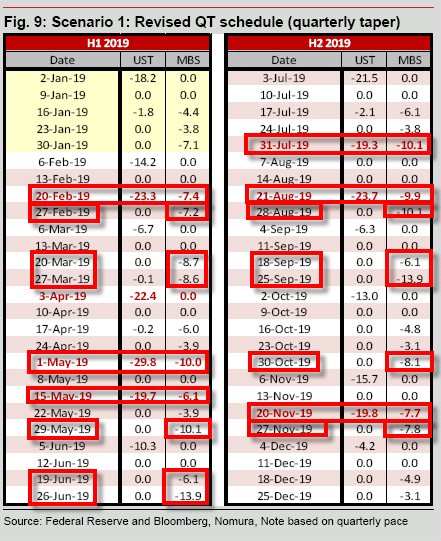

Now that the balance sheet reduction is in swing, I haven't really seen very much written about it.

We are accelerating the payback. The wind down of this balance sheet should be pretty telling.

Past year:

I get the sense that we (as a country) don't know as much about inflation, quantitative easing as we would have everyone believe.

It seems the equity markets are still flush with capital and the Fed still has firm control over short term interest rates. If anyone sees signs of an impact, please post here.

We are accelerating the payback. The wind down of this balance sheet should be pretty telling.

Past year:

I get the sense that we (as a country) don't know as much about inflation, quantitative easing as we would have everyone believe.

Quote:

"The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design".

- Friedrich Hayek

It seems the equity markets are still flush with capital and the Fed still has firm control over short term interest rates. If anyone sees signs of an impact, please post here.