Houston

https://www.har.com/content/newsroom

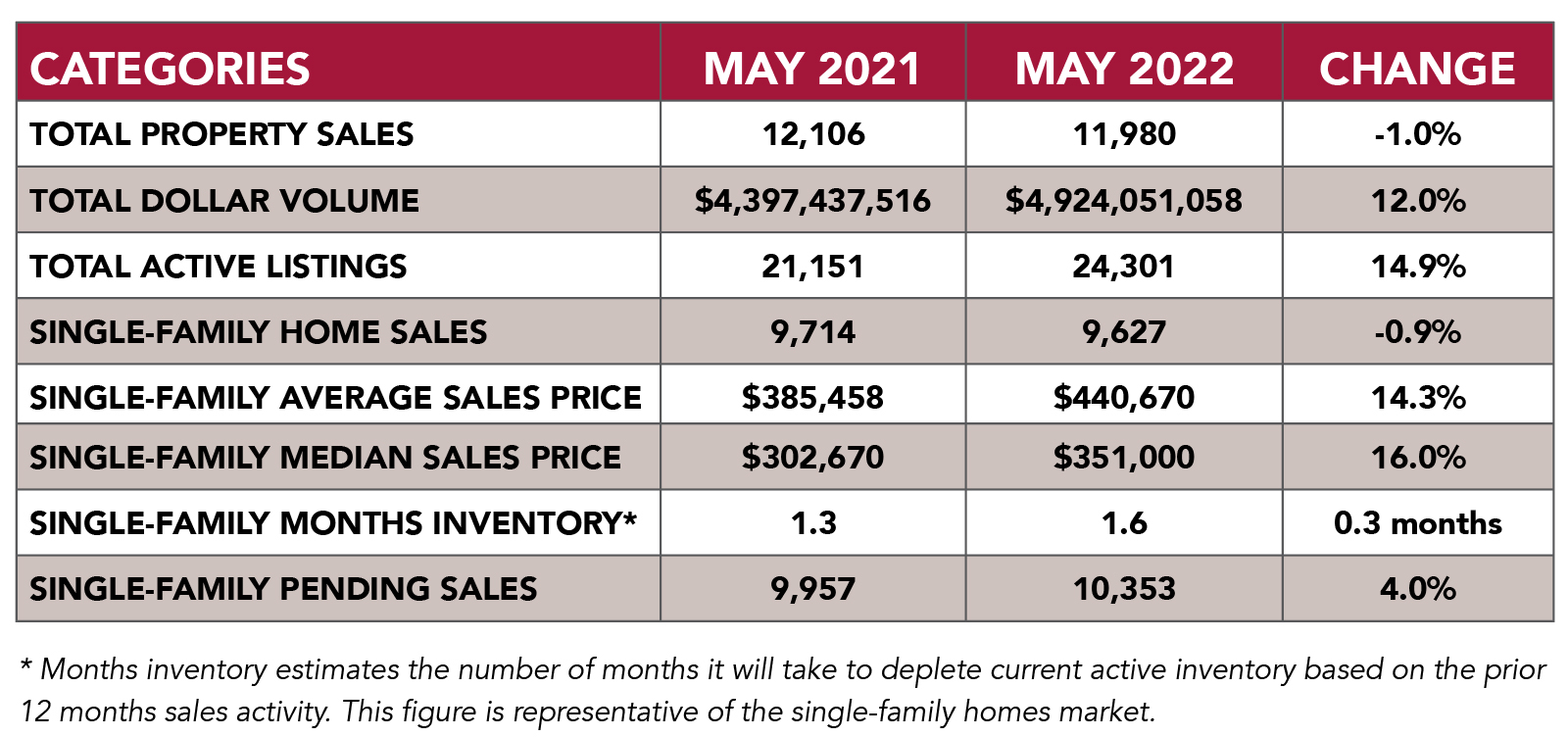

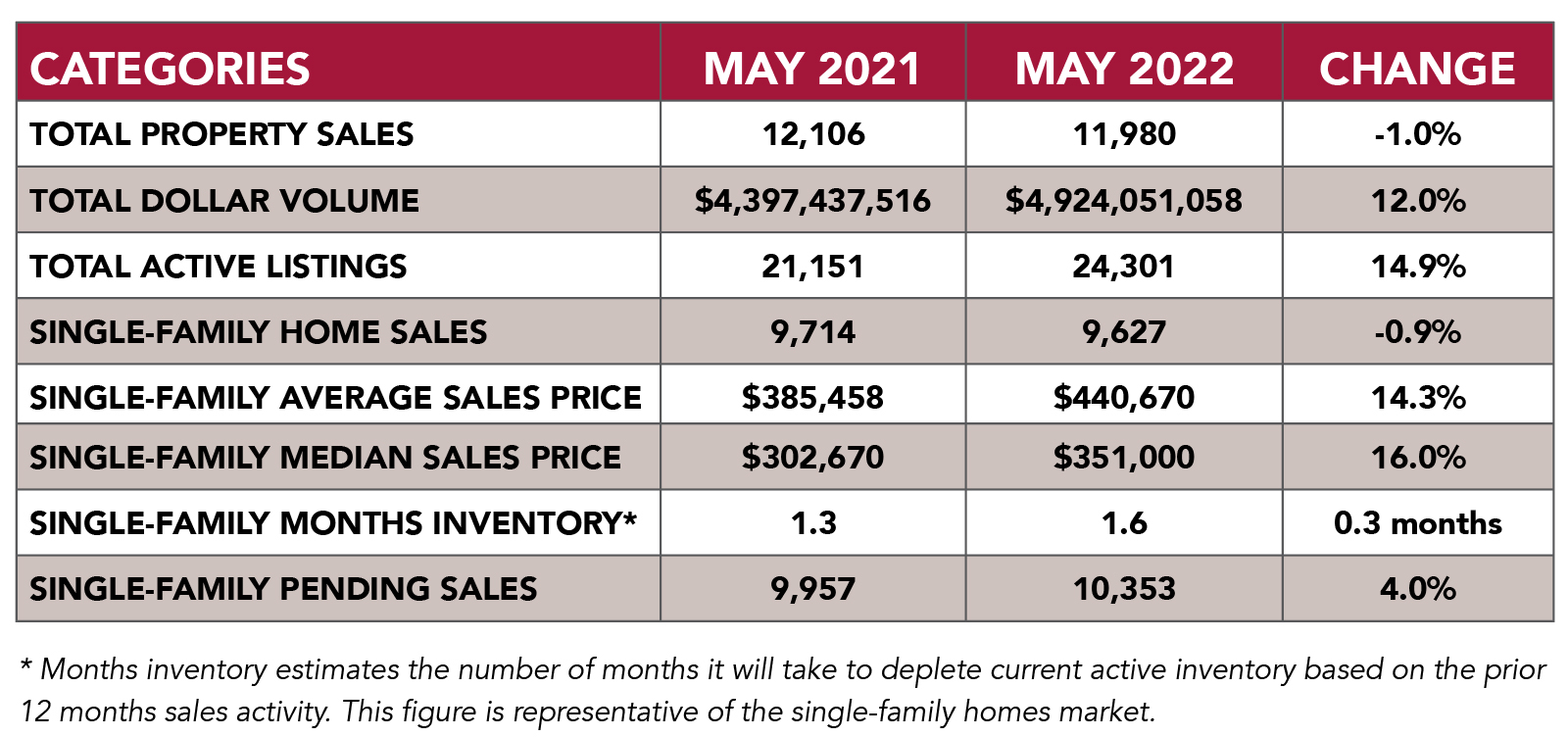

- Supply is up about 14% compared to last month and about 20% compared to this time last year.

- On the demand side, new mortgage applications are down to their lowest level in more than 20 years.

- Pricing is up about 15% compared to this time last year.

Quote:

Helped by a 9.0 percent increase in new listings, months of inventory reached a 1.6-months supply, the highest level since October 2021 when it was 1.7 months. Housing inventory nationally stands at a 2.2-months supply, according to the latest report from the National Association of Realtors (NAR). A 6.0-months supply is traditionally considered a "balanced market," in which neither the buyer nor the seller has an advantage.

https://www.har.com/content/newsroom

Sponsor Message: We Split Commissions. Full Service Agents in Austin, Bryan-College Station, Dallas-Fort Worth, Houston and San Antonio. Red Pear Realty