Fightin_Aggie said:Interest rates have to rise to get a crash and the fed won't let them rise.AggieDruggist89 said:

Because I am so ready!

Once the fed loses control of interest rates is when the **** hits the fan

Well....

Fightin_Aggie said:Interest rates have to rise to get a crash and the fed won't let them rise.AggieDruggist89 said:

Because I am so ready!

Once the fed loses control of interest rates is when the **** hits the fan

agsalaska said:

I'm still looking for evidence of a 'bubble' in Texas.

April homebuilder survey results are here. Top themes: 1) Demand is slowing, namely entry-level due to payment shock. 2) Investors are pulling back. 3) Ripple effect of rising rates starting to hit move-up market. Market commentary to follow…

— Rick Palacios Jr. (@RickPalaciosJr) May 9, 2022

TxAG#2011 said:agsalaska said:

I'm still looking for evidence of a 'bubble' in Texas.

A couple notes in the following thread from homebuilders in TexasApril homebuilder survey results are here. Top themes: 1) Demand is slowing, namely entry-level due to payment shock. 2) Investors are pulling back. 3) Ripple effect of rising rates starting to hit move-up market. Market commentary to follow…

— Rick Palacios Jr. (@RickPalaciosJr) May 9, 2022

TxAG#2011 said:agsalaska said:

I'm still looking for evidence of a 'bubble' in Texas.

A couple notes in the following thread from homebuilders in TexasApril homebuilder survey results are here. Top themes: 1) Demand is slowing, namely entry-level due to payment shock. 2) Investors are pulling back. 3) Ripple effect of rising rates starting to hit move-up market. Market commentary to follow…

— Rick Palacios Jr. (@RickPalaciosJr) May 9, 2022

I don't think you're accounting for just how many buyers were stretching themselves to afford the inflated house prices due to supply shortages and rising input costs.kag00 said:TxAG#2011 said:agsalaska said:

I'm still looking for evidence of a 'bubble' in Texas.

A couple notes in the following thread from homebuilders in TexasApril homebuilder survey results are here. Top themes: 1) Demand is slowing, namely entry-level due to payment shock. 2) Investors are pulling back. 3) Ripple effect of rising rates starting to hit move-up market. Market commentary to follow…

— Rick Palacios Jr. (@RickPalaciosJr) May 9, 2022

Demand has been off the charts so unless there is a massive collapse you move from multiple offers and a 2 week sales timeline to a more historical timeline of a few months (3) on the market and a more reasonable bid process.

I can see a situation where it becomes a bit less of a sellers market in the near term but until population and job growth slows in hot markets it will still be a seller's market.

While I generally agree that the prices cannot continue to inflate and what you said is very possible, there is a difference between 'take the air out of the market fairly quickly' and 'bust'.Diggity said:I don't think you're accounting for just how many buyers were stretching themselves to afford the inflated house prices due to supply shortages and rising input costs.kag00 said:TxAG#2011 said:agsalaska said:

I'm still looking for evidence of a 'bubble' in Texas.

A couple notes in the following thread from homebuilders in TexasApril homebuilder survey results are here. Top themes: 1) Demand is slowing, namely entry-level due to payment shock. 2) Investors are pulling back. 3) Ripple effect of rising rates starting to hit move-up market. Market commentary to follow…

— Rick Palacios Jr. (@RickPalaciosJr) May 9, 2022

Demand has been off the charts so unless there is a massive collapse you move from multiple offers and a 2 week sales timeline to a more historical timeline of a few months (3) on the market and a more reasonable bid process.

I can see a situation where it becomes a bit less of a sellers market in the near term but until population and job growth slows in hot markets it will still be a seller's market.

These are people that "should" be buying $250-300K homes but bumped up to $400K and could do so because of low rates.

Now you have those same inflated prices but a huge segment of buyers that simply can't qualify for these "starter" homes at 5-6%.

That will take the air out of the market fairly quickly.

One of the Texas A&M real estate economists said in a recent article that real estate takes about 4 quarters to fall off after interest rate hikes.Quote:

Real Estate correction takes time.

The exponential (almost step function) post 2020 in the graph below sure looks like a bubble to me. And, seeing Austin $/sqft at $350 also seems like a bubble. Maybe I am missing something.Quote:

I'm still looking for evidence of a 'bubble' in Texas.

Bonfire97 said:The exponential (almost step function) post 2020 in the graph below sure looks like a bubble to me. And, seeing Austin $/sqft at $350 also seems like a bubble. Maybe I am missing something.Quote:

I'm still looking for evidence of a 'bubble' in Texas.

https://fred.stlouisfed.org/series/TXSTHPI

Quote:

https://fred.stlouisfed.org/series/TXSTHPI

Diggity said:

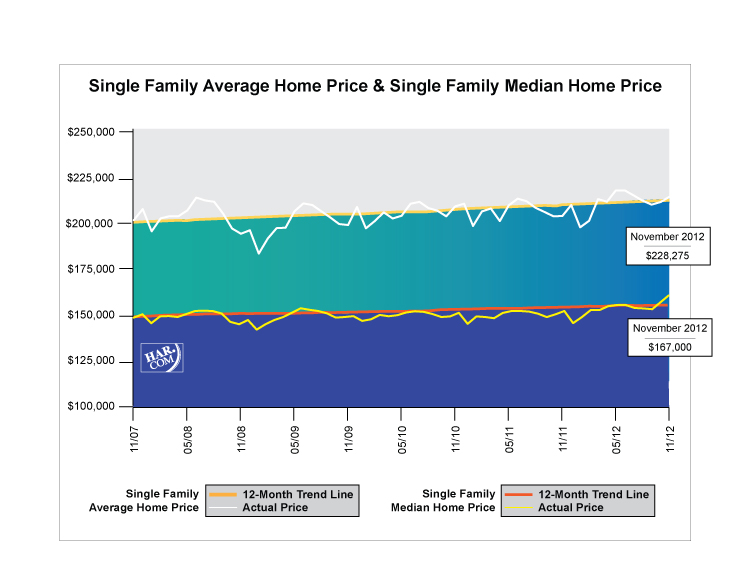

Hard to talk about these things on a national scale as real estate is local.

I can tell you that this really wasn't the case in Houston, as you can see below.

the majority of the pain was in late 2008/early 2009 and it was a bit choppy after that but definitely trending up.

You could argue that Houston was more resistant to the "Great Recession" because our appreciation prior to that was less speculative than other markets.

One thing that is clear this time around is buyers have a lot more equity in their homes than they did last time, so that should help with downside risk.

What I highlighted is a crash.Bonfire97 said:

I would like to see a correction to get house prices back to reality, maybe not a crash. $175/sqft is manageable, not $300+. I hope that yall aren't right that we are the new California and this is here to stay, but I am also afraid that may be the case. I really feel bad for kids just getting out of college now and facing the prospect of paying $600,000 for an 1800 square foot house. That sucks.

I bought a home in Vegas for $205,000 in 2009 that sold brand new in 2005 for $483,000. I turned around and sold it in 2012 for $198,000.AggieDruggist89 said:Diggity said:

Hard to talk about these things on a national scale as real estate is local.

I can tell you that this really wasn't the case in Houston, as you can see below.

the majority of the pain was in late 2008/early 2009 and it was a bit choppy after that but definitely trending up.

You could argue that Houston was more resistant to the "Great Recession" because our appreciation prior to that was less speculative than other markets.

One thing that is clear this time around is buyers have a lot more equity in their homes than they did last time, so that should help with downside risk.

That is correct. As I was living in DFW and sold my house in 2012. But we never saw the bubble either. Didn't go up but didn't crash either like Las Vegas.

At this point I think this just is reality. The prices are being driven by demand. Interest rates certainly were a factor, but the point about all of those people moving here is what is driving the market.Bonfire97 said:

I would like to see a correction to get house prices back to reality, maybe not a crash. $175/sqft is manageable, not $300+. I hope that yall aren't right that we are the new California and this is here to stay, but I am also afraid that may be the case. I really feel bad for kids just getting out of college now and facing the prospect of paying $600,000 for an 1800 square foot house. That sucks.

I believe we are there, sir.AggieDruggist89 said:

Because I am so ready!

Not yet....YouBet said:I believe we are there, sir.AggieDruggist89 said:

Because I am so ready!

I have been sitting waiting for the "big one" for quite some time, just like you. It's here. And, you are correct, it is still very early. We still have to go through the whole cycle of companies adjusting earnings downwards which is going to drive further lows in the market. Not to mention the real estate/housing collapse, which is going to lag all of this stock market stuff by probably 12 months.Quote:

My subjective non scientific pulling out of my ass intuition says the market will peak and trough slowly down through the recession before it turns around and it's still early??

Ol_Ag_02 said:

I'm with you. Being 10 years from retirement and having disposable income is allowing me to buy at a discount.

However, inflation is starting to eat into that disposable income. Starting to question whether it's time to find a new job and tap into those new baseline salaries or hold strong where I am. I may just be thankful to have a job here in six months.

What a **** storm these idiots have created.