Houston

https://www.har.com/content/department/newsroom?pid=1934

https://www.harconnect.com/wp-content/uploads/2023/04/har_weeklystats-23-14.pdf

- What a crazy month it has been since my last update.

- Interest rates are still high, but they have seemed to calm down a bit. I've got folks getting approved in the high 5% range right now.

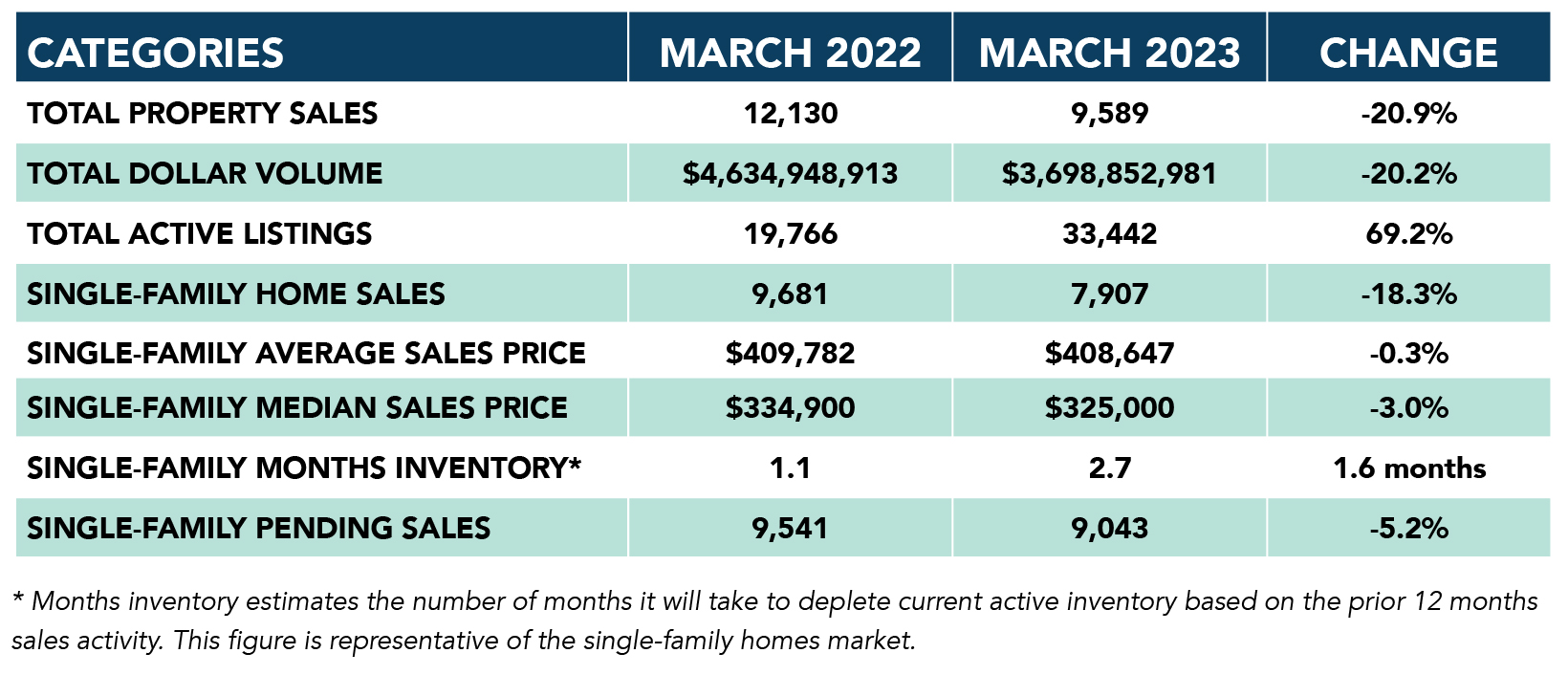

- The story of this last month has been a continued lack of inventory (2.7 months). The market is starved for available homes. I don't want to go into specifics of my properties that are under contract until after they close (because those addresses are public information now), but each of the three listed properties I helped buyers put under contract in the last month went for over asking price with multiple offers. We had to get aggressive to get them, and each of them went very quickly.

- I have multiple clients looking to buy in the Greater Houston area who have put in offers as high as $50,000 over ask price, who are still looking for homes. It's very difficult to see couples with two incomes, who have seemingly done everything "correctly" (dual income doctors, attorneys, O&G folks, etc) who cannot get a home under contract, even after offering a lot more than asking on homes. Submarkets like Memorial, GOOF, Cypress, Katy, etc. It seems to be city wide, and price non-discriminatory. Anything from $400,000 all the way up to $1,500,000.

- The difference in this year and last year is that not EVERYTHING is selling, regardless of price and condition. If the property is way overpriced, or needs work, its sitting. Just because you have a house does not mean you will sell it. At 6%+ interest rates, buyers are letting the ones that need work sit unsold. Remember, pigs get fat, hogs get slaughtered.

- I put together an off-market deal that was really fun as it seemed to be a "win" for both buyer and seller.

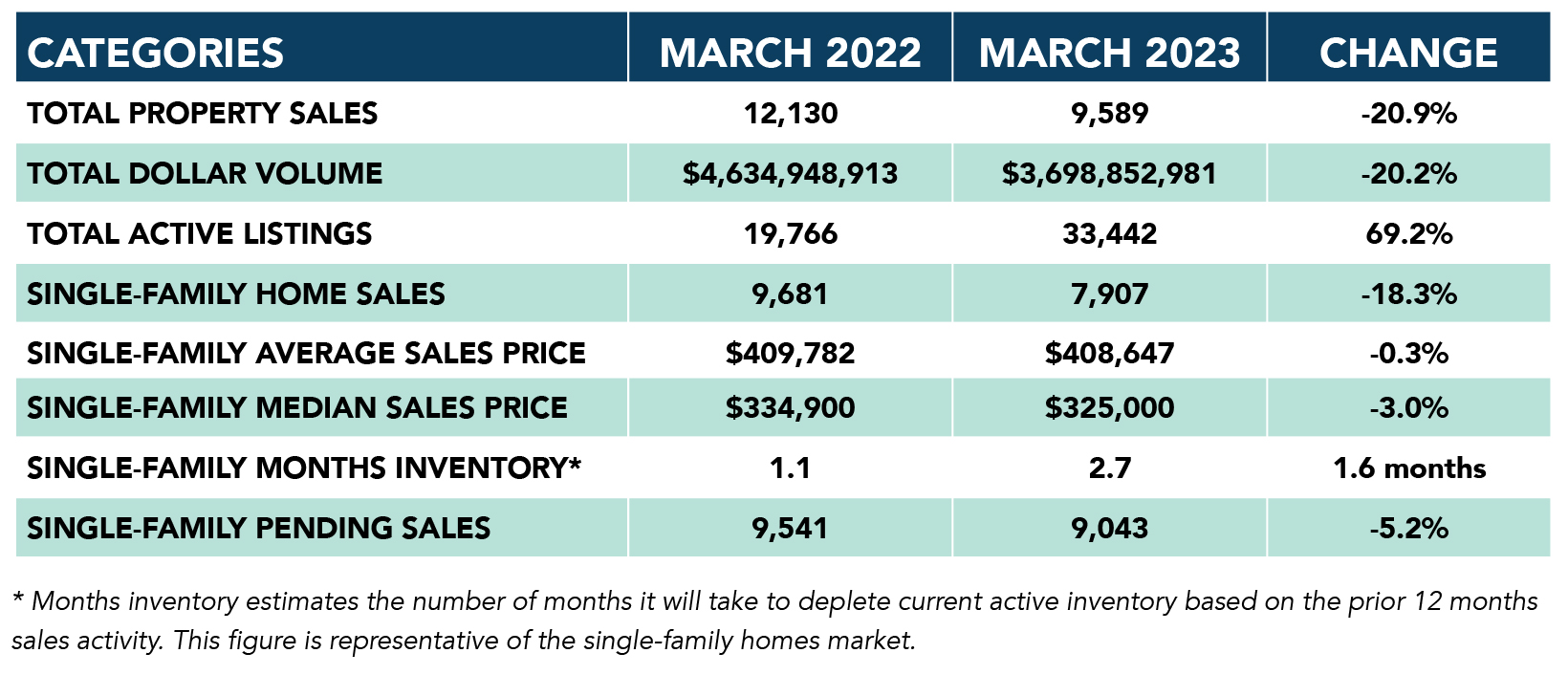

- See image below for year-over-year data. Month over month, average pricing is up over 6%, and average pricing is up 1.5%. I think pricing climbs in the April data.

- My overall deal volume is down a lot year over year for closed or under-contract deals. Just to give you an idea, so far in 2023, I've done 6 leases, 7 buy-side deals, and just 2 sales. Crazy to have done more leases than sales, but that just shows you where this market is. My overall deal volume is probably down at least 25% in 2023.

- One of the weirdest things about higher interest rates has been the change in the calculus relating to buyers selling their existing homes vs. renting them. A year ago, I was recommending that everyone hold and rent their homes if possible. HOWEVER, at this point, in some situations, it seems like folks are choosing to sell their old homes because their new interest rate is high enough that their equity from their existing home is better used to reduce their new loan balance in their new home. This argument only gets stronger as interest rates get higher. Something to consider. I'm a big proponent of building wealth through real estate, but you have to do the math on your own situation to decide what is the best option for you.

https://www.har.com/content/department/newsroom?pid=1934

https://www.harconnect.com/wp-content/uploads/2023/04/har_weeklystats-23-14.pdf