https://finance.yahoo.com/news/think-texas-cheaper-tax-burden-161359267.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAAQpCQdi74JF67FIkV9Hf2YwXHdBSBEEfim9EHc90wmmkDhCLOPbRX6zPeQE9HnmiJ8pe1onPmsNpGyQ5jGqkz9Eeby_59-uWtYkW9KoIBkBJ_A8vFiNogmEc2-RSumApynKqOPATq33XV46_eJ4KIXpNcxE8FMBbIMHP-_sQZaL#

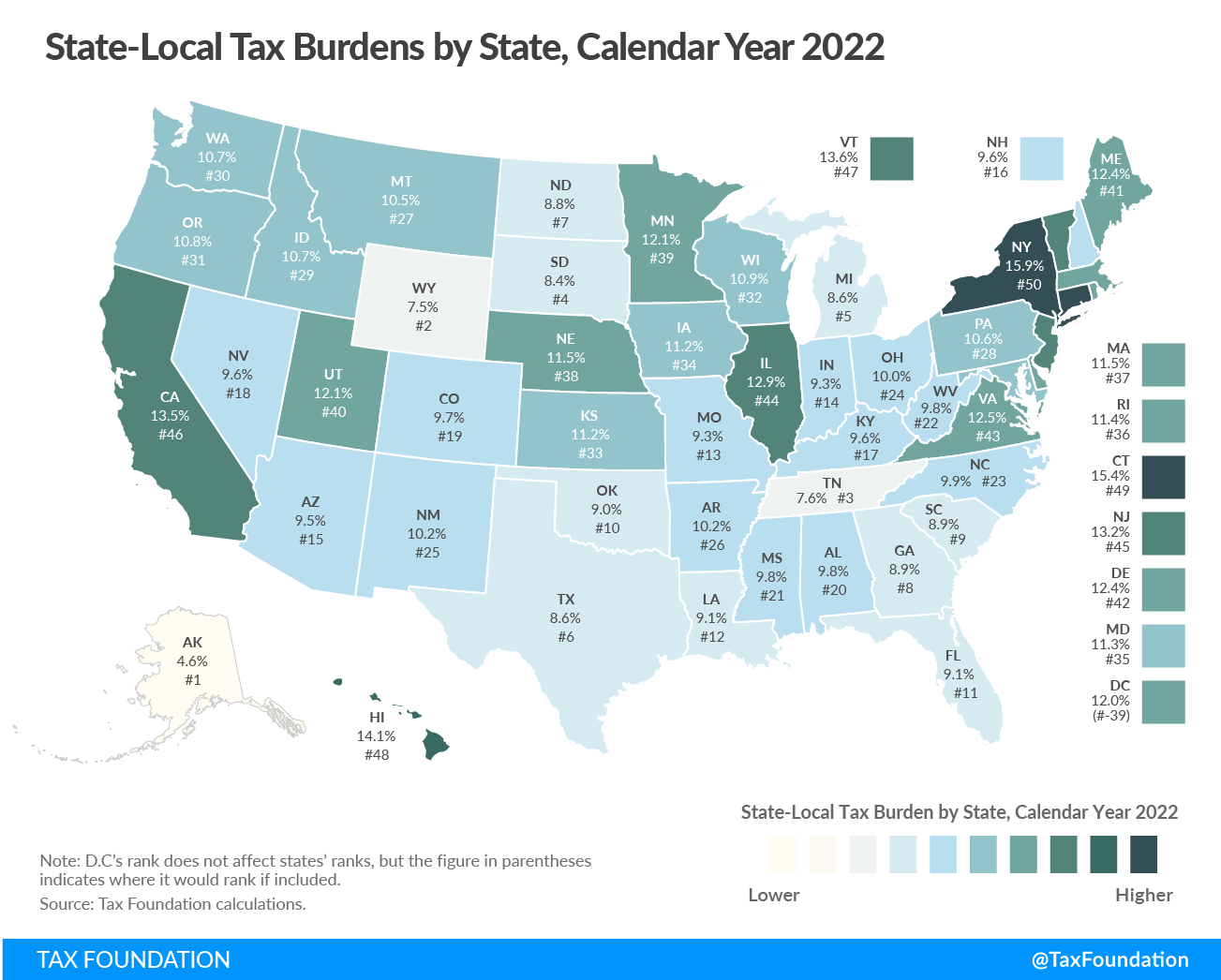

"Though Texas has no state-level personal income tax, it does levy relatively high consumption and property taxes on residents to make up the difference. Ultimately, it has a higher effective state and local tax rate for a median U.S. household at 12.73% than California's 8.97%, according to a new report from WalletHub".

"Though Texas has no state-level personal income tax, it does levy relatively high consumption and property taxes on residents to make up the difference. Ultimately, it has a higher effective state and local tax rate for a median U.S. household at 12.73% than California's 8.97%, according to a new report from WalletHub".

"I am neither an Athenian nor a Greek, but a citizen of the world"-Plato, attributed to Socrates, Theaetetus-