Corporate bankruptcies and defaults are surging here's why

UPDATED SUN, JUN 25 20239:17 AM EDT

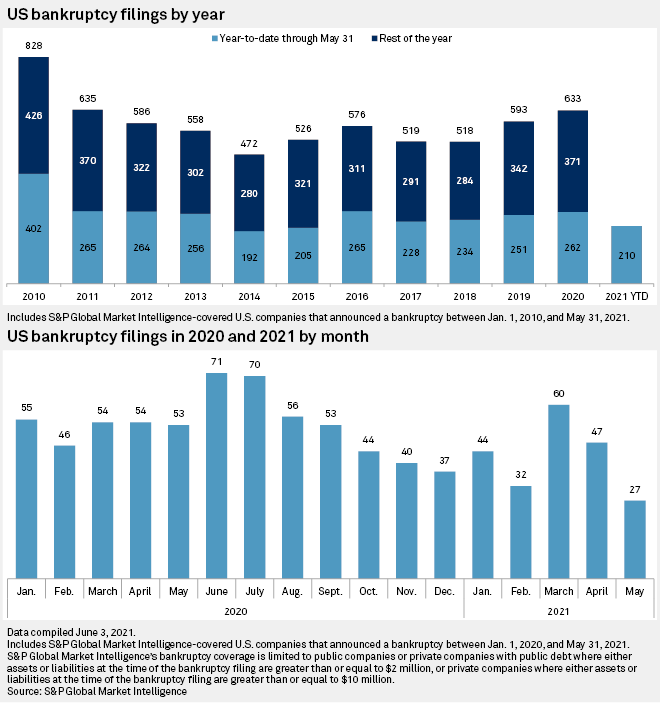

Corporate defaults rose last month, with 41 in the U.S. so far this year. That's more than double the same period last year, according to Moody's Investors Service.

Companies are defaulting on their debt due to uncertain economic conditions and heavy debt loads. High interest rates have made it difficult to refinance, as debt is more expensive.

The number of bankruptcy filings in the U.S. this year has also sharply risen, to levels not seen since 2010.

hmmm.. that's funny because I haven't heard anyone in the media or the White House discuss any of these issues. But surely this would be news if true, right?

UPDATED SUN, JUN 25 20239:17 AM EDT

Corporate defaults rose last month, with 41 in the U.S. so far this year. That's more than double the same period last year, according to Moody's Investors Service.

Companies are defaulting on their debt due to uncertain economic conditions and heavy debt loads. High interest rates have made it difficult to refinance, as debt is more expensive.

The number of bankruptcy filings in the U.S. this year has also sharply risen, to levels not seen since 2010.

hmmm.. that's funny because I haven't heard anyone in the media or the White House discuss any of these issues. But surely this would be news if true, right?