better yet, sell high and buy low.JohnLA762 said:

Y'all, it's not that damned hard. Sell before the market goes down and buy before it goes back up. Seriously, what is so hard about it?

is it time to sell ?

28,327 Views |

190 Replies |

Last: 8 mo ago by AgOutsideAustin

sell high, buy higher

txaggieacct85 said:

I know no one really knows the answer to this question, but the S&P 500 is up 14% YTD and NASDAQ is up 30% YTD.

And this has been a really good month so far.

I have a gut feeling it's time to move some more $ in cash. This has been a good run.

One doesn't look at something YTD. One looks at something through an entire cycle. That would be 1 Year. So judge an index based on the trailing 52 weeks.

then one would do this.infinity ag said:txaggieacct85 said:

I know no one really knows the answer to this question, but the S&P 500 is up 14% YTD and NASDAQ is up 30% YTD.

And this has been a really good month so far.

I have a gut feeling it's time to move some more $ in cash. This has been a good run.

One doesn't look at something YTD. One looks at something through an entire cycle. That would be 1 Year. So judge an index based on the trailing 52 weeks.

S&P 500 - one year cycle , 18.86% gain

NASDAQ - one year cycle, 25.44% gain.

S&P 500 - five year cycle. 60.83% gain - 12% annualized gain

NASDAQ - five year cycle, 80.34% gain - 16% annualized gain

Thems are some good cycles

NVDA - five year cycle; 629% gain, 125% annualized gain. WOW

txaggieacct85 said:better yet, sell high and buy low.JohnLA762 said:

Y'all, it's not that damned hard. Sell before the market goes down and buy before it goes back up. Seriously, what is so hard about it?

Why does this dude keep coming back to defend the indefensible? Just take the L, my man.

dude? sounds about right. what are you 15?Ag06Law said:

Why does this dude keep coming back to defend the indefensible? Just take the L, my man.

Annualized is not being used correctly.txaggieacct85 said:then one would do this.infinity ag said:txaggieacct85 said:

I know no one really knows the answer to this question, but the S&P 500 is up 14% YTD and NASDAQ is up 30% YTD.

And this has been a really good month so far.

I have a gut feeling it's time to move some more $ in cash. This has been a good run.

One doesn't look at something YTD. One looks at something through an entire cycle. That would be 1 Year. So judge an index based on the trailing 52 weeks.

S&P 500 - one year cycle , 18.86% gain

NASDAQ - one year cycle, 25.44% gain.

S&P 500 - five year cycle. 60.83% gain - 12% annualized gain

NASDAQ - five year cycle, 80.34% gain - 16% annualized gain

Thems are some good cycles

NVDA - five year cycle; 629% gain, 125% annualized gain. WOW

Annualized implies geometric returns, or IRR. You are actually using arithmetic or simple average, which is improper on compounded periods.

Really not that relevant over short periods with low (and low volatility) returns. But the longer then period, the higher the returns, or the more volatility of the returns (by sub period), the more divergence exists between the two methods.

I know this isn't the relevant to the point you are making, but it is a topic many misunderstand, and it can lead to misinterpretations and bad decisions.

Casey TableTennis said:Annualized is not being used correctly.txaggieacct85 said:then one would do this.infinity ag said:txaggieacct85 said:

I know no one really knows the answer to this question, but the S&P 500 is up 14% YTD and NASDAQ is up 30% YTD.

And this has been a really good month so far.

I have a gut feeling it's time to move some more $ in cash. This has been a good run.

One doesn't look at something YTD. One looks at something through an entire cycle. That would be 1 Year. So judge an index based on the trailing 52 weeks.

S&P 500 - one year cycle , 18.86% gain

NASDAQ - one year cycle, 25.44% gain.

S&P 500 - five year cycle. 60.83% gain - 12% annualized gain

NASDAQ - five year cycle, 80.34% gain - 16% annualized gain

Thems are some good cycles

NVDA - five year cycle; 629% gain, 125% annualized gain. WOW

Annualized implies geometric returns, or IRR. You are actually using arithmetic or simple average, which is improper on compounded periods.

Really not that relevant over short periods with low (and low volatility) returns. But the longer then period, the higher the returns, or the more volatility of the returns (by sub period), the more divergence exists between the two methods.

I know this isn't the relevant to the point you are making, but it is a topic many misunderstand, and it can lead to misinterpretations and bad decisions.

I can assure you, he has the bad decisions covered!

Casey TableTennis said:Annualized is not being used correctly.txaggieacct85 said:then one would do this.infinity ag said:txaggieacct85 said:

I know no one really knows the answer to this question, but the S&P 500 is up 14% YTD and NASDAQ is up 30% YTD.

And this has been a really good month so far.

I have a gut feeling it's time to move some more $ in cash. This has been a good run.

One doesn't look at something YTD. One looks at something through an entire cycle. That would be 1 Year. So judge an index based on the trailing 52 weeks.

S&P 500 - one year cycle , 18.86% gain

NASDAQ - one year cycle, 25.44% gain.

S&P 500 - five year cycle. 60.83% gain - 12% annualized gain

NASDAQ - five year cycle, 80.34% gain - 16% annualized gain

Thems are some good cycles

NVDA - five year cycle; 629% gain, 125% annualized gain. WOW

Annualized implies geometric returns, or IRR. You are actually using arithmetic or simple average, which is improper on compounded periods.

Really not that relevant over short periods with low (and low volatility) returns. But the longer then period, the higher the returns, or the more volatility of the returns (by sub period), the more divergence exists between the two methods.

I know this isn't the relevant to the point you are making, but it is a topic many misunderstand, and it can lead to misinterpretations and bad decisions.

Oh leave him alone. He's on a roll trying to troll the site again.

But it so fun.

There will be "sell" this week.

You don’t trade for money, you trade for freedom.

permabull said:

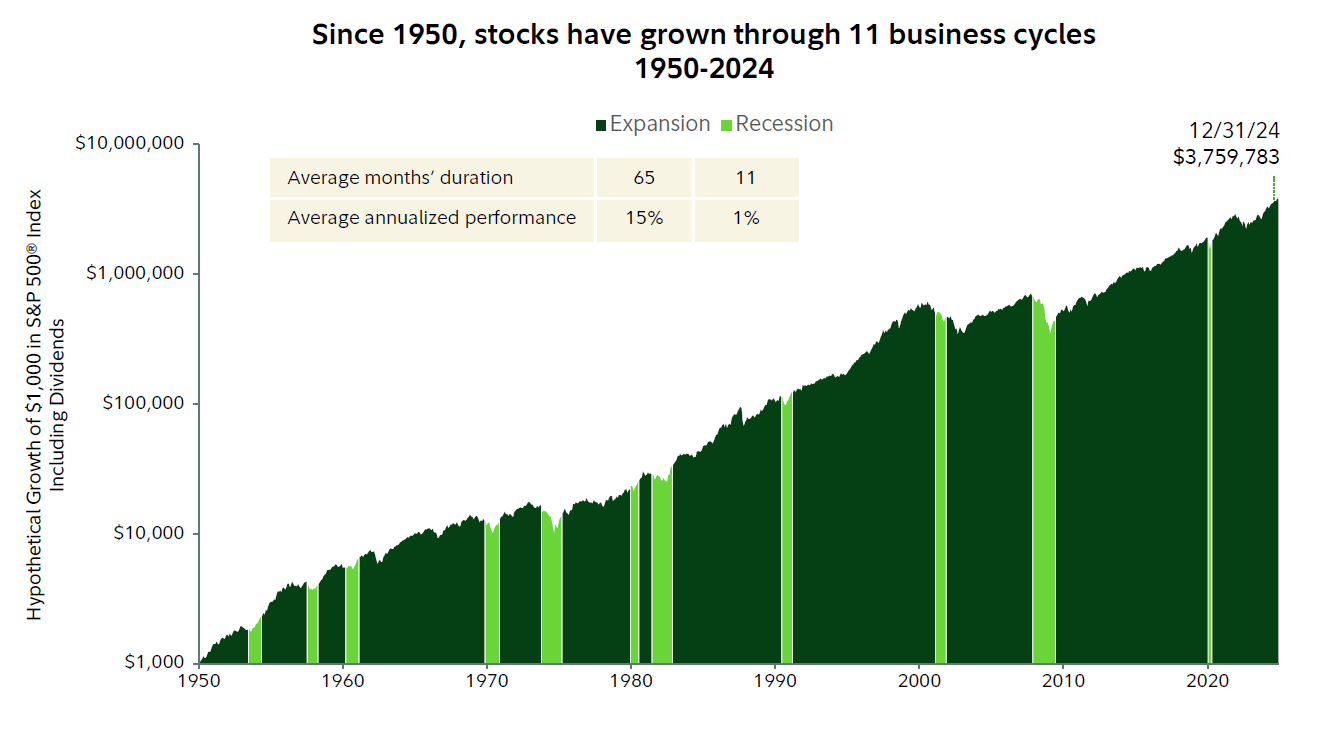

When I see charts like this, it makes me wonder why people always try to call a recession. Just ride it out and you will be fine.

This chart should be wallpaper for every person who desires to build wealth. It is shocking how few people - even the highly educated - understand the power of building wealth through diligent investing in quality companies and the broader market. Everyone should note the S&P is an index of WINNERS and LOSERS. If one can pick some individual winners, it is off to the races. From a professional perspective. It is why I get up in the morning. Forget daily, weekly, monthly or yearly gyrations in stock prices. Be diligent and build for the long term.

So replace annualized with average gain and it's good. Regardless those are good returns

LOL- you realize there is a massive thread on this same site just for day trading?Bobaloo said:permabull said:

When I see charts like this, it makes me wonder why people always try to call a recession. Just ride it out and you will be fine.

This chart should be wallpaper for every person who desires to build wealth. It is shocking how few people - even the highly educated - understand the power of building wealth through diligent investing in quality companies and the broader market. Everyone should note the S&P is an index of WINNERS and LOSERS. If one can pick some individual winners, it is off to the races. From a professional perspective. It is why I get up in the morning. Forget daily, weekly, monthly or yearly gyrations in stock prices. Be diligent and build for the long term.

Bobaloo said:permabull said:

When I see charts like this, it makes me wonder why people always try to call a recession. Just ride it out and you will be fine.

This chart should be wallpaper for every person who desires to build wealth. It is shocking how few people - even the highly educated - understand the power of building wealth through diligent investing in quality companies and the broader market. Everyone should note the S&P is an index of WINNERS and LOSERS. If one can pick some individual winners, it is off to the races. From a professional perspective. It is why I get up in the morning. Forget daily, weekly, monthly or yearly gyrations in stock prices. Be diligent and build for the long term.

The old "the way it was during the most prosperous period of humanity ever while unelected central banks destroyed our currency is the way it will always be" despite the dollar losing all of its value and economic headwinds never before seen in modern civilization. Classic.

You better hope the FED drops rates and prints money into the markets while devaluing the dollar further. Because if not, this market is going to be sideways or lower when you look back in 10 years. And this chart will look archaic.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

Just curious: care to share your age range? 20-25? 30-35? 60-65?

I'm not doubting you at all - but just curious how you're playing this given your opinion on future outlook?

Just checking-in, do we sell now or nah?

Yes sell it all.JohnLA762 said:

Just checking-in, do we sell now or nah?

and for the record, I never said sell it all. I said put more in cash.

txaggieacct85 said:Yes sell it all.JohnLA762 said:

Just checking-in, do we sell now or nah?

and for the record, I never said sell it all. I said put more in cash.

JohnLA762 said:txaggieacct85 said:Yes sell it all.JohnLA762 said:

ust checking-in, do we sell now or nah?

and for the record, I never said sell it all. I said put more in cash.

Like the lost decade…where if you stayed put, you still made money? Go read the Time Magazine headlines from 1970 on and they sound a lot like you.

What I do is when I get significantly up on a stock, I will put trailing stop losses on a stock from about 5 to 7 percent.Stive said:62strat said:rereading ops first post, he actually didn't ask the board anything.htxag09 said:Then why are you asking this board? Seems you got it all figured out.txaggieacct85 said:EliteZags said:

so really what you're asking is if it's a good idea to time the market

I've timed the market with a lot of success.

I'm semi retired with time to pay attention to the market and usually have a very good feel about the ebbs and flows.

Unless something totally unexpected happens, the market will be down next week.

The title of the thread is "Is it time to sell?"…with a question mark…..

Unless things have changed in the last few decades since I left Mrs Martin's first grade class I'm pretty sure that's a question

woodiewood1 said:What I do is when I get significantly up on a stock, I will put trailing stop losses on a stock from about 5 to 7 percent.Stive said:62strat said:rereading ops first post, he actually didn't ask the board anything.htxag09 said:Then why are you asking this board? Seems you got it all figured out.txaggieacct85 said:EliteZags said:

so really what you're asking is if it's a good idea to time the market

I've timed the market with a lot of success.

I'm semi retired with time to pay attention to the market and usually have a very good feel about the ebbs and flows.

Unless something totally unexpected happens, the market will be down next week.

The title of the thread is "Is it time to sell?"…with a question mark…..

Unless things have changed in the last few decades since I left Mrs Martin's first grade class I'm pretty sure that's a question

I did something like this once. It dipped to 7% and it sold like it was supposed to. Then I watched it go right back up to where it was, while I sat there missing out on the gains. How do you stop that from happening?

trailing stops are for p*ssies, it's like the Prevent Defense in college football, all it does it Prevent you from winning

you just called woodiewood1 a p$ssy.EliteZags said:

trailing stops are for p*ssies, it's like the Prevent Defense in college football, all it does it Prevent you from winning

EliteZags said:

trailing stops are for p*ssies, it's like the Prevent Defense in college football, all it does it Prevent you from winning

For investing or trading? For trading it's preservation

You don’t trade for money, you trade for freedom.

I'm not going to say I'm betting against that chart but I also think it's naive for people to laugh and say it's always going to look like that chart.

We are in uncharted waters at this point and no one has any idea if that chart will stay true to history or not. Past performance doesn't equal future returns and all that.

We are in uncharted waters at this point and no one has any idea if that chart will stay true to history or not. Past performance doesn't equal future returns and all that.

I have literally heard people brush away what the market is doing by saying "this wouldn't happen in a normal market" for the last 20 years. If the market isn't being "normal" by your definition for that long you might not know what that word means.

Nominal returns have been amazing.

Real returns have been okay to not so great.

Real returns have been okay to not so great.

Featured Stories

See All

Pass-catcher Will Hargett to continue family legacy at Texas A&M

by Olin Buchanan

12:06

4h ago

737

26:10

6h ago

4.3k

Top-ranked Texas A&M picked to win SEC in preseason coaches poll

by Richard Zane

DTP02

Would Prager & Rudis be the first Aggies to ever go to 3 CWS?

in Billy Liucci's TexAgs Premium

46