Something like 80% of all dollars created in all of history have been created since 2020.

Obviously, it doesnt take a rocket-economist to see that printing this many dollars this fast will make each one worth significantly less.

At what point does our dollar collapse into peso-like status? And do you think it will be a slow fade? Or a sudden and abrupt collapse?

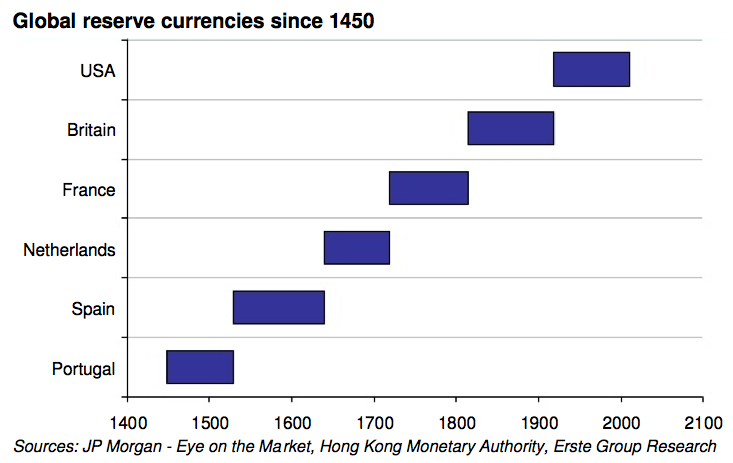

Obviously, the main reason it is still standing now is it's status as the world reserve currency, specifically as the petro-dollar, which is behind every trade worldwide of oil.

With China and the Saudis flirting, the Russians obviously looking to move away from the dollar, what will happen?

I have even read where Russia is looking at going back to the gold standard.

Is collapsing our greenback part of their plan to implement FedCoin (the supposedly forthcoming digital dollar)? This way, they can just drop a new currency, and nullify all of their debts (but certainly not yours!) Why would the people in charge do this? Do they assume that the new FedCoin would retain its status in the world?

Or is this paving the way for the whole "Great Reset" thing for a more global currency?

And for the economist types, if the dollar is devalued to the point of garbage, what does that look like for domestic spending? Obviously the international exchange rate would kill you going abroad, but what about domestically?

I was just curious as to the thoughts of this board on these things.

Obviously, it doesnt take a rocket-economist to see that printing this many dollars this fast will make each one worth significantly less.

At what point does our dollar collapse into peso-like status? And do you think it will be a slow fade? Or a sudden and abrupt collapse?

Obviously, the main reason it is still standing now is it's status as the world reserve currency, specifically as the petro-dollar, which is behind every trade worldwide of oil.

With China and the Saudis flirting, the Russians obviously looking to move away from the dollar, what will happen?

I have even read where Russia is looking at going back to the gold standard.

Is collapsing our greenback part of their plan to implement FedCoin (the supposedly forthcoming digital dollar)? This way, they can just drop a new currency, and nullify all of their debts (but certainly not yours!) Why would the people in charge do this? Do they assume that the new FedCoin would retain its status in the world?

Or is this paving the way for the whole "Great Reset" thing for a more global currency?

And for the economist types, if the dollar is devalued to the point of garbage, what does that look like for domestic spending? Obviously the international exchange rate would kill you going abroad, but what about domestically?

I was just curious as to the thoughts of this board on these things.