I haven't seen any discussion of this on the board. I also struggled to find a good summary article on it.

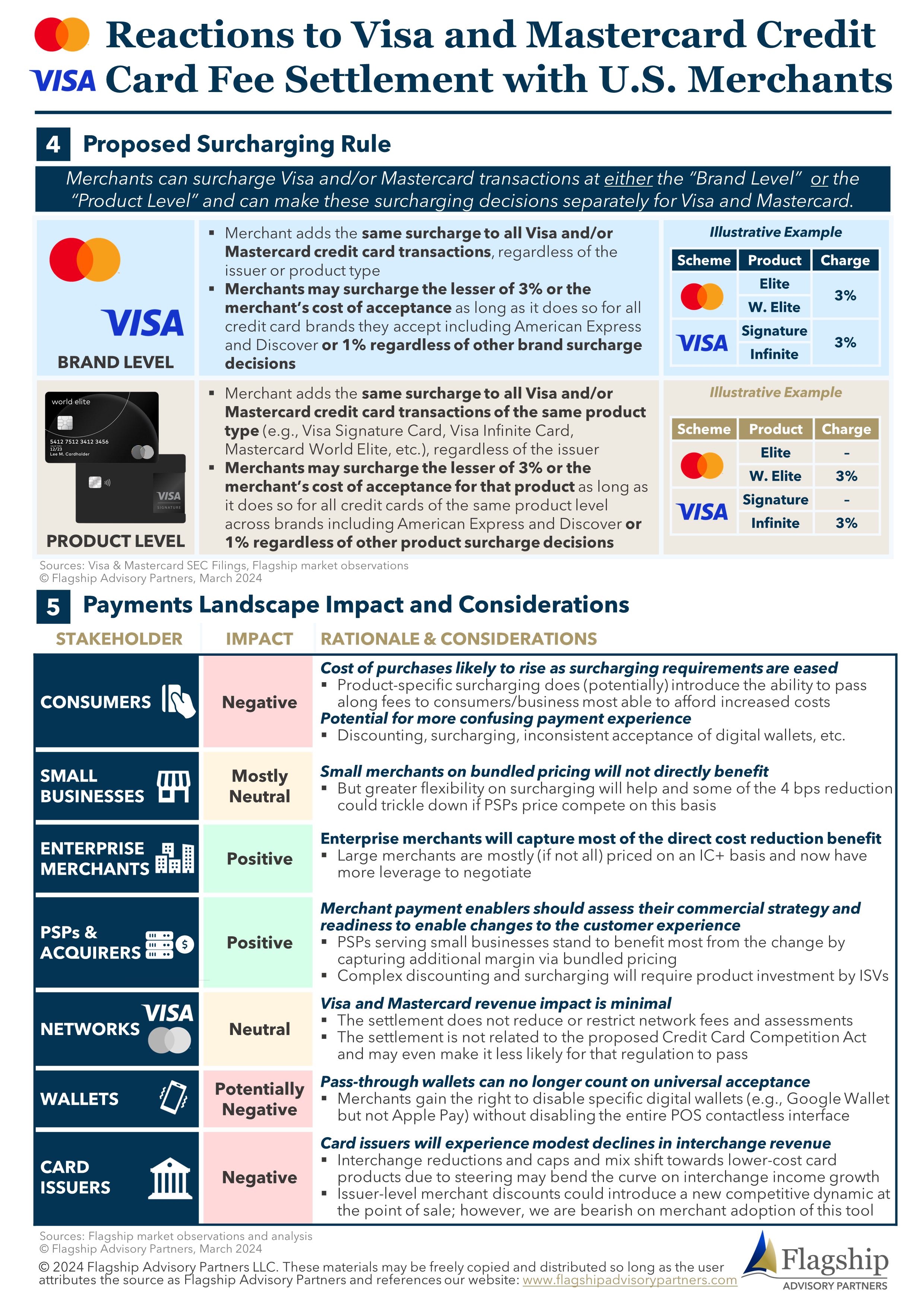

Essentially this settlement will reduce the interchange fee slightly for 5 years, make it easier for merchants to charge credit card surcharges, allow merchants to decline certain digital wallets, and allow merchants to discriminate based on card type (i.e. provide a discount for using a lower cost card such as a chase freedom vs a higher cost card like a chase sapphire reserve).

The credit card points competition between issuers has gotten out of hand largely because Visa/Mastercard were able to charge merchants higher fees for premium credit cards and Merchants did not have the ability to discriminate between cards. The settlement doesn't seem to bring about meaningful structural changes in the industry but will likely slow down the growth of premium cards.

Reactions to Visa and Mastercard Credit Card Fee Settlement with U.S. Merchants

Essentially this settlement will reduce the interchange fee slightly for 5 years, make it easier for merchants to charge credit card surcharges, allow merchants to decline certain digital wallets, and allow merchants to discriminate based on card type (i.e. provide a discount for using a lower cost card such as a chase freedom vs a higher cost card like a chase sapphire reserve).

The credit card points competition between issuers has gotten out of hand largely because Visa/Mastercard were able to charge merchants higher fees for premium credit cards and Merchants did not have the ability to discriminate between cards. The settlement doesn't seem to bring about meaningful structural changes in the industry but will likely slow down the growth of premium cards.

Reactions to Visa and Mastercard Credit Card Fee Settlement with U.S. Merchants

Quote:

- The schemes agreed to lower published credit card interchange fees by 0.04% for at least three years while ensuring that the average effective interchange rate (including posted rates and negotiated rates) is at least 0.07% lower than the average for the 12-month period ending on March 31, 2024, for five years.

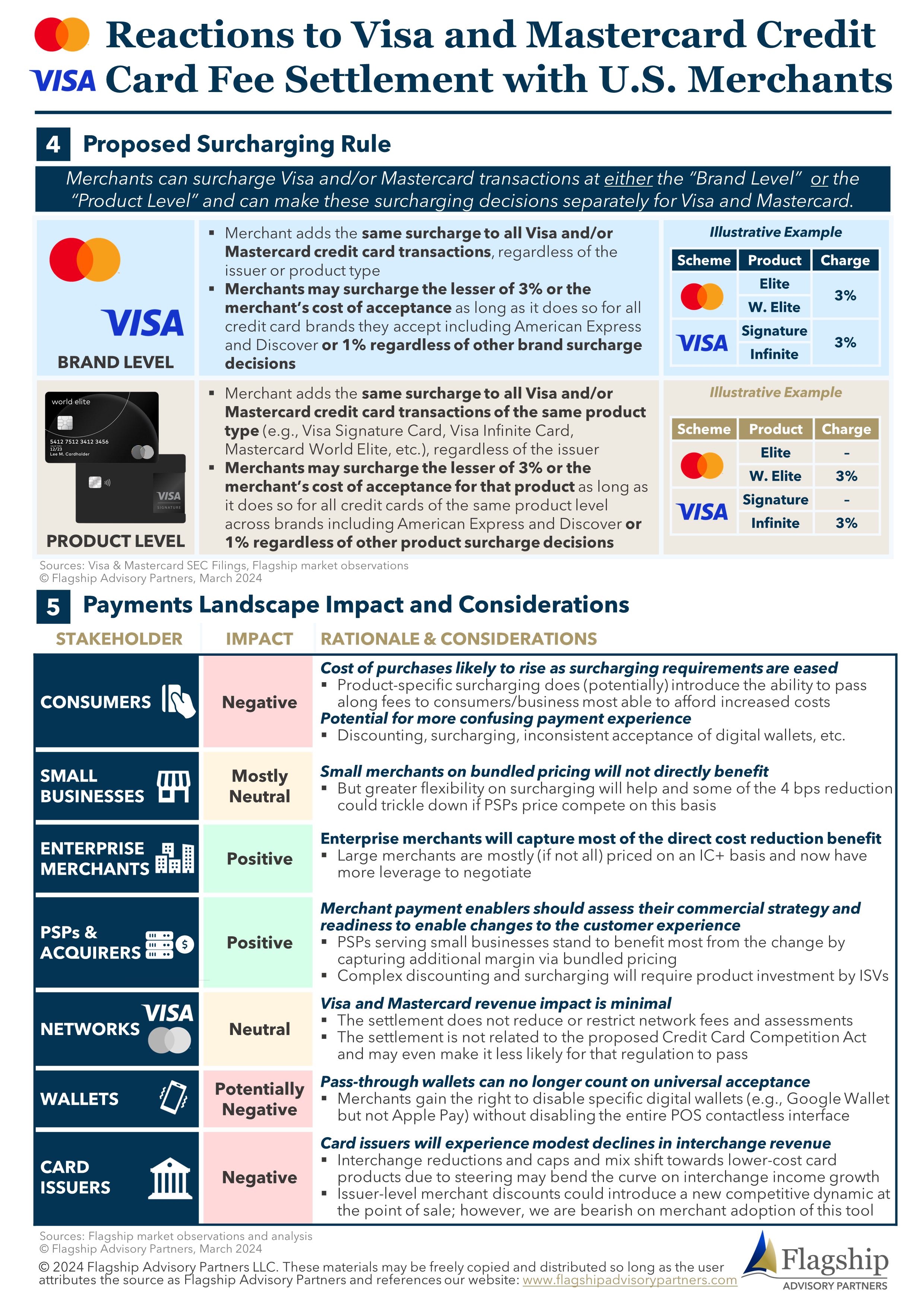

- Equally important, the settlement effectively removes most of the V/MC restrictions on surcharging, although for merchants to be fully unencumbered, certain states will also have to roll-back laws that restrict card surcharging (see Figure 4).

Other notable rule changes include:

1) Merchants may provide discounts (not surcharges) based on the card issuer and/or product type

2) Merchant can choose to accept or decline specific digital wallets whereas previously V/MC required merchants to honor all pass-through wallets like Apple Pay at brick-and-mortar locations

3) Merchants may now form "buying groups" to collectively negotiate with V/MC on fees