M4 Benelli said:

The same s stains who wrung their hands in poop clenched cacophony over everything that the MSM salaciously accused Trump of, are mighty quiet about their boy who is tangibly carrying them from the penthouse to the outhouse in all of one year's time. Cant put a pillow over production's face and expect a thriving citizenry.

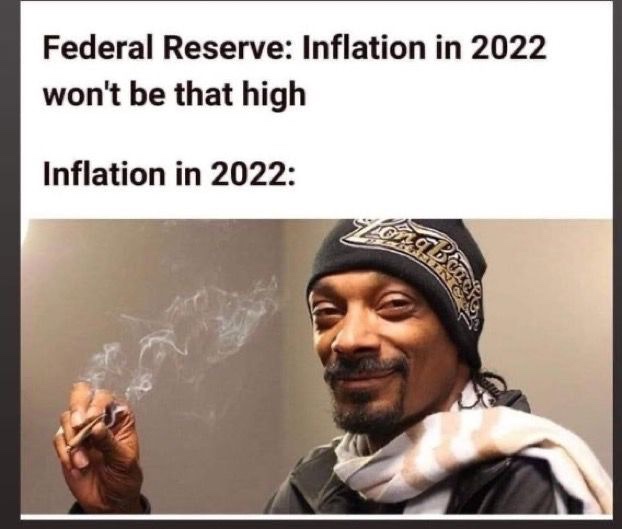

Same smurf brains who cashed their stimmies with glee, now clench their teeth every time they swipe their CC. Transitory Serfdom.

I agree with everything you say, and if I may paraphrase Blazzing Saddles:

Quote:

you use your tongue prettier than a twenty dollar *****

.

Seven and three are ten, not only now, but forever. There has never been a time when seven and three were not ten, nor will there ever be a time when they are not ten. Therefore, I have said that the truth of number is incorruptible and common to all who think. — St. Augustine