Let's try this again with a tweet that hopefully won't be taken down.

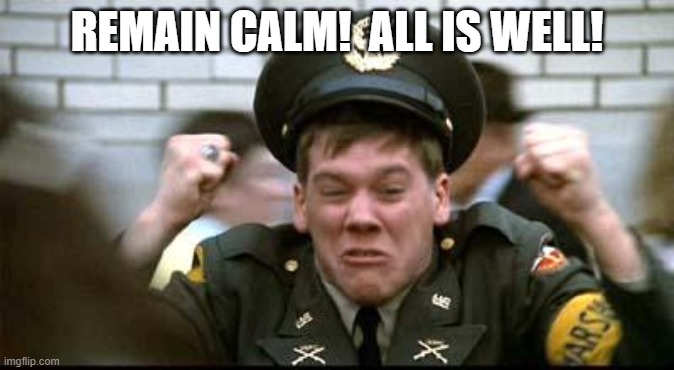

So is it just me that emphasizing there is no crisis means that there is in fact a crisis?

OMG look at Gensler's internal comments that the SEC mistakenly posted publicly:😅🙃🤦♀️ https://t.co/dFKuJ8OT0R pic.twitter.com/qIDP7feqIe

— Caitlin Long 🔑⚡️🟠 (@CaitlinLong_) September 10, 2024

So is it just me that emphasizing there is no crisis means that there is in fact a crisis?