Oldag2020 said:

3 weeks ago I would have said inflation was higher for longer than expected, but it would still decrease to approximately 3% over the next several months.

This arrogance blows my freaking mind. Whatever forecasting methodology you were using was proven to be unequivocally and catastrophically wrong for nearly a year before Putin ever moved troops to the Ukraine border. Yet you were continuing to rely on this laughable model and what it protected for the near term right up until geopolitical events dramatically changed. That's weapons grade dumb.

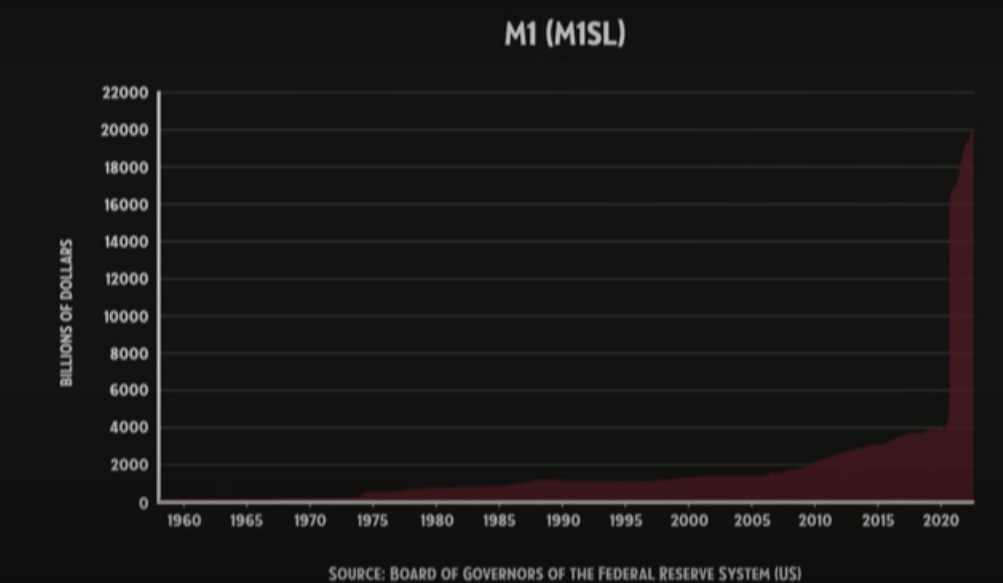

As for your OP a year later: Obviously pent up demand and supply chain issues contributed to inflation, but the rapid expansion of the money supply and 0% rates and ridiculous spending contributed a massive amount too (and if not for Machin, the first and third would be even more out of control). Even Larry freaking Summers was screaming this a year ago, and he isn't exactly a right wing guy.

The smartest guys in the room were exposed as MMT morons who doubled down in the face of overwhelming evidence. Now the rest of us will pay the price.