Article 3 is both very specific and completely inadequate for what exists today. Again, courts have been allowed to have way, way too much power. Trump is fixing that.

So courts have said, trust us, we the experts. And that has led us awry.

flown-the-coop said:

Courts have interpreted that they have the power to under article 3 to interpret laws and terms, but it's not specifically outlined.

Article 3 is both very specific and completely inadequate for what exists today. Again, courts have been allowed to have way, way too much power. Trump is fixing that.

So courts have said, trust us, we the experts. And that had led us awry.

jrdaustin said:

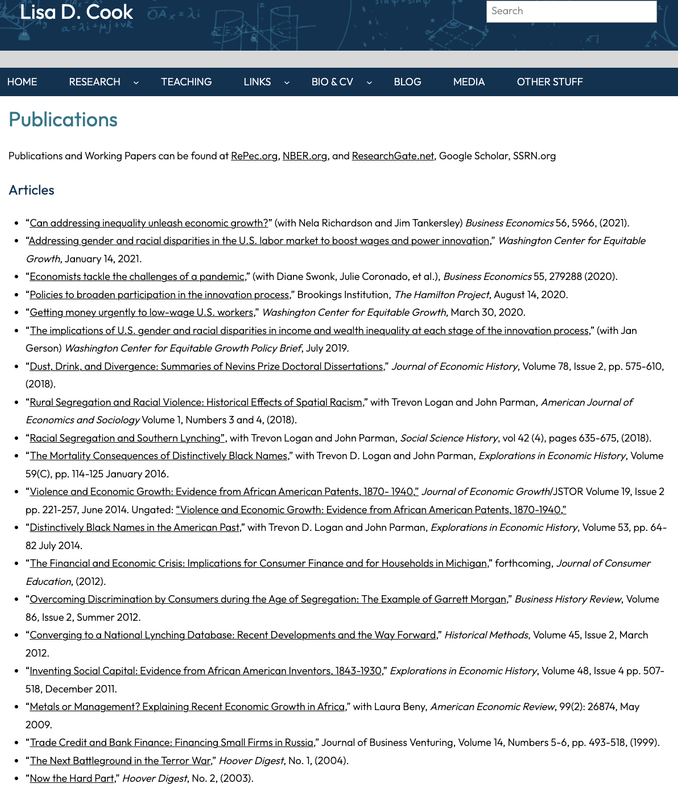

In the instance of Ms. Cook, I specifically interpret "for cause" to not only include lying on mortgage documents in violation of law; but specifically in her instance, said "lying" or "mistake" (either one) is directly related to the very institution she is charged with regulating.

Anyone who is appointed by a President in a regulatory and supposedly non-partisan position had better be:

a. Competent in said position of responsibility.

b. Squeaky clean with regard to personal interactions in the field they are regulating.

Ms. Cook horribly fails the second requirement. Imo, this is one of those instances where even the appearance of a conflict of interest can result in lasting damage to the institution. Ms. Cook has progressed far beyond an appearance of conflict. She's neck deep, and will likely not only lose her job, but face prosecution.

Quote:

The judicial Power of the United States, shall be vested in one supreme Court, and in such inferior Courts as the Congress may from time to time ordain and establish.

Quote:

The judicial Power shall extend to all Cases, in Law and Equity, arising under this Constitution, the Laws of the United States,

flown-the-coop said:

Chevron said that Congress needs to be more specific and that the executive cannot simply make up regulations based on their interpretation of Congress.

Quote:

But it doesn't have the "power" to take Congress laws, makeup their own interpretation, then command the executive to follow it. Which is what the courts have been doing all over the place with Trump.

flown-the-coop said:

There is no justiciable dispute here. That's the point.

She can sue Trump for wrongful termination, discrimination, hostile workplace, whatever.

But she has no basis under the law nor Constitution to retain her position.

flown-the-coop said:

So courts have said, trust us, we the experts. And that has led us awry.

BusterAg said:flown-the-coop said:

There is no justiciable dispute here. That's the point.

She can sue Trump for wrongful termination, discrimination, hostile workplace, whatever.

But she has no basis under the law nor Constitution to retain her position.

She could argue that "for cause" only means when she broke the law. That is a valid legal argument. Not a good one, not one she will win, but it is at least an argument.

flown-the-coop said:

And you cannot quote prior cases regarding what role the courts have when they ruled that they themselves magically have that power.

So for the @jpodhoretz and everyone else on the Commentary podcast:

— Shipwreckedcrew (@shipwreckedcrew) August 26, 2025

Trump fired Lisa Cook "For Cause" -- in line with the Supreme Court's recent decision. He did NOT fire her in contravention of that decision. The statute says members of the Fed Board of Governors can be…

Flashback: Fired Federal Reserve Governor Lisa Cook said in 2020 that Donald Trump was "definitely a fascist."

— Greg Price (@greg_price11) August 26, 2025

This is who was in charge of our nation's monetary policypic.twitter.com/iWawkhF31d

Implications of Trump attempting to fire FOMC voting member Lisa D. Cook

— Kashyap Sriram (@kashyap286) August 26, 2025

There are 12 voting members of the FOMC, 7 governors and 5 regional bank presidents.

Adriana D. Kugler, who recently resigned, was a governor. Her replacement will be appointed by Trump.

Michelle W.…

If only Democrats were as mad at Adriana Kugler for quitting the Fed board and handing it over to Trump as they are at attacks on 'Fed independence.' pic.twitter.com/VwQeZxvoKn

— Matt Stoller (@matthewstoller) August 6, 2025

Adriana Kugler just resigned from the Fed.

— Desiree (@DesireeAmerica4) August 1, 2025

She was handpicked by Chuck Schumer, the same guy blocking Trump from making appointments.

Now Trump gets to fill her seat. That’s what we call a reversal, Chuck. 🤷🏼♀️

Working people might finally catch a break on interest rates! pic.twitter.com/VS2AssrKuC

Pocahontas is crusading against @pulte. After melting down on MSNBC, she ran to CNN and used the same script.

— Gunther Eagleman™ (@GuntherEagleman) August 27, 2025

Why doesn't Warren want blatant fraud exposed? Especially by someone working at the Federal Reserve?

Weird, I think this reaction warrants a closer look into her past. https://t.co/RSYGS8ymSA pic.twitter.com/A7dS8EHQap

94chem said:jwhaby said:94chem said:BusterAg said:

Signing two different mortgage notes within 30 days of eachother, both attesting that they will be your primary residence, is way, way, way worse than any statement that might have inflated the opinion of value of a property you held.

Is it? I mean, I don't know how to rank these things. I mean, I can't claim real estate depreciation on my taxes because I make $150K, but he can lie about his real estate value to get better terms. Rules for thee... Is it worse than calling hush money to your side piece a business expense?

Real estate valuations are subjective if they're not part of a transaction between a willing seller and a willing buyer. That's why the lender on a mortgage will order an appraisal to estimate the value of the underlying collateral. It doesn't matter what the borrower thinks his asset is worth, only the lender's opinion counts. Also, Trump can't claim depreciation on an estimated value that he made up, so you can rest assured.

First, you don't seriously believe that Trump went through the same appraisal process that you or I would go through, do you? The court documents explain this clearly.

Second, I'm not saying thar Trump claimed depreciation on exaggerated base values. I'm merely saying that the Trump tax code punishes middle class real estate owners with small portfolios by making it difficult to deal with negative cash flow early in their ownership phase. It's very difficult to justify an otherwise good investment if you can't monetize increased equity or deduct operating losses.

Third, all of this is moot. We all know that POTUS is firing people so he can control interest rates. Is that really what you want?

BTHOB said:

So…. Is she gone or not? Trump says she's fired. She says she's not going anywhere. The Fed says she's still there.

"A Federal Reserve spokesperson has indicated that from the central bank's perspective, Cook's status as a governor is unchanged. The Fed, which is designed to be independent from political influence, will wait for a court ruling to determine the outcome."

I guess there will be a court that will ultimately have to decide? Is she still there until that decision?

jwhaby said:94chem said:jwhaby said:94chem said:BusterAg said:

Signing two different mortgage notes within 30 days of eachother, both attesting that they will be your primary residence, is way, way, way worse than any statement that might have inflated the opinion of value of a property you held.

Is it? I mean, I don't know how to rank these things. I mean, I can't claim real estate depreciation on my taxes because I make $150K, but he can lie about his real estate value to get better terms. Rules for thee... Is it worse than calling hush money to your side piece a business expense?

Real estate valuations are subjective if they're not part of a transaction between a willing seller and a willing buyer. That's why the lender on a mortgage will order an appraisal to estimate the value of the underlying collateral. It doesn't matter what the borrower thinks his asset is worth, only the lender's opinion counts. Also, Trump can't claim depreciation on an estimated value that he made up, so you can rest assured.

First, you don't seriously believe that Trump went through the same appraisal process that you or I would go through, do you? The court documents explain this clearly.

Second, I'm not saying thar Trump claimed depreciation on exaggerated base values. I'm merely saying that the Trump tax code punishes middle class real estate owners with small portfolios by making it difficult to deal with negative cash flow early in their ownership phase. It's very difficult to justify an otherwise good investment if you can't monetize increased equity or deduct operating losses.

Third, all of this is moot. We all know that POTUS is firing people so he can control interest rates. Is that really what you want?

First, I hate to break it to you, but the diligence/vetting process only becomes more detailed and onerous as the size of the transaction increases. A $500 million loan to Trump would definitely be more scrutinized than a $750k mortgage to you or me. Fact.

Second, please explain how the tax code (not Trump's tax code) punishes middle class real estate owners. There is no limit to depreciation based on income, and Trump has now increased bonus depreciation to 100%. Sounds like he's helping people by creating more non-cash expenses that will reduce taxable income. Now, if you don't spend at least 50% of your time pursuing real estate, I think you're limited to $25,000 of losses against your AGI. Regardless, Trump didn't impose this limit. Congress made the "qualifying real estate professional " exception in 1993, so not sure how Trump has anything to do with it.

Third, we all know that Powell is keeping interest rates high for political purposes. It's funny that he didn't have a problem cutting rates for his buddy Biden before the election when inflation was higher than it is now. Also, the Fed Funds Rate is sitting at 4.5%, while the ECB is at 2%, the Bank of Japan is at 0.5%, and China is at 1.4%. Why should we be paying interest rates that are 2.25x-9x higher than the rest of the world? Don't you think that's unfairly burdening the interest carry on our national debt and throttling our economy?

BTHOB said:BTHOB said:

So…. Is she gone or not? Trump says she's fired. She says she's not going anywhere. The Fed says she's still there.

"A Federal Reserve spokesperson has indicated that from the central bank's perspective, Cook's status as a governor is unchanged. The Fed, which is designed to be independent from political influence, will wait for a court ruling to determine the outcome."

I guess there will be a court that will ultimately have to decide? Is she still there until that decision?

I guess nobody really knows whether she is still employed there or not? (see my question quoted above)

What a cluster.

The Fed is not a court. See Article III.

— Jeff Clark (@JeffClarkUS) August 27, 2025

The Fed is not an organ of Congress. See Article I.

Therefore, by simple process of elimination, the Fed must be part of the Article II Executive Branch. And that is even without making the obvious points that the Fed issues regulations.… https://t.co/1Cp95Kscto

Quote:

The Fed is not a court. See Article III.

The Fed is not an organ of Congress. See Article I.

Therefore, by simple process of elimination, the Fed must be part of the Article II Executive Branch. And that is even without making the obvious points that the Fed issues regulations. It administers federal banking laws. These are executive functions.

Or

@JamesSurowiecki

, has your archaeological dig discovered a previously unknown Article of the Constitution creating a fourth branch of government? Or did we all miss an amendment to the Constitution adopted at some point before 1913 when the Federal Reserve Act was passed?

Without its own branch-enabling Article in the original Constitution or a constitutional amendment authorizing "an independent central bank," your concept of an "independent central bank" branch as "its own thing" is farcical.

Quote:

So…. Is she gone or not? Trump says she's fired. She says she's not going anywhere. The Fed says she's still there.

"A Federal Reserve spokesperson has indicated that from the central bank's perspective, Cook's status as a governor is unchanged. The Fed, which is designed to be independent from political influence, will wait for a court ruling to determine the outcome."

I guess there will be a court that will ultimately have to decide? Is she still there until that decision?