Why is Zillow selling most of their Phoenix portfolio at a loss and more than half of their houses in DFW at a loss if RE is continuing to appreciate?

AM I THE ONLY ONE WAITING FOR A MAJOR MARKET AND REAL ESTATE CRASH?

27,666 Views |

150 Replies |

Last: 1 yr ago by Harkrider 93

Bonfire97 said:

I have come to the conclusion that there will never be a crash. Their game is to keep printing money and inflating the currency so they can pay back debt in cheaper dollars. We are all going to be paying $10 for a loaf of bread like Mexico. These fed A-holes know exactly what they are doing. Biden is just carrying this on. This started under Obama in 2008 and went on steroids under Trump in late 2019 when the fed started the injections prior to Covid. We are just now on an exponential curve. I'd like for someone to post facts proving me wrong.

The only conclusion I have come to is that absolutely none of us know what is going to happen.

Real estate will crash when cheap money becomes not that. Which it will.

Does nobody remember 2001 to 2008? Does no one remember W. (AWFUL, and I am not a leftist) holding big press conferences, talking about the "ownership society" ? And promoting "equality" , constantly? I do.

What did that mean in reality? It meant credit worthiness, lol who cares.

It will happen again.

Does nobody remember 2001 to 2008? Does no one remember W. (AWFUL, and I am not a leftist) holding big press conferences, talking about the "ownership society" ? And promoting "equality" , constantly? I do.

What did that mean in reality? It meant credit worthiness, lol who cares.

It will happen again.

To be fair W went to congress a couple of times and warned about a potential crisis.

Deplorable Neanderthal Clinger

Is that because of the RE market, or because Zillow is a tech company that doesn't know **** about RE?AggieDruggist89 said:

Why is Zillow selling most of their Phoenix portfolio at a loss and more than half of their houses in DFW at a loss if RE is continuing to appreciate?

Deplorable Neanderthal Clinger

There may be pockets of significant disruption in real estate (looking at you Canada), but you almost never have 2 of the same types of crashes consecutively.... fighting the last war and all.AggieDruggist89 said:Some signs of market shift in San Jose CA area....hamean02 said:

I wouldn't hold your breath on real estate crashing.

AggieDruggist89 said:

Why is Zillow selling most of their Phoenix portfolio at a loss and more than half of their houses in DFW at a loss if RE is continuing to appreciate?

Zillow thought they could fire up algorithms to determine where arbitrage was possible. In general, that's a great strategy for market selection and I've been personally and professionally successful doing exactly that. Where they failed is asset selection. Knowing whether to invest in Phoenix/ Dallas doesn't mean you should buy THAT HOUSE in those markets. In fact, the profile of an asset seller that wants to sell to an ibuyer is textbook adverse selection. At scale, this strategy was doomed.

Real estate is still a capital and labor intensive business that requires looking under nooks and crannies, understanding major cost components (foundation, plumbing, HVAC, electric cost a lot more to fix than ugly cabinets), and actually looking around to know why 123 Main Street and 223 Main Street are completely different comps. A centralized robot can't do that yet.

As I posted on the RE forum, Zillow iBuyer sector was very profitable until recently. There are alot of truths to your point but if the market continues to rise with 50 cash offers with no contingencies, Zillow would still be in it.

This housing market is utterly insane. I really feel badly for you guys trying to first get in the market.

Absolutely brutal and ridiculous. Pat Buchanan was correct about everything - down with the ideology of invade the world, invite the world, in hock the world.

Supply and demand and incentives are always present. We have ravaged our middle and working class citizens with the FIRE (finance, insurance, real estate) moral criminality.

Absolutely brutal and ridiculous. Pat Buchanan was correct about everything - down with the ideology of invade the world, invite the world, in hock the world.

Supply and demand and incentives are always present. We have ravaged our middle and working class citizens with the FIRE (finance, insurance, real estate) moral criminality.

as I posted in the follow-up to your post in the RE forum...no it wasn'tAggieDruggist89 said:

As I posted on the RE forum, Zillow iBuyer sector was very profitable until recently. There are alot of truths to your point but if the market continues to rise with 50 cash offers with no contingencies, Zillow would still be in it.

Diggity said:as I posted in the follow-up to your post in the RE forum...no it wasn'tAggieDruggist89 said:

As I posted on the RE forum, Zillow iBuyer sector was very profitable until recently. There are alot of truths to your point but if the market continues to rise with 50 cash offers with no contingencies, Zillow would still be in it.

I have no dog in this hunt, but I don't see this as a rebuttal of aggiedruggist's comment.

Do you have a longer historical data set on their profit/loss? Of course you may be fully correct as there could be losses going back indefinitely, but two quarters is not the only definition of recent.

AggieDruggist, when were you referring to when you said "until recently"?

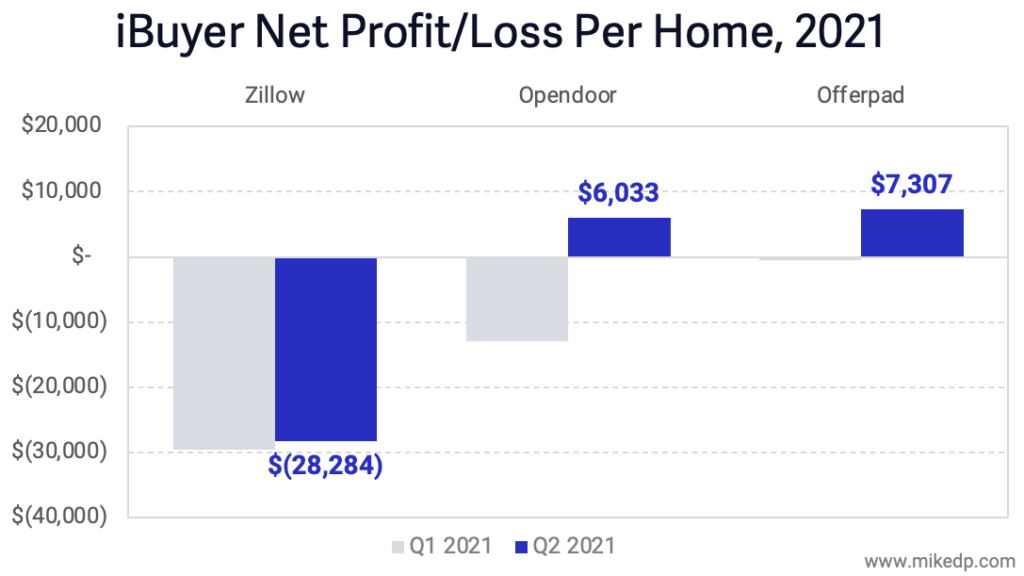

Zillow has never turned a profit with ibuying. The last few quarters (prior to the current one) were their best.

AggieDruggist was suggesting that a market correction is to blame for this, but Zillow couldn't even make money when appreciation was at its highest.

Their acquisition costs have always been too high in order to capture market share. It's a bad model plain and simple.

AggieDruggist was suggesting that a market correction is to blame for this, but Zillow couldn't even make money when appreciation was at its highest.

Their acquisition costs have always been too high in order to capture market share. It's a bad model plain and simple.

Diggity said:

Zillow has never turned a profit with ibuying. The last few quarters (prior to the current one) were their best.

AggieDruggist was suggesting that a market correction is to blame for this, but Zillow couldn't even make money when appreciation was at its highest.

Their acquisition costs have always been too high in order to capture market share. It's a bad model plain and simple.

Actually, Zillow did lose money with iBuyer program as overall even though they were able to turn profit on individual sales. Loss was mostly due to their overhead. Zillow execs were OK with some losses as it was nominal but decided to halt it as the recent losses are in hundreds of millions.

Some can certainly say the large losses of the recent was purely due to the overhead, increase in scalability and bad algorithm and the market has nothing to do with it. But the market has certainly slowed. And the fact that Zillow is willing to dump properties at a loss shows that the unending appreciation of RE isn't happening.

There is no way the economy is free floating.

I don't know what we are looking at, but it all seems fake.

We haven't seen the economic reaction to covid that I anticipated.

Its not here yet.

The longer it drags out the worse its gonna be.

People are acting like the economy is too big to fail. Thats the best way I can describe it.

I don't know what we are looking at, but it all seems fake.

We haven't seen the economic reaction to covid that I anticipated.

Its not here yet.

The longer it drags out the worse its gonna be.

People are acting like the economy is too big to fail. Thats the best way I can describe it.

Is it true a tik tok video took down Zillow

Whats up with this tiktok video?

Saw something about some tik tok video that was making the rounds on Twitter exposing zillows BS, another poster on WSB also shorted it prior to the drop

Which means it's about to crash; heard a lot of this in 07-08 as well.hamean02 said:

I wouldn't hold your breath on real estate crashing.

Ag CPA said:Which means it's about to crash; heard a lot of this in 07-08 as well.hamean02 said:

I wouldn't hold your breath on real estate crashing.

It might or might not, but you're right about hearing this in 07-08.

In fact wasn't that whole thing built on the thought that it would never go down and so the loans got riskier and riskier

There will always be significant corrections in real estate and stock markets . It's like the sun coming up in the East. When is the question.

I am in the process of pulling equity from my res and comm holdings for the coming crypto crash/correction in early 2022.

For a host of reasons, I feel crypto is where the world is headed!

For a host of reasons, I feel crypto is where the world is headed!

in phase 3 of my prediction...Ag92NGranbury said:

Unneeded stimulus --> Inflation --> Fed has to raise rates quicker --> Economic Recession

I'm loaded for bear.... just not sure when the bear will appear... 2023?

https://finance.yahoo.com/video/market-sell-off-indicates-investors-193452962.html?contentType=VIDEO

Why is OP yelling at us though?

General question:

for those who thought Apple/Google/MSFT would never go down and leveraged up to buy additional shares in the last few months...

is there a due date in which if the price has actually gone LOWER that they will have to sell on margin and reduce their holdings?

one of the youtube guys was mentioning that this issue is not being paid attention to but could be very bearish. particularly with millenials taking bitcoin or Fed Stimulus checks and trying to get rich quick.

for those who thought Apple/Google/MSFT would never go down and leveraged up to buy additional shares in the last few months...

is there a due date in which if the price has actually gone LOWER that they will have to sell on margin and reduce their holdings?

one of the youtube guys was mentioning that this issue is not being paid attention to but could be very bearish. particularly with millenials taking bitcoin or Fed Stimulus checks and trying to get rich quick.

It seems like it has to pull back. I think the stock market and real estate are on opposite sides of fear driven buying and selling.

Three months from now and we might be in phase 4.

I wasn't yelling..Brian Earl Spilner said:

Why is OP yelling at us though?

Hoping for a major dip soon. Then get out of CASH...

1 outta 2 ain't bad

A Major Dip gets us where we were maybe 6 months ago. Waiting gets you what?AggieDruggist89 said:I wasn't yelling..Brian Earl Spilner said:

Why is OP yelling at us though?

Hoping for a major dip soon. Then get out of CASH...

That's just the sign of an idiot - a bubble is when a lender gives him a $17M loan on that ranchSully Dog said:

I just watched a guy pay $19M for a ranch in desert part of Wyoming that can hold 550 head. This has to be a bubble.

jws87ag said:That's just the sign of an idiot - a bubble is when a lender gives him a $17M loan on that ranchSully Dog said:

I just watched a guy pay $19M for a ranch in desert part of Wyoming that can hold 550 head. This has to be a bubble.

Maybe he paid cash

I know nothing about ranching but thought it might be fun to take a swag at evaluating an ag property. Assuming it takes 1.5 years to raise a 1000 pound Burger on Wheels (BoW) which then sells for $1.50 per pound you're looking at annual revenue of $1000 per BoW. Assuming feed, vet services, and other operating costs range between $250-$500 per BoW per year, annual profits are between $500 - $750 per BoW.jws87ag said:That's just the sign of an idiot - a bubble is when a lender gives him a $17M loan on that ranchSully Dog said:

I just watched a guy pay $19M for a ranch in desert part of Wyoming that can hold 550 head. This has to be a bubble.

Using a 4x operating profit multiplier for determining value puts the ranch value between $1.1M and $1.65M.

For a sanity check I looked up lease prices in neighboring Montana and in 2021 leases were $26.50 per Animal Unit per month. (Unfortunately the industry doesn't use my more colorful BoW units.). Working backwards from a common 1% lease rate rule of thumb, puts the value of a 550 AU ranch at $1.45M.

In conclusion, the rancher above is either in the wind energy, mineral extraction, or money laundering business or following the adage that to retire as a millionaire in the Ag business, one must start with at least $10M.

barnag said:jws87ag said:That's just the sign of an idiot - a bubble is when a lender gives him a $17M loan on that ranchSully Dog said:

I just watched a guy pay $19M for a ranch in desert part of Wyoming that can hold 550 head. This has to be a bubble.

Maybe he paid cash

I think that is his point.

A rich idiot buying an expensive property isn't a bubble. A poor idiot being given money they don't have to buy an expensive property is.

OldArmyCT said:A Major Dip gets us where we were maybe 6 months ago. Waiting gets you what?AggieDruggist89 said:I wasn't yelling..Brian Earl Spilner said:

Why is OP yelling at us though?

Hoping for a major dip soon. Then get out of CASH...

Really? Dow was 36,430 six months ago.

Featured Stories

See All

27:24

7h ago

6.8k

16:33

7h ago

4.4k

Brauny's Bullets: Texas A&M's 12th shutout clinches spot in MCWS final

by Ryan Brauninger

27:24

8h ago

15k