Keep an eye on this Silicon Valley Bank Financial thing

85,385 Views |

902 Replies |

Last: 19 days ago by itsyourboypookie

Around 2009 the BIS made a big deal about bank stress testing models and capital requirements so that the perils of the 2008 crisis would never happen again. They've since revised the models and requirements.

Also I seem to recall that insurance contracts on investments are not part of the bank stress test equation but the banks and insurance companies are inextricably linked. This was part of the issue in 2008 when AIG had a bunch of insurance contracts on failed investments.

From my limited knowledge of banking and finance the problem comes in when you got these giant insurance contracts backing investments held by banks, and all that information is latent. Lurking in the background. So you may have curb appeal on these bank financials but theres termites and foundation problems once you look into the crawl space and that data is private.

So you gotta wonder how all this stress test business is going nowadays.

Perhaps somebody on here knows something about it and can give us some rw analysis.

Also I seem to recall that insurance contracts on investments are not part of the bank stress test equation but the banks and insurance companies are inextricably linked. This was part of the issue in 2008 when AIG had a bunch of insurance contracts on failed investments.

From my limited knowledge of banking and finance the problem comes in when you got these giant insurance contracts backing investments held by banks, and all that information is latent. Lurking in the background. So you may have curb appeal on these bank financials but theres termites and foundation problems once you look into the crawl space and that data is private.

So you gotta wonder how all this stress test business is going nowadays.

Perhaps somebody on here knows something about it and can give us some rw analysis.

tremble said:Sims said:

At some point you just have to invest in the financial market / economy you have rather than the one you want.

A lot of folks struggle with this.

Nope not me, I've buried my precious metals in my backyard, including ammo.

I suggest not worrying about everything that can go wrong and go about living life and enjoy it. Part of the mental health crisis in this country is people read about all of the possible disasters and bad things that can happen yet few of them ever do and when they do, the world still goes on after some pain.

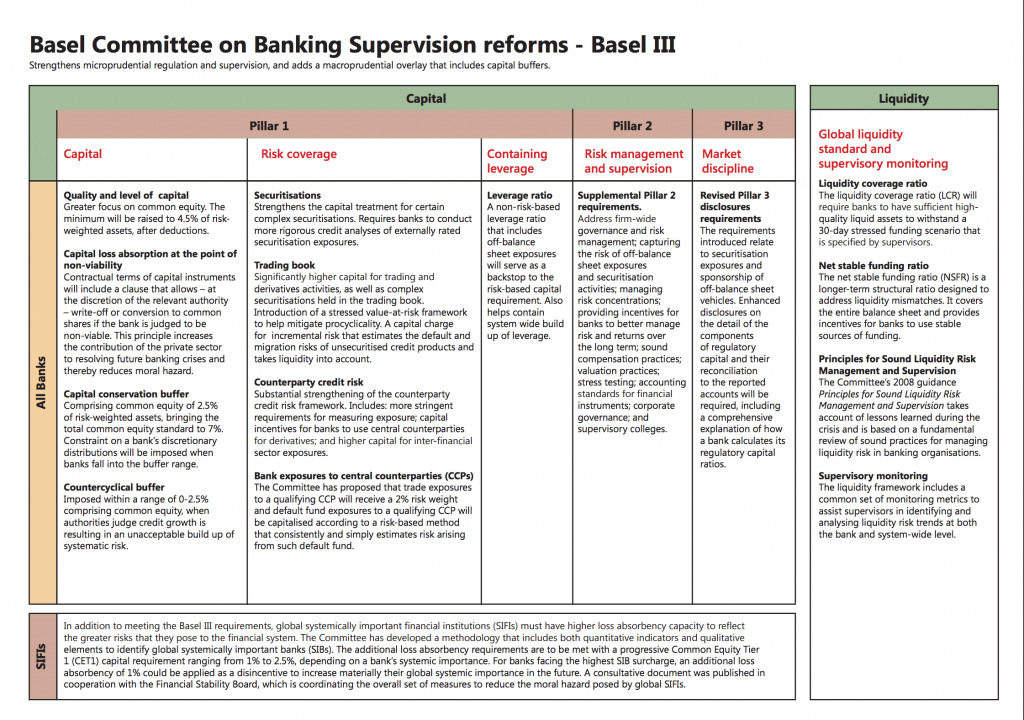

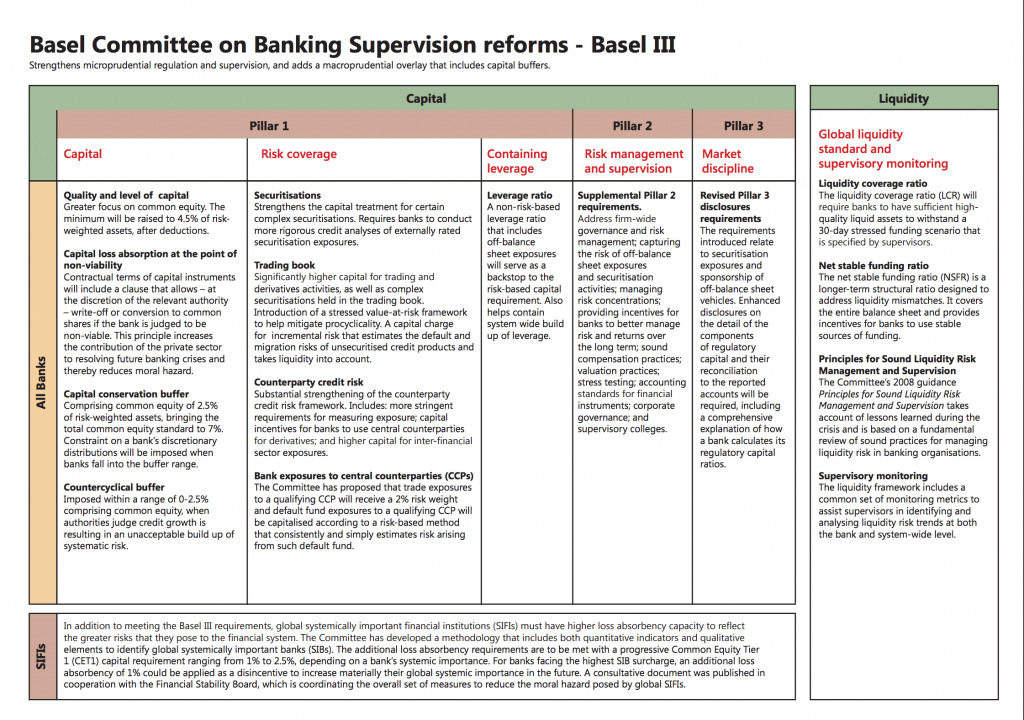

Basel III once implemented (and followed) would do a lot to mitigate some of those risks. It wouldn't necessarily extricate the banking system from the larger investment world but it would serve to more accurately impair the bank assets at risk and give a better indication of counter-party risk that the banking system is exposed to.

All that being said, it's a framework for compliance and only works if banks/regulators do what they're prescribed to do.

The regulators in the 12th district of the fed have been asleep at the wheel and have overseen, or overlooked, most of the ills in the banking system. They probably won't be changing that any time soon.

All that being said, it's a framework for compliance and only works if banks/regulators do what they're prescribed to do.

The regulators in the 12th district of the fed have been asleep at the wheel and have overseen, or overlooked, most of the ills in the banking system. They probably won't be changing that any time soon.

Analysts claiming it for 2023 and it never happening at all are two different things. Analysts are usually wrong. But recessions don't happen overnight. And we might not even be nearing a recession. It might be far worse. I hope you've thought about what a 5-10 year duration economic downturn might do to you and how you can start preparing. If you haven't, there is still time. But blindly investing into deteriorating conditions being propped by unprecedented liquidity might look good short term, but can have devastating effects long term if your head isn't on a swivel.Sims said:I agree it's broken from a technical standpoint when you think about in terms of an Austrian model. I don't think it changes the fact that the most advertised recession of 2023 never happened. The fundamentals said one thing and the financial markets and economy did another.Heineken-Ashi said:Sims said:I'm on the exact same page. It seems like the metrics and indicators that worked before don't mean as much now. It's almost like the system is working on some mix of extend & pretend and hope for lower rates. I would imagine BTFP is renewed/extended so I'm not real concerned about banks.Zergling Rush said:

I never thought they'd be able to pull this crap off for as long as they have, yet here we are.....

A few posters have pointed out liquidity and I think they're spot on. As long as there is balance sheet capacity, it doesn't seem like servicing costs mean as much as we thought they did. Michael Howell @ CrossBorder Capital is a good read when it comes to liquidity matters.

Just because they launch liquidity into the system, whether through QE or RRP, doesn't mean the system is healthy. Last spring had just a handful of bank failures and the emergency levers they had to pull were only ones granted to them after 2008. You think they wanted to continue QT and have to pull the RRP lever if they could do QE or print? Why would this round of bank failures have a different gameplan than the last? Simple, they don't have the runway to act without admitting the system is unhealthy/ broken. And once they admit it (QE), the economy will already be heading down. And the gap between major events needing new liquidity will shrink.

I think the thought that the reason is liquidity is accurate. It may be the last thing that works before it all blows up in the end but it's currently working.

At some point you just have to invest in the financial market / economy you have rather than the one you want.

The stress test has never been a good indicator. In fact, the most recent one blatantly ignored the majority of actual stress that could happen.Stat Monitor Repairman said:

Around 2009 the BIS made a big deal about bank stress testing models and capital requirements so that the perils of the 2008 crisis would never happen again. They've since revised the models and requirements.

Also I seem to recall that insurance contracts on investments are not part of the bank stress test equation but the banks and insurance companies are inextricably linked. This was part of the issue in 2008 when AIG had a bunch of insurance contracts on failed investments.

From my limited knowledge of banking and finance the problem comes in when you got these giant insurance contracts backing investments held by banks, and all that information is latent. Lurking in the background. So you may have curb appeal on these bank financials but theres termites and foundation problems once you look into the crawl space and that data is private.

So you gotta wonder how all this stress test business is going nowadays.

Perhaps somebody on here knows something about it and can give us some rw analysis.

Bank balance sheets are awful. And they aren't getting any better.

YikesZergling Rush said:Heineken-Ashi said:

If you haven't yet learned about bail ins, you better do your research. You better be damn sure your bank con stomach a banking crisis.

Bank bail-ins are just the tip of the iceberg.....Read (or watch) this book at your own peril. It's pretty frightening how this is all playing out.

https://thegreattaking.com/read-online-or-download[url=https://www.zerohedge.com/geopolitical/great-taking-exposes-financial-end-game][/url]Quote:

What is this book about? It is about the taking of collateral, all of it, the end game of this globally synchronous debt accumulation super cycle. This is being executed by long-planned, intelligent design, the audacity and scope of which is difficult for the mind to encompass. Included are all financial assets, all money on deposit at banks, all stocks and bonds, and hence, all underlying property of all public corporations, including all inventories, plant and equipment, land, mineral deposits, inventions and intellectual property. Privately owned personal and real property financed with any amount of debt will be similarly taken, as will the assets of privately owned businesses, which have been financed with debt. If even partially successful, this will be the greatest conquest and subjugation in world history.

In the Prologue of the book Webb paints a richly textured, autobiographical picture of his provenance as finance guru, obviously with exceptional intelligence and, it turned out, courage. His knowledge of finance and economics has been the result of long years of work in the field, but he recalls the assassination of President John F. Kennedy, before the start of his professional career, when he was a child, and what he calls (witnessing) the subsequent "industrial collapse" of the US in Cleveland, where the family lived, culminating in "the complete destruction of everything we had known" (p. vii). Before he gets into the details of his life....

https://www.zerohedge.com/geopolitical/great-taking-exposes-financial-end-game

Heineken-Ashi said:The stress test has never been a good indicator. In fact, the most recent one blatantly ignored the majority of actual stress that could happen.Stat Monitor Repairman said:

Around 2009 the BIS made a big deal about bank stress testing models and capital requirements so that the perils of the 2008 crisis would never happen again. They've since revised the models and requirements.

Also I seem to recall that insurance contracts on investments are not part of the bank stress test equation but the banks and insurance companies are inextricably linked. This was part of the issue in 2008 when AIG had a bunch of insurance contracts on failed investments.

From my limited knowledge of banking and finance the problem comes in when you got these giant insurance contracts backing investments held by banks, and all that information is latent. Lurking in the background. So you may have curb appeal on these bank financials but theres termites and foundation problems once you look into the crawl space and that data is private.

So you gotta wonder how all this stress test business is going nowadays.

Perhaps somebody on here knows something about it and can give us some rw analysis.

Bank balance sheets are awful. And they aren't getting any better.

The Big 6 Banks are mad about new BIS / FED rules and are talking about suing over plan to increase capital requirements.

Banks warn that if new rules are implemented they'll pull back from lending, particularly to small businesses and borrowers with lower incomes or credit scores.

Lol what a mess. "We want to hold no cash on hand and give bad loans out or we'll file a lawsuit!l

I remember him. Good poster.Bregxit said:JeffHamilton82 predicted 2027 years ago. Three years to go.CDUB98 said:

As always, in the back of my mind, that little crazy voice (one of many) keeps telling me that at some point this whole damn charade has to come crashing down.

Did he pass or get the banhammer?

This board has hopped from one disaster economic scenario to the next for nearly a decade. I feel like some here just want to see the world burn so they can come here to say "I told you so".

I won't hold my breathe. Is there going to be pain in the future at some point? With certainty. But don't let that hinder you from making sound business decisions today.

You don't have to have a bunker full of dry goods and tons of gold on hand to make it through the next downturn. Get real you Peter pans.

And if the doom and gloom is as accurate as some of yall predict it will be the downfall of society not just a swipe of wealth from Americans.

I won't hold my breathe. Is there going to be pain in the future at some point? With certainty. But don't let that hinder you from making sound business decisions today.

You don't have to have a bunker full of dry goods and tons of gold on hand to make it through the next downturn. Get real you Peter pans.

And if the doom and gloom is as accurate as some of yall predict it will be the downfall of society not just a swipe of wealth from Americans.

Gross misunderstanding of warning signs that some of us are bring up. No research done. Just the standard "i can't imagine bad things happening, and because they haven't happened yet, I will discount you".WestHoustonAg79 said:

This board has hopped from one disaster economic scenario to the next for nearly a decade. I feel like some here just want to see the world burn so they can come here to say "I told you so".

I won't hold my breathe. Is there going to be pain in the future at some point? With certainty. But don't let that hinder you from making sound business decisions today.

You don't have to have a bunker full of dry goods and tons of gold on hand to make it through the next downturn. Get real you Peter pans.

And if the doom and gloom is as accurate as some of yall predict it will be the downfall of society not just a swipe of wealth from Americans.

Nobody says world is ending. But long term sustained slow deterioration bear market nobody alive has ever experienced? Possible and maybe even likely. Look at the warning signs flashing. Rome didn't fall in a day. 2008 didn't even happen in a day. It was 10 years of build up, and even right before it happened, skies were blue according to analysts and permabulls. And 2008 was from ONE bubble. We have an entire economy of bubbles right now only propped up by emergency liquidity.

Stop thinking in bull and bear and start operating with a mindset of being nimble, noticing when trends are ending and new ones are emerging, and prepare yourself for any scenario ahead.

A lot of us were around for the 70s bear market which was topped only by the 30s and they are painful. If you graduated college in 2009, you are about 37 and haven't experienced a bear market in your professional life time.

That said, a lot of people have lost a ton of money sitting on the sidelines over fear. Study after study shows retail investors usually get in near/at the top when the economy looks the best and get out near the bottom when things look the scariest. Hedge funds look at retail investors are doing and do the opposite. Except for the meme stock craze of a few years ago, the hedge funds have eaten the retail investors for breakfast, lunch, and dinner. That's not to say people should just take blind risk but continual fear gets in the way of people making money.

I agree people need to be nimble. The problem is a lot of people live in permabear or permabull land. Permabears will do worse over time.

That said, a lot of people have lost a ton of money sitting on the sidelines over fear. Study after study shows retail investors usually get in near/at the top when the economy looks the best and get out near the bottom when things look the scariest. Hedge funds look at retail investors are doing and do the opposite. Except for the meme stock craze of a few years ago, the hedge funds have eaten the retail investors for breakfast, lunch, and dinner. That's not to say people should just take blind risk but continual fear gets in the way of people making money.

I agree people need to be nimble. The problem is a lot of people live in permabear or permabull land. Permabears will do worse over time.

I don't remember what happened to him. Just noticed that he no longer posted. Kind of like when titan takes a break from F16. Never saw Jeff return though.CDUB98 said:

Did he pass or get the banhammer?

He was very vocal about the dangers of bailouts, the increasing national debt, and other topics that had to do with macro economics. He made some fiscal and monetary predictions about how the dollar would crumble in the future...and here we are.

TTUArmy said:I don't remember what happened to him. Just noticed that he no longer posted. Kind of like when titan takes a break from F16. Never saw Jeff return though.CDUB98 said:

Did he pass or get the banhammer?

He was very vocal about the dangers of bailouts, the increasing national debt, and other topics that had to do with macro economics. He made some fiscal and monetary predictions about how the dollar would crumble in the future...and here we are.

The reason I question will the dollar crumble is how do you measure it. If it is against other currencies, I like the dollar over a lot of other currencies because they are in worse shape without the strongest military in the world. If it is against commodities, that is a given just because of inflation. I share all the concerns about bailouts and the national deficit. There will be a day of reckoning and we will have some tough times with real austerity required. Go see Greece during their recent debt crisis as a great example of what it looks like.

Man, if the US has to go into austerity mode, the entire world will be a giant fustercluck.

"On a long enough timeline, the survival rate for everyone drops to zero."

Anyone can say that it will eventually all come crashing down. Everyone knows that. What people have no idea about is the timeline.

So be prepared -- you should always be prepared -- but you aren't going to be able to say "I told you so!" because being wrong on the timeline 17 times only to finally be right the 18th just means you wasted a lot of your life being wrong.

Anyone can say that it will eventually all come crashing down. Everyone knows that. What people have no idea about is the timeline.

So be prepared -- you should always be prepared -- but you aren't going to be able to say "I told you so!" because being wrong on the timeline 17 times only to finally be right the 18th just means you wasted a lot of your life being wrong.

Dollar milkshake theory!Kansas Kid said:TTUArmy said:I don't remember what happened to him. Just noticed that he no longer posted. Kind of like when titan takes a break from F16. Never saw Jeff return though.CDUB98 said:

Did he pass or get the banhammer?

He was very vocal about the dangers of bailouts, the increasing national debt, and other topics that had to do with macro economics. He made some fiscal and monetary predictions about how the dollar would crumble in the future...and here we are.

The reason I question will the dollar crumble is how do you measure it. If it is against other currencies, I like the dollar over a lot of other currencies because they are in worse shape without the strongest military in the world. If it is against commodities, that is a given just because of inflation. I share all the concerns about bailouts and the national deficit. There will be a day of reckoning and we will have some tough times with real austerity required. Go see Greece during their recent debt crisis as a great example of what it looks like.

Does it bring all the boys to the yard?

CDUB98 said:

Man, if the US has to go into austerity mode, the entire world will be a giant fustercluck.

Yep and we won't be the only ones doing austerity. The retirement liabilities will overwhelm most western governments and then there is Japan which is a bug looking for a windshield. China is toast in 10-30 years as their demographics implode. Their population has peaked and is beginning a slow decline they won't be able to stop unless they allow immigration which they won't do anytime soon, if ever.

The dollar has just become the other side of US Debt - the coupon if you will, in a world with too many trillions of this US Debt. When US Treasuries etc. demand dries up (why do you think we've had rate increases -- it's not to "fight inflation," (we'd balance our books if we wanted that), it's to keep the US Debt as a desirable asset with a better rate of return for its buyers).Kansas Kid said:TTUArmy said:I don't remember what happened to him. Just noticed that he no longer posted. Kind of like when titan takes a break from F16. Never saw Jeff return though.CDUB98 said:

Did he pass or get the banhammer?

He was very vocal about the dangers of bailouts, the increasing national debt, and other topics that had to do with macro economics. He made some fiscal and monetary predictions about how the dollar would crumble in the future...and here we are.

The reason I question will the dollar crumble is how do you measure it. If it is against other currencies, I like the dollar over a lot of other currencies because they are in worse shape without the strongest military in the world. If it is against commodities, that is a given just because of inflation. I share all the concerns about bailouts and the national deficit. There will be a day of reckoning and we will have some tough times with real austerity required. Go see Greece during their recent debt crisis as a great example of what it looks like.

When all of these undesired Treasuries get dumped, we in America will see it in the higher prices of everything, but especially with those goods based upon commodities (oil, gas, plastics, chemicals, and associated manufacturing) or imported components. So pretty much everything thanks to our offshoring of the 90s, 2000s.

Heineken-Ashi said:Gross misunderstanding of warning signs that some of us are bring up. No research done. Just the standard "i can't imagine bad things happening, and because they haven't happened yet, I will discount you".WestHoustonAg79 said:

This board has hopped from one disaster economic scenario to the next for nearly a decade. I feel like some here just want to see the world burn so they can come here to say "I told you so".

I won't hold my breathe. Is there going to be pain in the future at some point? With certainty. But don't let that hinder you from making sound business decisions today.

You don't have to have a bunker full of dry goods and tons of gold on hand to make it through the next downturn. Get real you Peter pans.

And if the doom and gloom is as accurate as some of yall predict it will be the downfall of society not just a swipe of wealth from Americans.

Nobody says world is ending. But long term sustained slow deterioration bear market nobody alive has ever experienced? Possible and maybe even likely. Look at the warning signs flashing. Rome didn't fall in a day. 2008 didn't even happen in a day. It was 10 years of build up, and even right before it happened, skies were blue according to analysts and permabulls. And 2008 was from ONE bubble. We have an entire economy of bubbles right now only propped up by emergency liquidity.

Stop thinking in bull and bear and start operating with a mindset of being nimble, noticing when trends are ending and new ones are emerging, and prepare yourself for any scenario ahead.

Ok. Keep playing safe bud. I take calculated risks regularly. I'm young. If I had to start over today it wouldn't be the end of our family. The risks I take worst case is not losing my house etc. I plan well imo. But I also put it out there when I believe in a side car deal.

I'm also in a "eat what you kill" compensation structure so that has a lot to do with it. Hard to truly run a budget.

But if you behave financially like your posts are you are capping yourself at market and savings account performance which is not the way I plan to build wealth for my family.

TTUArmy said:I don't remember what happened to him. Just noticed that he no longer posted. Kind of like when titan takes a break from F16. Never saw Jeff return though.CDUB98 said:

Did he pass or get the banhammer?

He was very vocal about the dangers of bailouts, the increasing national debt, and other topics that had to do with macro economics. He made some fiscal and monetary predictions about how the dollar would crumble in the future...and here we are.

The dollar is really "crumbling" and we're headed into a global Great Depression eh?

Heineken-Ashi said:Gross misunderstanding of warning signs that some of us are bring up. No research done. Just the standard "i can't imagine bad things happening, and because they haven't happened yet, I will discount you".WestHoustonAg79 said:

This board has hopped from one disaster economic scenario to the next for nearly a decade. I feel like some here just want to see the world burn so they can come here to say "I told you so".

I won't hold my breathe. Is there going to be pain in the future at some point? With certainty. But don't let that hinder you from making sound business decisions today.

You don't have to have a bunker full of dry goods and tons of gold on hand to make it through the next downturn. Get real you Peter pans.

And if the doom and gloom is as accurate as some of yall predict it will be the downfall of society not just a swipe of wealth from Americans.

Nobody says world is ending. But long term sustained slow deterioration bear market nobody alive has ever experienced? Possible and maybe even likely. Look at the warning signs flashing. Rome didn't fall in a day. 2008 didn't even happen in a day. It was 10 years of build up, and even right before it happened, skies were blue according to analysts and permabulls. And 2008 was from ONE bubble. We have an entire economy of bubbles right now only propped up by emergency liquidity.

Stop thinking in bull and bear and start operating with a mindset of being nimble, noticing when trends are ending and new ones are emerging, and prepare yourself for any scenario ahead.

Lots of research done btw. My job and production is directly correlated with Houston/Texas job and population growth and a growing economy. I follow it daily. But I'm not some suburban salary clipper that relies on my "financial planner" to tell me where to put 10k

Your assumptions about me are humorous. My posts are nothing more than attempts to educate and open eyes. I wish you nothing but the best and hope everything works out for you.

Heineken knows his stuff. I always pay attention to what he has to say. Others can do whatever.

The dollar has lost 98% of it's purchasing power since we got off the gold standard in 1971. What would you call that?WestHoustonAg79 said:TTUArmy said:I don't remember what happened to him. Just noticed that he no longer posted. Kind of like when titan takes a break from F16. Never saw Jeff return though.CDUB98 said:

Did he pass or get the banhammer?

He was very vocal about the dangers of bailouts, the increasing national debt, and other topics that had to do with macro economics. He made some fiscal and monetary predictions about how the dollar would crumble in the future...and here we are.

The dollar is really "crumbling" and we're headed into a global Great Depression eh?

But it's lost 15-20% in the last 5 years and the fed has been unable to get inflation under control. Meanwhile the national debt is on a hockey stick trajectory. These are not signs of a rosy future.

Not to mention, when had to raise interest rates to 19% to finally defeat inflation in the 80s. Yet if we raised rates to a mere 14.7% today, our interest payments will be larger than the entirety of our tax revenue.

Another warning sign is that commodity futures are starting to trigger bottoming buy alerts along the same lines that they did in 2021.

Inflation happens in 3 rounds 9 out of 10 times over our history. A spike up, a cool off period, and then a bigger spike.

I wrote a couple lengthy posts this morning on the stock market thread of the B&I board explaining whats going on. The first was a deep dive into the FED's current financial status and what it indicates. The second was an even deeper dive, but more of an ELI5, on how our Fed manipulated economic cycles come to be, why they happen, and what we can possibly expect going forward. I know I'm likely labeled a permabear or some other term equally as stupid. But I'm not. I simply approach finance and economics based on what the world is telling me through a historical lense. I was on the bull train until 2022, and even now am putting a list together of bullish stock setups to invest in this year. But I can spot warning signs when they appear. And my head is on a swivel.

Inflation happens in 3 rounds 9 out of 10 times over our history. A spike up, a cool off period, and then a bigger spike.

I wrote a couple lengthy posts this morning on the stock market thread of the B&I board explaining whats going on. The first was a deep dive into the FED's current financial status and what it indicates. The second was an even deeper dive, but more of an ELI5, on how our Fed manipulated economic cycles come to be, why they happen, and what we can possibly expect going forward. I know I'm likely labeled a permabear or some other term equally as stupid. But I'm not. I simply approach finance and economics based on what the world is telling me through a historical lense. I was on the bull train until 2022, and even now am putting a list together of bullish stock setups to invest in this year. But I can spot warning signs when they appear. And my head is on a swivel.

Agreed. I think the Fed knows it as well which is why they will be slower to ease this go around because they want to try avoid the rebound inflation.

Featured Stories

See All

Keys to the Game: No. 12 Texas A&M vs. Vanderbilt

by Luke Evangelist

22:52

1d ago

3.3k

Running Thread: Three Ags participating in 2025 NFL Scouting Combine

by Matthew Dawson

Habanero Guero

Earley Honeymoon Phase Over Quicker Than Expected

in Billy Liucci's TexAgs Premium

42

Nonregdrummer09

Earley Honeymoon Phase Over Quicker Than Expected

in Billy Liucci's TexAgs Premium

23