HOUSTON

The Facts

https://www.har.com/content/department/newsroom?pid=2096

https://www.har.com/content/department/newsroom?pid=2097

https://www.cnbc.com/quotes/US10Y

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html

My Take

The Facts

- Inventory continues to climb. Currently sitting at 4.3 months (up 1.3 months YOY and up 0.3 months MOM). We would not normally be seeing inventory rise in a summer month like June.

- Total sales and total dollar volume are DOWN 13.6% and 12.2%, respectively.

- Mean and median sales prices are still trending up (0.8% and 0.7% YOY)

- Rental listings are up 8.5% YOY and lease prices are up slightly (1.3%)

- 10 Year Treasury is sitting at 4.242% as of this posting. Mortgage rates for owner occupied 30 year loans are sitting in the high 6 / low 7 percent range.

- See the CME Group FedWatch tool link below. The market continues to bet on lower interest rates going forward. Right now the market is betting on about 150 bps of target rate drops a year from now. But they've been betting basically the same thing for the last two years, so we will see!

https://www.har.com/content/department/newsroom?pid=2096

https://www.har.com/content/department/newsroom?pid=2097

https://www.cnbc.com/quotes/US10Y

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html

My Take

- I'm continuing to put deals under contract on both sides. The homes that sell the fastest and for the most money are the ones with absolutely nothing for a buyer to do when they close.

- The luxury market (I'm going to call this $1M+) and the first time buyer market (I call this <$400k) have remained strong. It's the middle class type of home ($400k to $1M) that's been a little more difficult to move lately. That's submarket dependent of course, but in general terms, fairly accurate.

- In the last month, Breanne and I closed deals in East Downtown, Spring, Montgomery, New Braunfels, and La Vernia.

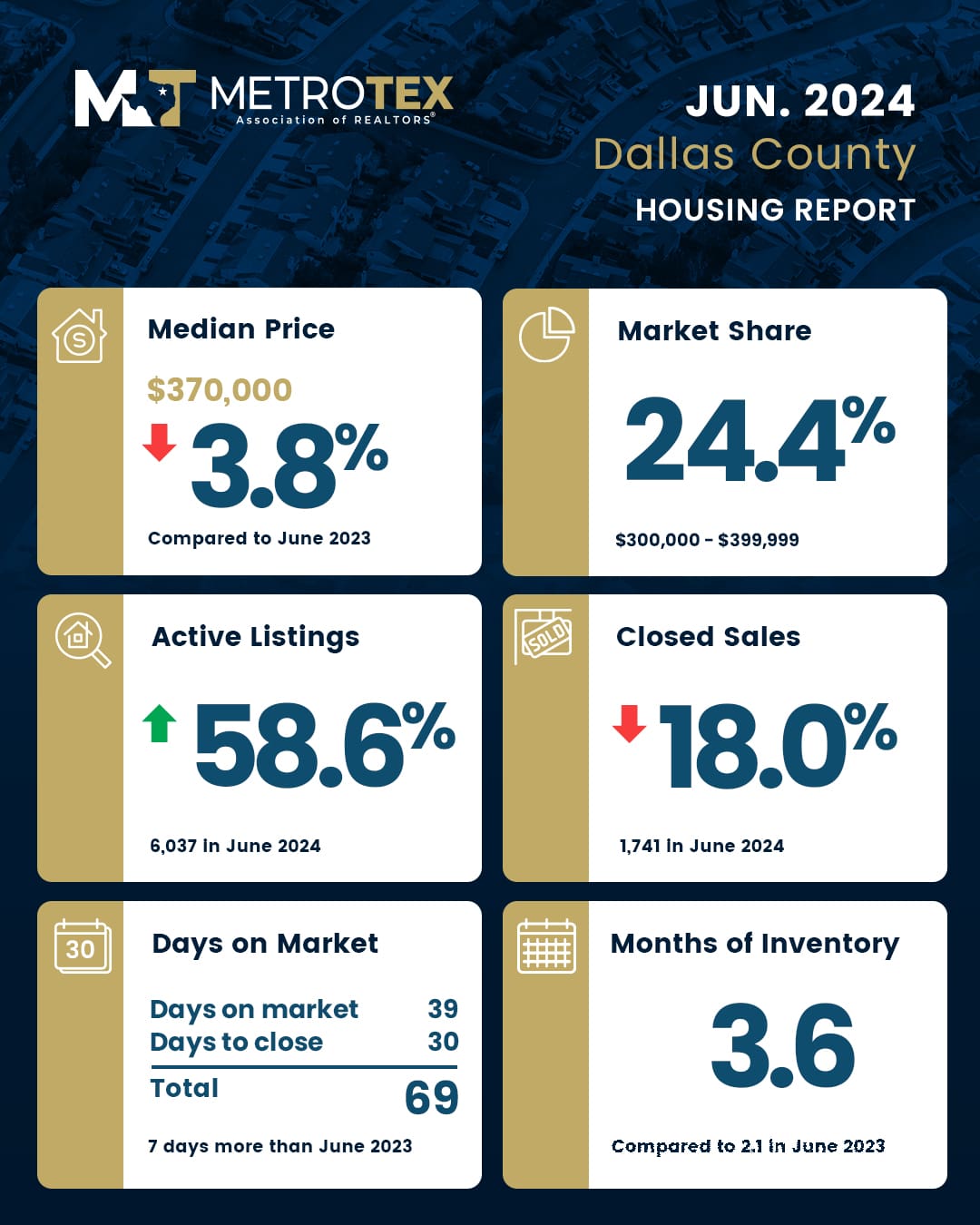

- About a year ago, maybe a year and a half ago, I started getting "bail me out" calls from owner occupant folks with real estate in the DFW market. I probably got about 4 or 5 of these from folks looking to offload real estate in the DFW market for below market prices. The DFW market is down overall since then (Jack can speak better to the amount than I can), and I think there is probably a correlation. I just got my first call from someone in Houston like this. So is it possible that the building inventory numbers we see above coupled with my anecdotal story here could mean that we are in for some price declines in Houston in the next year or so?

Sponsor Message: We Split Commissions. Full Service Agents in Austin, Bryan-College Station, Dallas-Fort Worth, Houston and San Antonio. Red Pear Realty