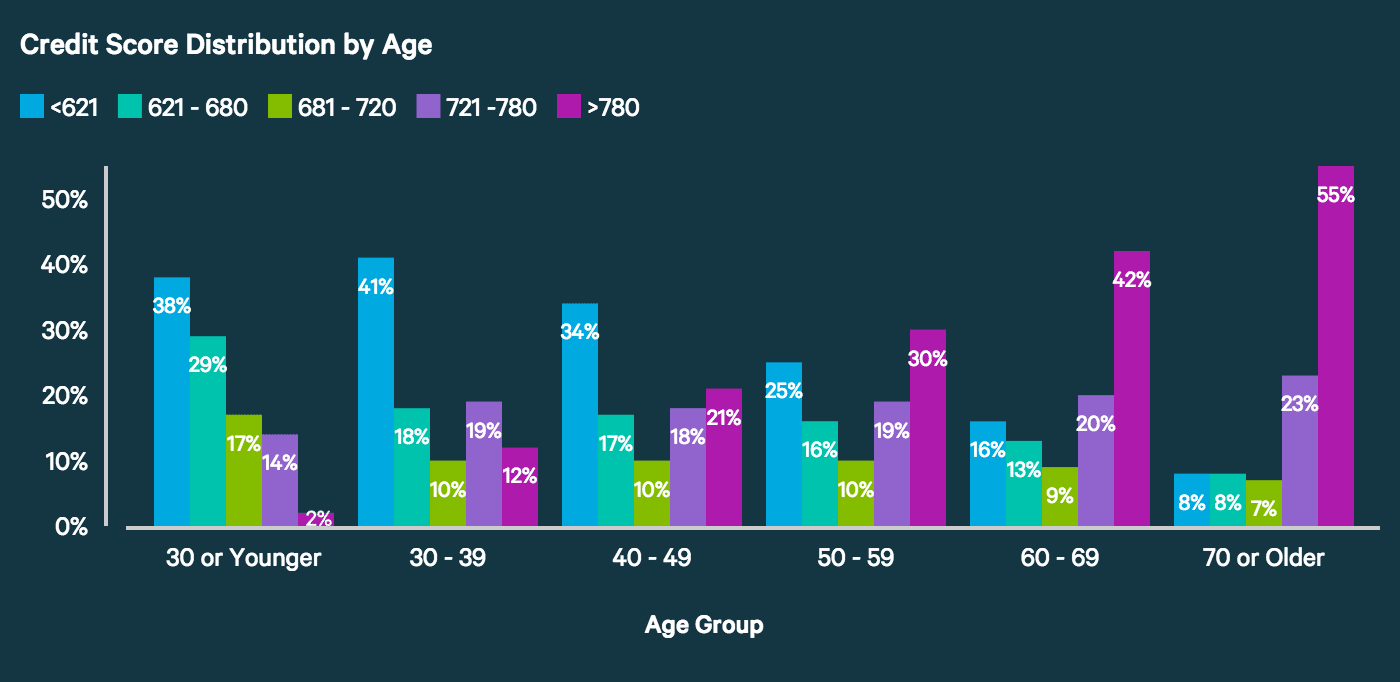

Been at 801-810 for a decade. No inquiries, no delinquent, 80,000 credit line. Paid every loan off early. Never carry a balance. Paid home mortgage off early.

What the hell is perfect credit? Does anyone have it?

What the hell is perfect credit? Does anyone have it?