Stole this from the Politics board.

Interesting commentary from a well regarded but low profile money manager:

The Fed is dealing with what has been called the "Tinbergen dilemma," named for the economist Jan Tinbergen, who first described it. The dilemma describes when a policymaker faces two policy problems but only has one policy tool. It is sometimes described as "trying to shoot two bad guys with one bullet." The Tinbergen dilemma can only be resolved if the two policy problems can be fixed by the same solution. The Fed is facing an economy that is still rather strong (though momentum is clearly weakening), which supports tighter policy, and financial markets that are signaling increasing stress, which begs for easing. What has the financial markets so upset is that there is evidence that, in the past, the Fed has tended to placate the financial markets when facing a similar Tinbergen dilemma.

Essentially, financial markets have become accustomed to being favored when the aforementioned Tinbergen dilemma exists. Powell is trying to weave a path that addresses both but, in reality, it looks like the Fed is more concerned about the economy overheating than it is about a weak stock market or a flattening yield curve. This position increases the likelihood of a policy mistake, one of our four potential threats to the expansion we discussed in our 2019 Outlook.

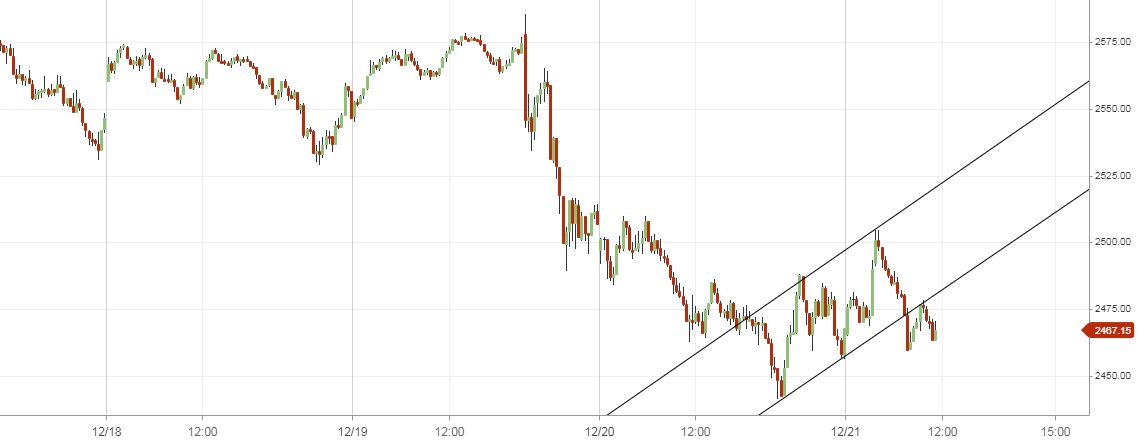

So, what happens now? Equity market valuations are improving and sentiment is becoming increasingly negative. Both tend to favor a bounce at some point. The proverbial "Santa Claus Rally" probably won't happen this year, but we would expect a January bounce.

Interesting commentary from a well regarded but low profile money manager:

The Fed is dealing with what has been called the "Tinbergen dilemma," named for the economist Jan Tinbergen, who first described it. The dilemma describes when a policymaker faces two policy problems but only has one policy tool. It is sometimes described as "trying to shoot two bad guys with one bullet." The Tinbergen dilemma can only be resolved if the two policy problems can be fixed by the same solution. The Fed is facing an economy that is still rather strong (though momentum is clearly weakening), which supports tighter policy, and financial markets that are signaling increasing stress, which begs for easing. What has the financial markets so upset is that there is evidence that, in the past, the Fed has tended to placate the financial markets when facing a similar Tinbergen dilemma.

Essentially, financial markets have become accustomed to being favored when the aforementioned Tinbergen dilemma exists. Powell is trying to weave a path that addresses both but, in reality, it looks like the Fed is more concerned about the economy overheating than it is about a weak stock market or a flattening yield curve. This position increases the likelihood of a policy mistake, one of our four potential threats to the expansion we discussed in our 2019 Outlook.

So, what happens now? Equity market valuations are improving and sentiment is becoming increasingly negative. Both tend to favor a bounce at some point. The proverbial "Santa Claus Rally" probably won't happen this year, but we would expect a January bounce.