It absolutely does, because qualifying vs. not qualifying for the credit impacts the manufacturer's pricing decisions. This is an absolutely silly statement.FJB24 said:Consumer Tax credits have zero impact on manufacturer profits from the sale. That the Mach-E uses a Chicom battery is not a big surprise.hph6203 said:

Ford's Mach-E (their best selling EV) doesn't qualify for tax credits. In order to compete with Tesla's Model Y RWD they have to price the vehicle below the price of the Tesla to capture some of the "don't qualify for the credit at all" market.

The Lightning does, but you're really talking about a $70,000 vehicle for someone that makes <$150,000 for a single filer, or <$300,000 joint. That's a ~$1500 car payment, with probably another $200/mo in insurance. Don't think you're pulling many tax dollars with those stats.

The vast majority of EVs do not qualify for credits It is actually easier for a manufacturer to make a PHEV that qualifies for tax credits than it is for them to make an EV that does.

That Tesla was out of them when some bought them (used them up first) doesn't mean any of the EVangelists turned down a tax credit offer to subsidize their prized cars. The games around the credits/subsidies are absurd. Tesla itself still pimps various credits/'incentives.'

I will never buy an electric powered vehicle.

531,556 Views |

7787 Replies |

Last: 1 mo ago by techno-ag

We did not get Tax credits on our Tesla because of income. It's not that hard for 2 college educated people in their 40's to surpass the income floor for tax credits. I doubt anyone we know with a Tesla got the credits.

My wife drives about 200-250 miles per day with her rep job. She's loving that she can just plug it in at night and skip the gas stations. She's also loving the fact she can pre-cool the cabin or leave it running when she's in an office for a short time. Went to North Padre this weekend and no problem throwing it on the 220 with the adapter.

My wife drives about 200-250 miles per day with her rep job. She's loving that she can just plug it in at night and skip the gas stations. She's also loving the fact she can pre-cool the cabin or leave it running when she's in an office for a short time. Went to North Padre this weekend and no problem throwing it on the 220 with the adapter.

The tax credits are egregious. What is amusing is watching the pretzels EVangelists twist themselves into assuring us that they do not take any of these tax credits.FJB24 said:Consumer Tax credits have zero impact on manufacturer profits from the sale. That the Mach-E uses a Chicom battery is not a big surprise.hph6203 said:

Ford's Mach-E (their best selling EV) doesn't qualify for tax credits. In order to compete with Tesla's Model Y RWD they have to price the vehicle below the price of the Tesla to capture some of the "don't qualify for the credit at all" market.

The Lightning does, but you're really talking about a $70,000 vehicle for someone that makes <$150,000 for a single filer, or <$300,000 joint. That's a ~$1500 car payment, with probably another $200/mo in insurance. Don't think you're pulling many tax dollars with those stats.

The vast majority of EVs do not qualify for credits It is actually easier for a manufacturer to make a PHEV that qualifies for tax credits than it is for them to make an EV that does.

That Tesla was out of them when some bought them (used them up first) doesn't mean any of the EVangelists turned down a tax credit offer to subsidize their prized cars. The games around the credits/subsidies are absurd. Tesla itself still pimps various credits/'incentives.'

Trump will fix it.

If I could get a tax credit for it I would take it. Ya got me.

Same here.MaxPower said:

If I could get a tax credit for it I would take it. Ya got me.

I took the energy saving credits when I added insulation and replaced my windows back in 2009 or 2010 even I thought the credits were a total government boondoggle. As said above, I will take every chance I legally can to reduce my tax bill even though I would get rid of essentially everyone of them if I were King for a day except the one I get because I am alive.

Let me help the EV crew.

All ICE vehicles are more expensive because of regulations. The EV doesn't have to be more cost competitive because of an incentive but also because the cost is raised on its competitors. This isn't a difficult concept.

All ICE vehicles are more expensive because of regulations. The EV doesn't have to be more cost competitive because of an incentive but also because the cost is raised on its competitors. This isn't a difficult concept.

And most of us EV owners are also ICE owners.

For the 332nd time thanks for the reminder.Teslag said:

And most of us EV owners are also ICE owners.

All EVs are more expensive because of regulations. Welcome to reality.

Almost everything is more expensive because of regulations. Some are good regulations, some are bad. Such is the way of modern life.texagbeliever said:

Let me help the EV crew.

All ICE vehicles are more expensive because of regulations. The EV doesn't have to be more cost competitive because of an incentive but also because the cost is raised on its competitors. This isn't a difficult concept.

Same here. However, I knew I would not get the tax credit when I bought the Tesla.MaxPower said:

If I could get a tax credit for it I would take it. Ya got me.

Still think it was a great decision- love not stopping for gas, love the drive, really love the fuel and maintenance savings.

The Texas state tax is $275 - higher than for ICE cars, but a fraction of the fuel and maintenance savings

FIDO*98* said:

We did not get Tax credits on our Tesla because of income. It's not that hard for 2 college educated people in their 40's to surpass the income floor for tax credits. I doubt anyone we know with a Tesla got the credits.

My wife drives about 200-250 miles per day with her rep job. She's loving that she can just plug it in at night and skip the gas stations. She's also loving the fact she can pre-cool the cabin or leave it running when she's in an office for a short time. Went to North Padre this weekend and no problem throwing it on the 220 with the adapter.

Glad to see you liking it. Seems like more and more conservatives I know are taking the leap simply because they are just good cars to own for commuters.

3 Evs and no tax credit for me. I avg 100 miles/dy. 5 supercharger stops for about 90 minutes with over 100K miles driving which is inconsequential especially when I likely would have stopped to go to the bathroom anyhow.

If tax credits is why everyone hates EVs and people who buy them; I guess you guys also hate kids and those who have them. I am sure many more have taken this credit than Ev credits.

If tax credits is why everyone hates EVs and people who buy them; I guess you guys also hate kids and those who have them. I am sure many more have taken this credit than Ev credits.

Our auto industry is a bit of a union/communist party scam on the American people.

The real threat will be cheap Chicom EV's. I expect Xiden and his boss would happily unleash these on Americans in 'his' second term.

https://t.co/Ck7rsblRhM

— David P. Goldman (@davidpgoldman) May 16, 2024

The American auto industry is a conspiracy to fleece consumers. The challenge is to protect it against China's superior technology without protecting the scam. Trump has the right idea.

The real threat will be cheap Chicom EV's. I expect Xiden and his boss would happily unleash these on Americans in 'his' second term.

Medaggie said:

3 Evs and no tax credit for me. I avg 100 miles/dy. 5 supercharger stops for about 90 minutes with over 100K miles driving which is inconsequential especially when I likely would have stopped to go to the bathroom anyhow.

If tax credits is why everyone hates EVs and people who buy them; I guess you guys also hate kids and those who have them. I am sure many more have taken this credit than Ev credits.

Subsidizing a product line to make it a worthwhile value proposition is problematic. Let the market decide what it wants. That is the government picking winners to advance a ridiculous green agenda. Subsidizing families is much less a problem. Conflating the two is a surprising lack of understanding.

The only difference is you think one is good and the other is bad. At that point, you have established you don't think tax credits are bad in principle. You are simply upset because enough people who think it's good voted for their politicians to get it passed.

Aggies1322 said:Medaggie said:

3 Evs and no tax credit for me. I avg 100 miles/dy. 5 supercharger stops for about 90 minutes with over 100K miles driving which is inconsequential especially when I likely would have stopped to go to the bathroom anyhow.

If tax credits is why everyone hates EVs and people who buy them; I guess you guys also hate kids and those who have them. I am sure many more have taken this credit than Ev credits.

Subsidizing a product line to make it a worthwhile value proposition is problematic. Let the market decide what it wants. That is the government picking winners to advance a ridiculous green agenda. Subsidizing families is much less a problem. Conflating the two is a surprising lack of understanding.

Do you have an issue with my passive investment in small oil and gas production that allows me to 1) not pay tax on 15% of the income off the top and 2) unlike usual passive investments, I can deduct losses from my regular income including salary? How is this the government not subsidizing oil and gas since I don't know of other investments I can make with this advantage?

See below for details

"The 1990 Tax Act provided tax advantages for the typical investor in Oil and Gas drilling projects. This "Small Producers Exemption" allows 15% of any investor's gross income for an Oil and Gas property to be TAX FREE, subject to certain limitations."

"The Tax Reform Act of 1986 introduced the concept of "passive" income and "active" income. The Act prohibits the offsetting of losses from passive activities against income from active businesses. The Act provides that a working interest in an Oil and Gas drilling program is not "passive" activity. Accordingly, deductions can be offset against income from business income, salaries, etc."

https://www.crownexploration.com/tax-advantages

In what universe does it make sense to subsidize a luxury good. That is the act of aristocratic crooks.MaxPower said:

The only difference is you think one is good and the other is bad. At that point, you have established you don't think tax credits are bad in principle. You are simply upset because enough people who think it's good voted for their politicians to get it passed.

It would be like subsidizing real diamonds. And you would say yes well the government also subsidizes the cost of copper so its all fair. You are just picking and choosing winners. Despite the fact one is clearly a luxury item, diamonds and the other is utility useful, copper.

The luxury versions don't qualify for the tax credit, either because of price caps or the income limits for the people that would be buying them.

The affordable ICE car is up in price.MaxPower said:

The luxury versions don't qualify for the tax credit, either because of price caps or the income limits for the people that would be buying them.

Why, because manufactures have a quota ratio of fuel efficient to non-fuel efficient to hit.

Why does EV matter. Oh well the quotas are based on a target EV portfolio which are obviously very fuel efficient (not really but that isn't relevant here).

So if for every 3 non-fuel efficient cars you sell you have to sell 1 EV but the demand for non-fuel efficient at the price levels is a natural ratio of 5:1 in order to not be hit with massive fines a company then has to subsidize the cost of EV and increase the cost of the affordable non-fuel efficient cars. So you are stuck with less affordable cars and dealer rebates for EVs.

Does that help?

texagbeliever said:The affordable ICE car is up in price.MaxPower said:

The luxury versions don't qualify for the tax credit, either because of price caps or the income limits for the people that would be buying them.

Why, because manufactures have a quota ratio of fuel efficient to non-fuel efficient to hit.

Why does EV matter. Oh well the quotas are based on a target EV portfolio which are obviously very fuel efficient (not really but that isn't relevant here).

So if for every 3 non-fuel efficient cars you sell you have to sell 1 EV but the demand for non-fuel efficient at the price levels is a natural ratio of 5:1 in order to not be hit with massive fines a company then has to subsidize the cost of EV and increase the cost of the affordable non-fuel efficient cars. So you are stuck with less affordable cars and dealer rebates for EVs.

Does that help?

CAFE standards date back to 1975 and have been driving this issue ever since. I strongly oppose CAFE standards but you can't blame EVs for them unless you think Congress and Pres Ford saw EVs coming back then.

EVs provide a bigger bang for the buck than the most fuel efficienct ICE under current standards so if anything; they allow more muscle cars and other low fuel mileage cars to be sold. Have the Dems increased the CAFE standards, yes, but they would have done it even if EVs didn't exist.

CAFE has been updated, and those updates reflect the availability of EVs and assume a certain quota. Otherwise the targets would be insane.Kansas Kid said:texagbeliever said:The affordable ICE car is up in price.MaxPower said:

The luxury versions don't qualify for the tax credit, either because of price caps or the income limits for the people that would be buying them.

Why, because manufactures have a quota ratio of fuel efficient to non-fuel efficient to hit.

Why does EV matter. Oh well the quotas are based on a target EV portfolio which are obviously very fuel efficient (not really but that isn't relevant here).

So if for every 3 non-fuel efficient cars you sell you have to sell 1 EV but the demand for non-fuel efficient at the price levels is a natural ratio of 5:1 in order to not be hit with massive fines a company then has to subsidize the cost of EV and increase the cost of the affordable non-fuel efficient cars. So you are stuck with less affordable cars and dealer rebates for EVs.

Does that help?

CAFE standards date back to 1975 and have been driving this issue ever since. I strongly oppose CAFE standards but you can't blame EVs for them unless you think Congress and Pres Ford saw EVs coming back then.

EVs provide a bigger bang for the buck than the most fuel efficienct ICE under current standards so if anything; they allow more muscle cars and other low fuel mileage cars to be sold. Have the Dems increased the CAFE standards, yes, but they would have done it even if EVs didn't exist.

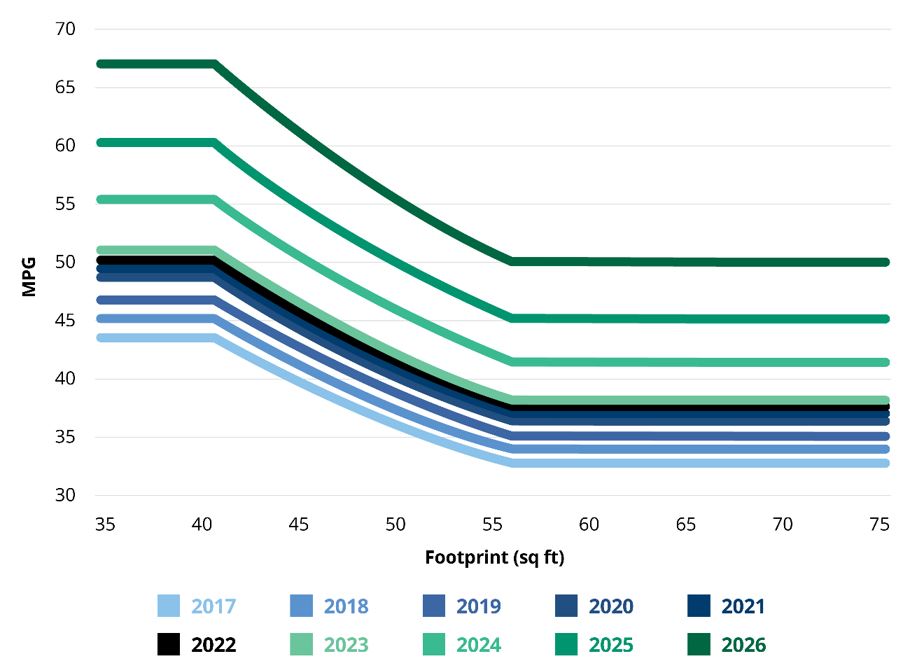

Graphic 3: Footprint-Based CAFE Targets, Passenger Cars, Model Years 2017-26

[url=

]

] [/url]

[/url]link

The big change in the targets was under Obama again before EVs were being pushed. There was a view that we would make massive improvements in engine efficiency that proved to be unrealistic. Were they insane, yes, but you can't blame EVs.

"On July 29, 2011, President Obama announced an agreement with thirteen large automakers to increase fuel economy to 54.5 miles per gallon for cars and light-duty trucks by model year 2025."

Tesla has clearly benefitted from CAFE standard increases selling credits worth about 9 billion dollars and was why they were profitable for a few years. While I oppose the rules that provided this benefit, again these rules were set in motion before EVs were viewed as a solution by politicians.

"On July 29, 2011, President Obama announced an agreement with thirteen large automakers to increase fuel economy to 54.5 miles per gallon for cars and light-duty trucks by model year 2025."

Tesla has clearly benefitted from CAFE standard increases selling credits worth about 9 billion dollars and was why they were profitable for a few years. While I oppose the rules that provided this benefit, again these rules were set in motion before EVs were viewed as a solution by politicians.

Yes but EVs are only doing as well as they are because of those standards.Kansas Kid said:

The big change in the targets was under Obama again before EVs were being pushed. There was a view that we would make massive improvements in engine efficiency that proved to be unrealistic. Were they insane, yes, but you can't blame EVs.

"On July 29, 2011, President Obama announced an agreement with thirteen large automakers to increase fuel economy to 54.5 miles per gallon for cars and light-duty trucks by model year 2025."

Tesla has clearly benefitted from CAFE standard increases selling credits worth about 9 billion dollars and was why they were profitable for a few years. While I oppose the rules that provided this benefit, again these rules were set in motion before EVs were viewed as a solution by politicians.

Also the setup of the rules pushed massive research $$$s into the EV space because of the obvious market being created for them under these standards. Which would have been the whole point of the CAFE standard. Signal the creation of a profitable market space for EVs.

Quote:

Yes but EVs are only doing as well as they are because of those standards.

It can't be that people MAY actually want them right?

If I thought you could understand supply and demand I'd make a more wordy post. Instead, i'll save my efforts.Teslag said:Quote:

Yes but EVs are only doing as well as they are because of those standards.

It can't be that people MAY actually want them right?

Do you or do you not believe people actually want these cars?

Just like people want diamonds, people want EVs. That isn't relevant.Teslag said:

Do you or do you not believe people actually want these cars?

Dang I just ordered a Tesla and I was hoping you'd explain how I actually didn't want it and only bought it because of CAFE

GAC06 said:

Dang I just ordered a Tesla and I was hoping you'd explain how I actually didn't want it and only bought it because of CAFE

I think electric cars are right for the right people. My only complaint is many owners, not all, want the government to pay to build more charging stations. Many of these same people throw a fit over other people's pet projects but are totally in support of theirs.

The difference between you and I is the world seems to revolve around you and your choices and how things impact you. I see the world and how others are impacted. In this case those who can't afford an expensive luxury car but are looking for one to be able to commute to work daily and have an affordable monthly car payment. I know so selfish of me.GAC06 said:

Dang I just ordered a Tesla and I was hoping you'd explain how I actually didn't want it and only bought it because of CAFE

There's some validity probably to this but his EPA fascists were really not interested in anything but what we now call the green new deal/global warming lies.

That EV's may have been substantively added as a front in this information war doesn't really mean they are substantively unrelated or that there is a reason to separate it out. When cafe was begun there was no 'global warming' fear, after all.

A distinction without a difference, in other words. And the 'BEV" lobby latched onto all the CAFE regulations they could as adding things like grill shutters etc. incrementally would quite deliberately make these cars less competitive/more expensive over time.

That EV's may have been substantively added as a front in this information war doesn't really mean they are substantively unrelated or that there is a reason to separate it out. When cafe was begun there was no 'global warming' fear, after all.

A distinction without a difference, in other words. And the 'BEV" lobby latched onto all the CAFE regulations they could as adding things like grill shutters etc. incrementally would quite deliberately make these cars less competitive/more expensive over time.

texagbeliever said:The difference between you and I is the world seems to revolve around you and your choices and how things impact you. I see the world and how others are impacted. In this case those who can't afford an expensive luxury car but are looking for one to be able to commute to work daily and have an affordable monthly car payment. I know so selfish of me.GAC06 said:

Dang I just ordered a Tesla and I was hoping you'd explain how I actually didn't want it and only bought it because of CAFE

You think a Tesla Model Y and Model 3 are "expensive luxury cars"?

Featured Stories

See All

27:26

4h ago

1.1k

19:50

19h ago

7.6k

4:28

4h ago

393

Game Highlights: No. 8 Texas A&M 69, Georgia 53

by Matthew Dawson

Photo Gallery: No. 8 Texas A&M 69, Georgia 53

by Zoe Kelton

3 Days 'til: Outlining what Texas A&M's 'best version' looks like in 2025

by Ryan Brauninger

LukeEvangelist

Postgame Discussion: No. 8 Texas A&M 69, Georgia 53

in Billy Liucci's TexAgs Premium

7