Houston

https://www.har.com/content/newsroom?pid=1778

https://www.har.com/content/newsroom?pid=1778

Quote:

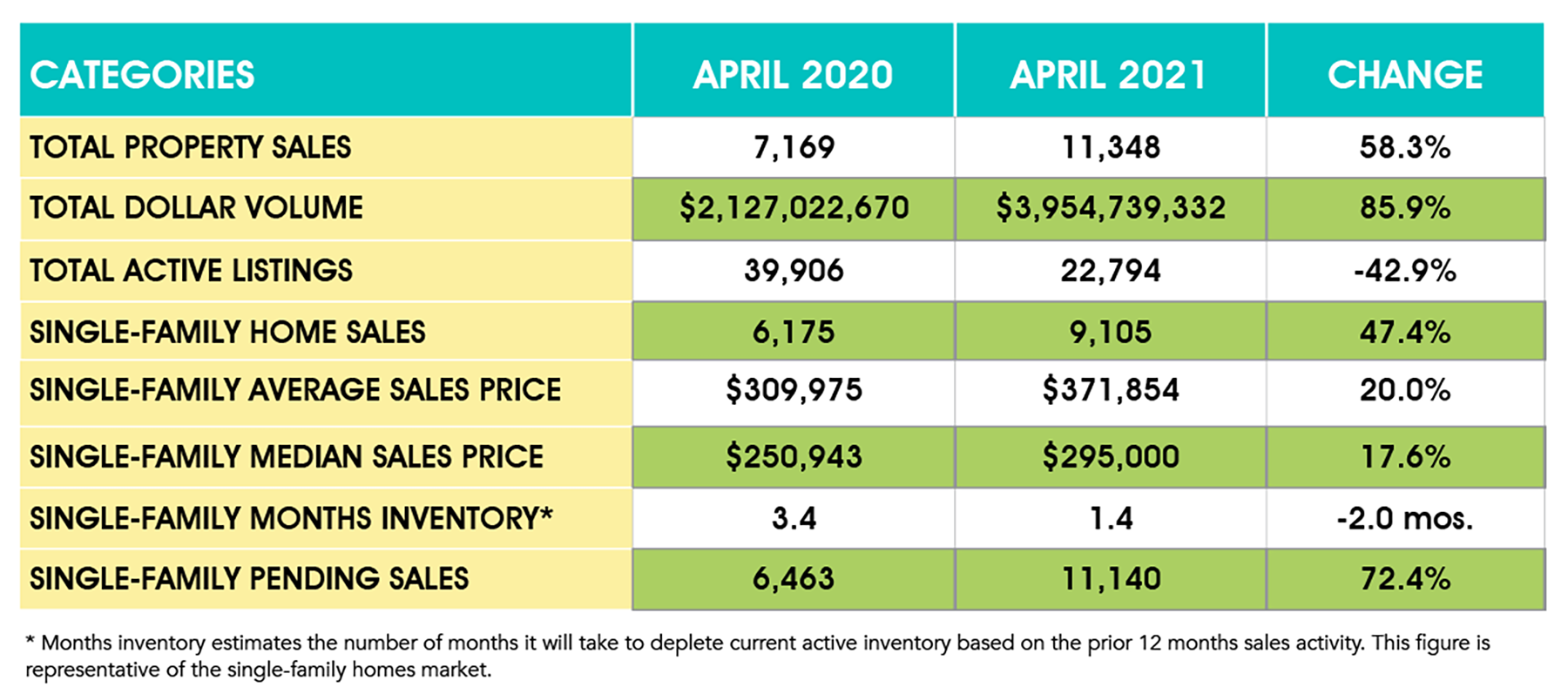

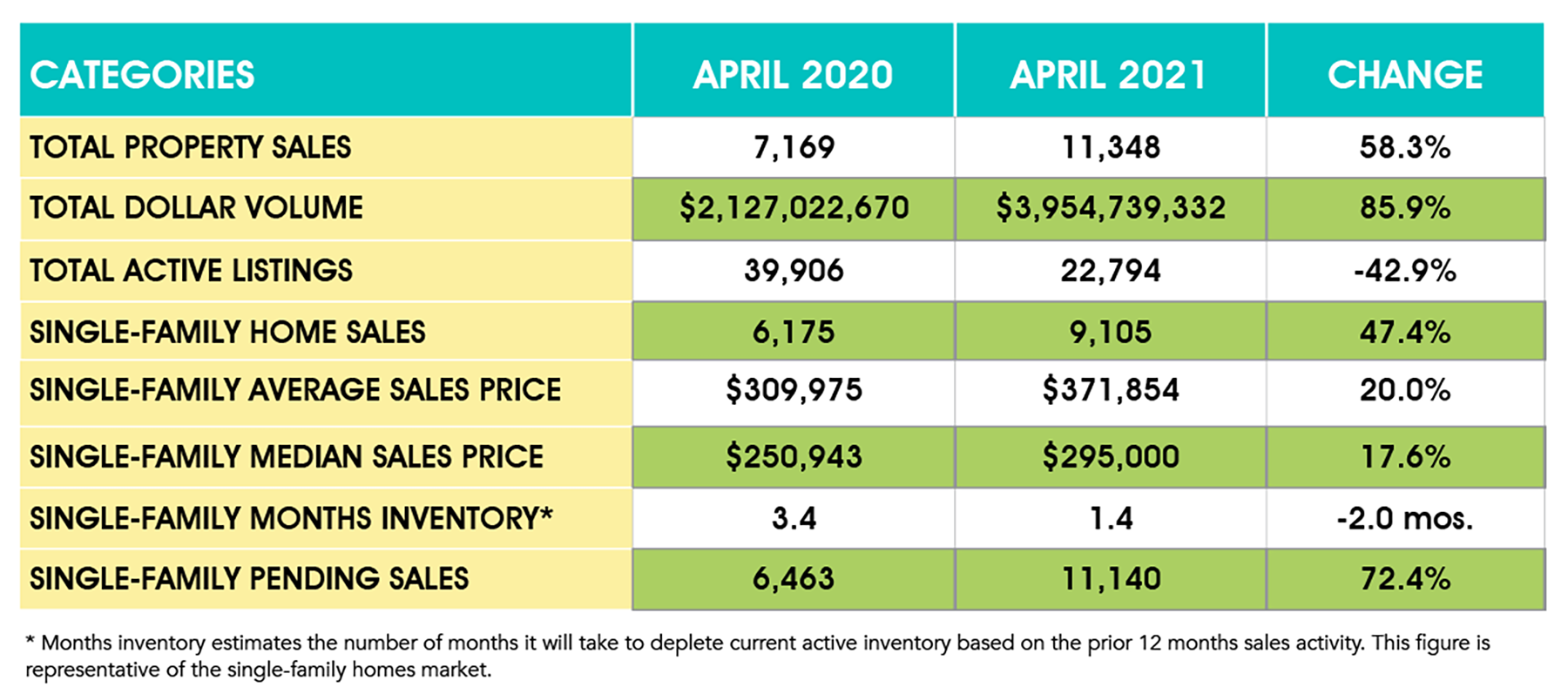

"In my 20 years in real estate, I have never seen such dramatic forces sweeping across the Houston housing market as we have experienced since the coronavirus pandemic began," said HAR Chairman Richard Miranda with Keller Williams Platinum. "The market is humming along at a record pace, fueled by low mortgage rates despite dwindling inventory and rising prices. However, without a healthy boost in new listings in the weeks and months ahead, the current pace of sales cannot be sustained."

Sponsor Message: We Split Commissions. Full Service Agents in Austin, Bryan-College Station, Dallas-Fort Worth, Houston and San Antonio. Red Pear Realty