rules. And not just any way can be a diagonal. Only beginning and ending waves of segments can. I really don't like it to be honest, and I struggled with AMD since mid 2023 because of this fact. But the breakout this year has made it to where its the only option, so we're running with it until it breaks.

With the breakout, we can see the wave patterns inside of Wave 3 developing. The standard target for the 3rd wave inside of a larger 3rd wave is 100%-123.6%. Look where AMD tapped in March. 100% almost exactly. It then sold off predictably. The 61.8% extension is the line that can't break if this is to continue going up as expected. And it happens to be the 50% retracement level of the preceding Wave [iii]. That's a massive clue at how big of a support level it is.

So like I mentioned earlier, our stop is below $160. Should $160 hold, our next target is the 138% extension projecting a price of $315. Going back to previous earnings booms, and looking at NVDA last year, it's not out of the question to see a stock in a prized sector jump $100 or more quickly. So that's what I'm showing here. IT DOES NOT MEAN I'M EXPECTING AN EARNINGS BOOM OR THAT THE TOP WILL HAPPEN TIMING WISE AS I LAID OUT. It's just how I have the chart illustrated. I cannot predict the future and the market rarely goes along as planned.

The yellow you see on the chart is showing what would happen in a scenario where the top is in. March high would be assumed to be an expanded (B) wave with a flat double bottom expected next. I have a hard time though picturing AMD at $50. While I'm expecting a selloff in the market sometime this year, that kind of drop would mean the rest of the market has absolutely tanked, likely 50% drawdown or more. And that's just too bearish for me too quickly. But I always have an alternate count in case I need to pivot. So that stays as the long-term alternate until we make a new high.

If you read this far and followed along with the charts, I hope you learned something and got some insight into how I use EW. I can't possibly go through all of the things that happened in the life of this stock to show you how it's played along so nicely. I've already written enough of an essay here. But the only reason I am still looking up, as long as $160 holds, is because the history of the chart has played out exactly as you would draw it up. Until it breaks, I have to stay on program.

Where am I positioned? I'm currently not. But I will definitely buy in if we get a hold of $160 and a clearly impulsive intraday 5-wave move off of it. Earnings could be big.

One last thing, and this is getting in the weeds. But a break of $160 might not be catastrophic long term. 5th waves tend to often turn into diagonals. Diagonals happen when the preceding move went "too far too fast". It shows an exhaustion of bullishness that doesn't quite resume the previous impulsiveness but still melts up in overlapping fashion. When that happens, it's called an ending diagonal. This could absolutely be doing that. You will know if it breaks $160, holds the red line, and then breaks back above the previous high, likely targeting $275. Unfortunately, the nature of ED's means that you likely don't know it, and are bearish on the stock, UNTIL most of that move has happened. That's why they are unreliable trading structures and why I will be avoiding below $160.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)