DRE06 said:

G Money said:

OA,

Currently sitting with 95% cash in IRAs.

What would your advice be on getting back in?

As an example, 15% drop from all time highs and put 25% in and then average back in at 5% per month over the next 15 months?

Thanks in advance for your advice.

Jeez. You missed out on quite the run. This is exactly why I advovocate buy and whole for 99% of people. If you pull out 95% of your money, you should be savvy enough to have a plan of when and how to get back in.

Meanwhile, trading the macro moves the last year produced a 48% increase. From the initial Darvis Box breakout posting, along with the "Bet on Trump" posting, the cautionary exit point to that breakout was a whopping .002%. Horrifying!

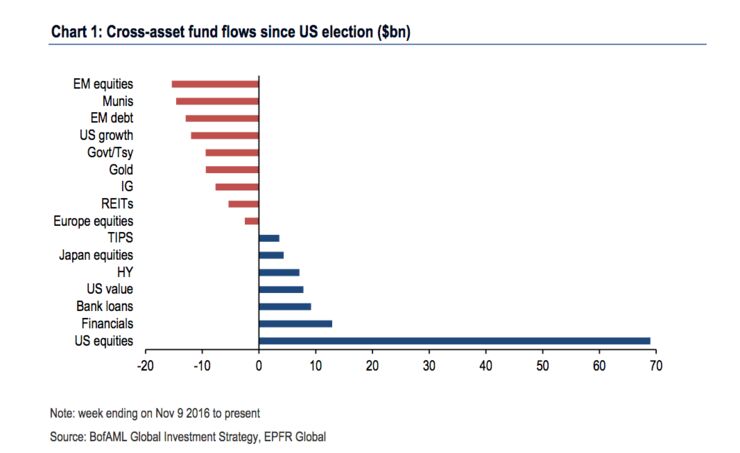

Whether you came back in with 25%, 50%, or higher you would do so in likely completely different sectors/funds than the previous period, as outlined on the sector winner listings. The markets will give a further opportunity to place other sidelined monies and the returns will, as usual, crush the traditional approach.

Again, I'm not against sanctuary investing, where you simply continue letting 401k contributions average in and not touch/look at them much, if at all. The alternative approach requires time, education, temperament, etc.