Background: Vanguard is forecasting global equities (ex-U.S.) to return significantly more over the next 10 years than domestic equities.

Source: Vanguard December Outlook

Over the past several years, I have probably been "overweight" on U.S. equities. While it has served me well, I am starting to slightly increase my international allocation as I invest my excess cash. With valuations where they are, global equities are increasingly looking like the better value to me. As of the last update on Vanguard's website (11/30/2020), VTSAX had a P/E ratio of 27.7x, while VTIAX had a P/E ratio of 19.1x. I haven't done the math, but I assume the FAANG and Tesla stocks drive the VTSAX ratio up pretty significantly, so I understand P/E isn't the end-all be-all in this assessment.

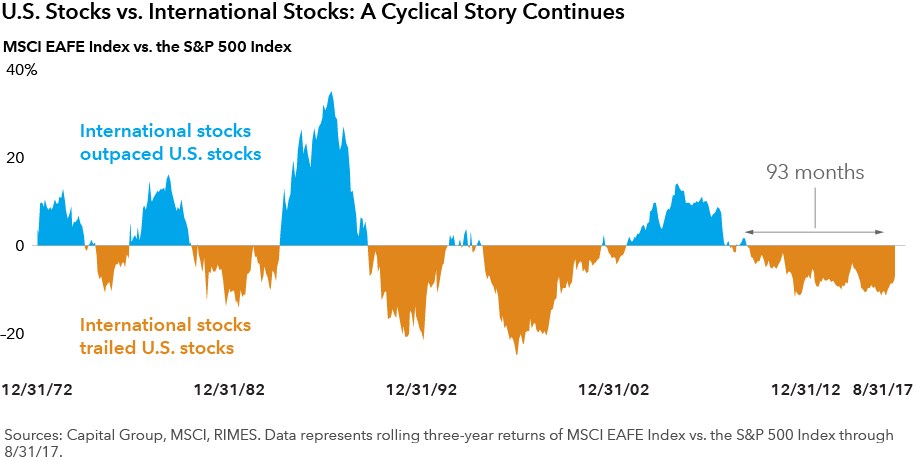

At the same time, I do question whether the same factors that have allowed the U.S. stock market to flourish in recent years (e.g., governmental policy, tech innovation, sociocultural aspects, etc.) will continue to push the U.S. to outperform other countries. Is it inevitable that we are going the way of Europe? It does feel like I've been reading these types of articles/white papers for a few years now and the forecast hasn't materialized yet. This article from Fidelity a year ago seems relevant to the discussion, as I imagine similar arguments may surface.

Curious to get the board's opinion and what moves everyone is making, if any.

- U.S. equities: 3.7%-5.7%

- Global equities (ex-U.S.): 7.0%-9.0%

Source: Vanguard December Outlook

Over the past several years, I have probably been "overweight" on U.S. equities. While it has served me well, I am starting to slightly increase my international allocation as I invest my excess cash. With valuations where they are, global equities are increasingly looking like the better value to me. As of the last update on Vanguard's website (11/30/2020), VTSAX had a P/E ratio of 27.7x, while VTIAX had a P/E ratio of 19.1x. I haven't done the math, but I assume the FAANG and Tesla stocks drive the VTSAX ratio up pretty significantly, so I understand P/E isn't the end-all be-all in this assessment.

At the same time, I do question whether the same factors that have allowed the U.S. stock market to flourish in recent years (e.g., governmental policy, tech innovation, sociocultural aspects, etc.) will continue to push the U.S. to outperform other countries. Is it inevitable that we are going the way of Europe? It does feel like I've been reading these types of articles/white papers for a few years now and the forecast hasn't materialized yet. This article from Fidelity a year ago seems relevant to the discussion, as I imagine similar arguments may surface.

Curious to get the board's opinion and what moves everyone is making, if any.