My wife's aunt is an independent drug testing and safety rep at rigs in the Permian and EagleFord. Talked to her last night for over an hour and she said that she is seeing people being let go of all capacities left and right. She is on the road everyday of the year working, and said that she is seeing fewer and fewer people and is afraid that its gonna be rough for her being an independent contractor.

Houston..we have a problem....

7,325,593 Views |

28760 Replies |

Last: 4 hrs ago by Caliber

I think we are in for another 2 to 3 dollar drop today. $30 oil here we come.

I've actually seen an increase in drug tests lately here as some contractors are trying to get ahead of the issue and fire people rather than have layoffs. Doesn't mean that trend will continue indefinitely though.

If it drops to $30 I think I'll go long.

I believe Archer in the Permian is doing some more layoffs today. Just what I heard. Apache going down to using three frac fleets in the Permian.

She said she had a bump in Nov and Dec and she is on pace again for December. No indication of what you mentioned, but I think you are correct in your point.

What industries do O&G engineers move to during times like this?

quote:Usedtacould move to aero until ol Barry gutted that sector...

What industries do O&G engineers move to during times like this?

quote:

I've actually seen an increase in drug tests lately here as some contractors are trying to get ahead of the issue and fire people rather than have layoffs. Doesn't mean that trend will continue indefinitely though.

Seeing the same thing at my place. Desk folks too, not just field ops

Likely very little. The drop in oil is basically a $200-250 billion dollar stimulus package for the rest of the country.

quote:

Likely very little. The drop in oil is basically a $200-250 billion dollar stimulus package for the rest of the country.

At what point is it not beneficial to the rest of the country? If $40 is great, then what does $4 oil do? Is that another $200B stimulus?

quote:i don't know if it's that linear, but yes "free" oil would do wonders for the US economyquote:

Likely very little. The drop in oil is basically a $200-250 billion dollar stimulus package for the rest of the country.

At what point is it not beneficial to the rest of the country? If $40 is great, then what does $4 oil do? Is that another $200B stimulus?

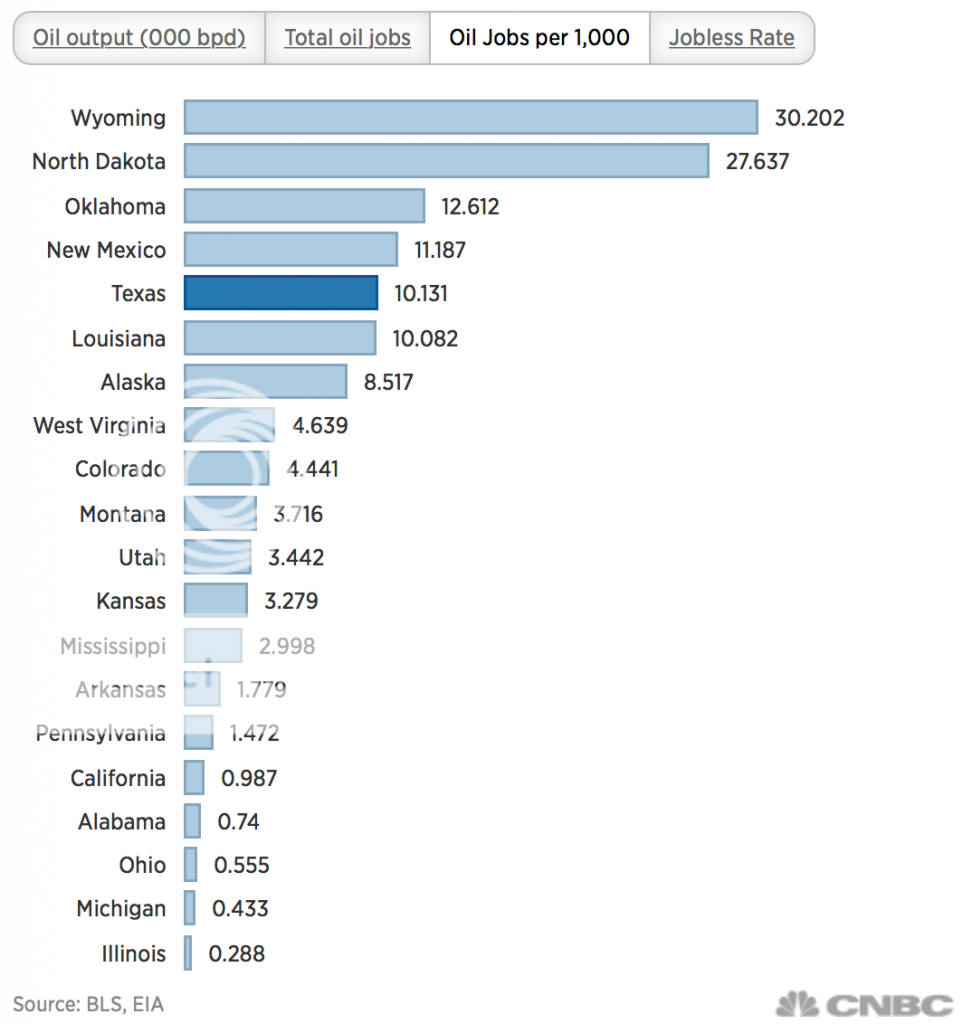

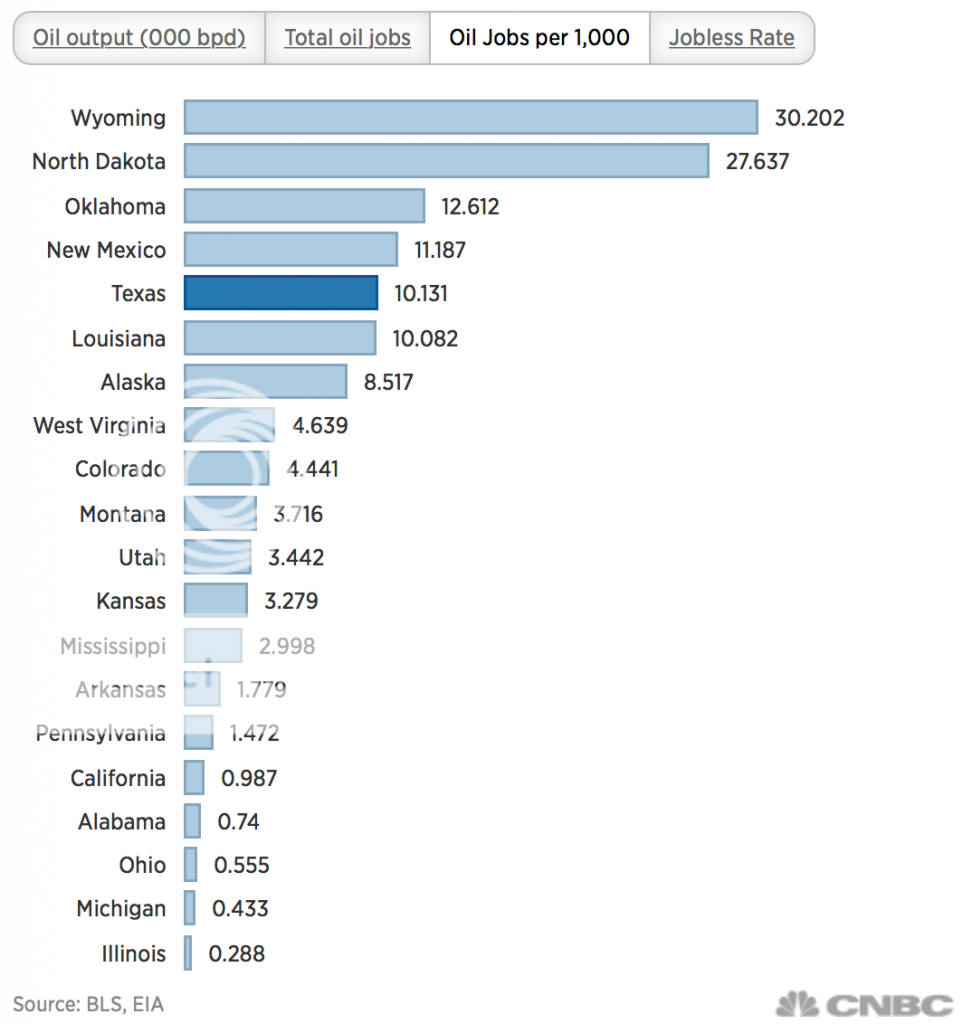

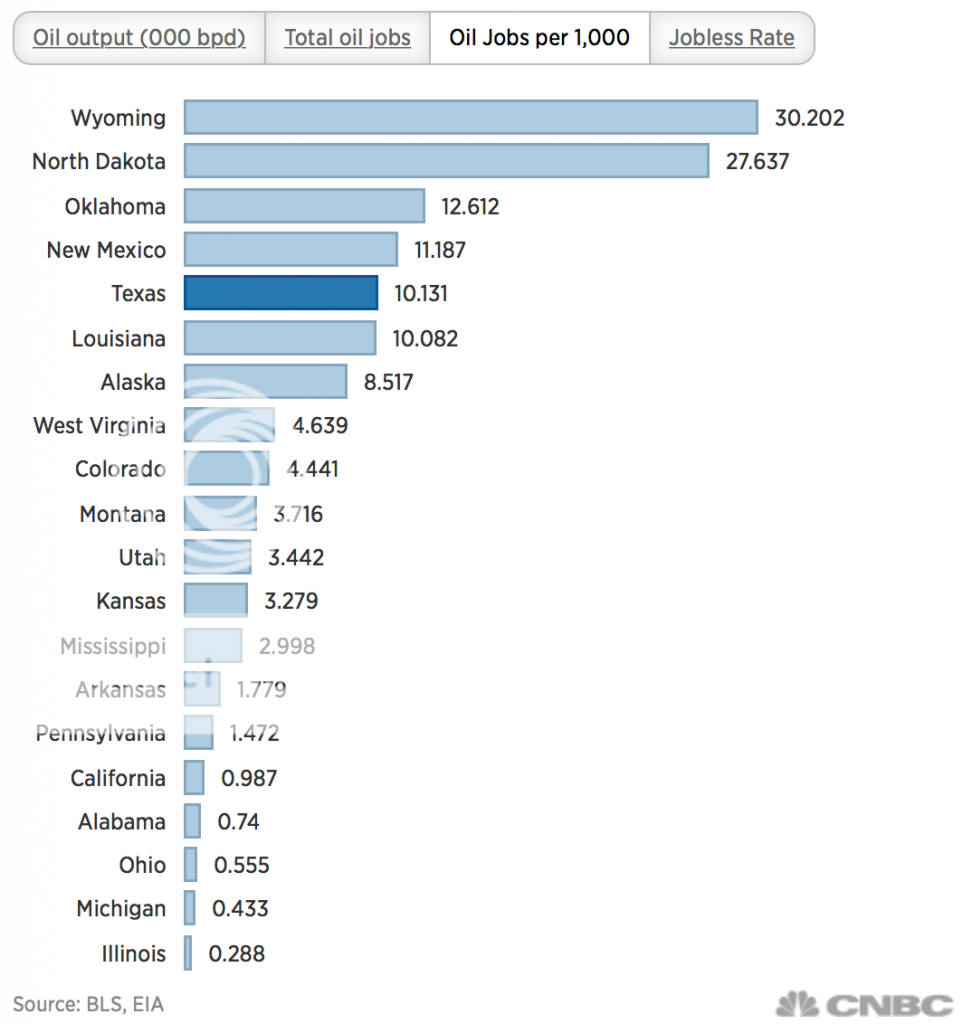

I'd need to talk to an economist to get a surplus welfare estimate, but a drop in oil will hit those states at the top of the graph I posted hardest. The problem is sans TX, those aren't states where a large gain in purchasing power from the general population would be beneficial. What is bad for TX is good for the US economy.

wooohoo back above $45...for the moment

quote:Happy times are here again!!!! Time to buy a boat!!!!

wooohoo back above $45...for the moment

In the long term, "free" oil would cause a major drop in supply. There is a point where the short term gain is outweighed by the long (or at least medium) term spike in prices.

Heck it would probably cause a major supply drop immediately because free is definitely below the marginal cost of production.

Heck it would probably cause a major supply drop immediately because free is definitely below the marginal cost of production.

quote:Yup spot on - I'm actually on the Kitimat pipeline. Still waiting on confirmation, but was asked to rotate 28/28 to Gorgon.

My guess was Kitimat (Apache is in the process of selling their share) and Gorgon or Wheatstone.

There will be minor layoffs in my downstream group for a supermajor next month, but these were announced back in Nov 2014 so not sure if it's directly related to oil or just some cost cutting that needed to happen

It will be interesting to see how the super majors react. I suspect they will take a wait and see approach for the next 6 months or so.

quote:

What industries do O&G engineers move to during times like this?

Construction, manufacturing, high-tech, petrochem, etc...

I'm not trying to get into if the oil collapse will result in an adverse feedback loop because of systemic underlying shadow exposure across industries argument. I'm saying the data would suggest that the economy is regressing back to the pre-oil mean regarding employment levels across sectors and locations.

As a whole, the rest of the country benefits as the price to produce via utility/transportation costs falls.

As a whole, the rest of the country benefits as the price to produce via utility/transportation costs falls.

quote:quote:

Likely very little. The drop in oil is basically a $200-250 billion dollar stimulus package for the rest of the country.

Don't agree at all with this logic. There are huge secondary effects which are always underestimated. Oil and gas is one of the largest sectors in the S&P and high yield market. A prolonged downturn will hit debt which will hurt the banks not to mention job losses. These things tend to spread and create contagion and are rarely isolated. The decline isn't limited to just oil, all commodities have declined sharply lately including copper. Commodity volatility typically precedes equity volatility. The Fed is trying its best to counteract this but I would bet the equity markets play downside catch up this year which will have negative effects as well. Always remember Bernacke saying the subprime mortgage crisis was contained and would have little effect on the economy in 2007.

Agree 100%. It's going to have ripple affect across the Country but other industries will lag by 3 to 4 months.

quote:

It will be interesting to see how the super majors react. I suspect they will take a wait and see approach for the next 6 months or so.

Not sure about that. Heard a rumor that one of our BUs is going to ROM. Granted the majority of those cuts are due to sale of assets, but was told higher numbers are expected now. No clue on count, just a rumor passed early this morning.

TKE - hoping you took the offer? Use your off-rotation to visit places afar, etc.

The subprime lending crisis and the current oil collapse are very very different. I doubt ABCP is going to dry up because of oil dropping. HY debt market will get a wash, but thats still investors and the industry footing the bill. Again, I don't want to get into an adverse feedback loop discussion.

quote:No contract yet - just lot's of "This is a good move for you".quote:

It will be interesting to see how the super majors react. I suspect they will take a wait and see approach for the next 6 months or so.

Not sure about that. Heard a rumor that one of our BUs is going to ROM. Granted the majority of those cuts are due to sale of assets, but was told higher numbers are expected now. No clue on count, just a rumor passed early this morning.

TKE - hoping you took the offer? Use your off-rotation to visit places afar, etc.

If interest rates are raised this year, any estimates on the price of oil? It doesn't look like the dollar rally is going to stop anytime soon.

Brent and WTI almost equal.

46.05!!!

46.05!!!

These oil stocks trading weird. Oil

Down about 20% in a month but stocks are flat to positive for last month. Earnings have to be terrible and I don't think any CEO will forecast great numbers for 2015. I think they are being setup for a huge down day on earnings

Down about 20% in a month but stocks are flat to positive for last month. Earnings have to be terrible and I don't think any CEO will forecast great numbers for 2015. I think they are being setup for a huge down day on earnings

quote:just because the commodity is down 20% doesn't mean all stocks should. If the company is situated well financially i would expect little to no sliding. now the ones that aren't, well yes people will be in for a rude awakening.

These oil stocks trading weird. Oil

Down about 20% in a month but stocks are flat to positive for last month. Earnings have to be terrible and I don't think any CEO will forecast great numbers for 2015. I think they are being setup for a huge down day on earnings

quote:There are still companies out there that will weather the storm and do decently well. They will be the low debt ratio, low expense companies, that are well hedged through 2015.

These oil stocks trading weird. Oil

Down about 20% in a month but stocks are flat to positive for last month. Earnings have to be terrible and I don't think any CEO will forecast great numbers for 2015. I think they are being setup for a huge down day on earnings

It's going to be rough for the companies with a high debt ratio and expensive costs. A lot of those will simply get washed away. There are going to be a lot of cheap leases for some of the more stable companies to buy up later this year.

At what point does a broad contango play come in and provide price support? Right now, the one year return ex storage is close to 17%.

Featured Stories

See All

21:11

9h ago

1.6k

Payne makes Reed debut as Aggies host East Texas A&M on Friday night

by Olin Buchanan

38:43

1d ago

2.6k

Scouting Report: No. 13 Texas A&M vs. East Texas A&M

by Tom Schuberth

35:14

6h ago

629

Reed Report: Catching up with Boots as A&M hoops is underway

by Luke Evangelist