HOUSTON

HAR:

The Facts

My Take

https://www.har.com/content/department/newsroom?pid=2061

https://www.cnbc.com/quotes/US10Y

HAR:

Quote:

With an uptick in home sales and expanding inventory, the Houston real estate market's positive momentum in February brings an optimistic outlook for the spring homebuying season.

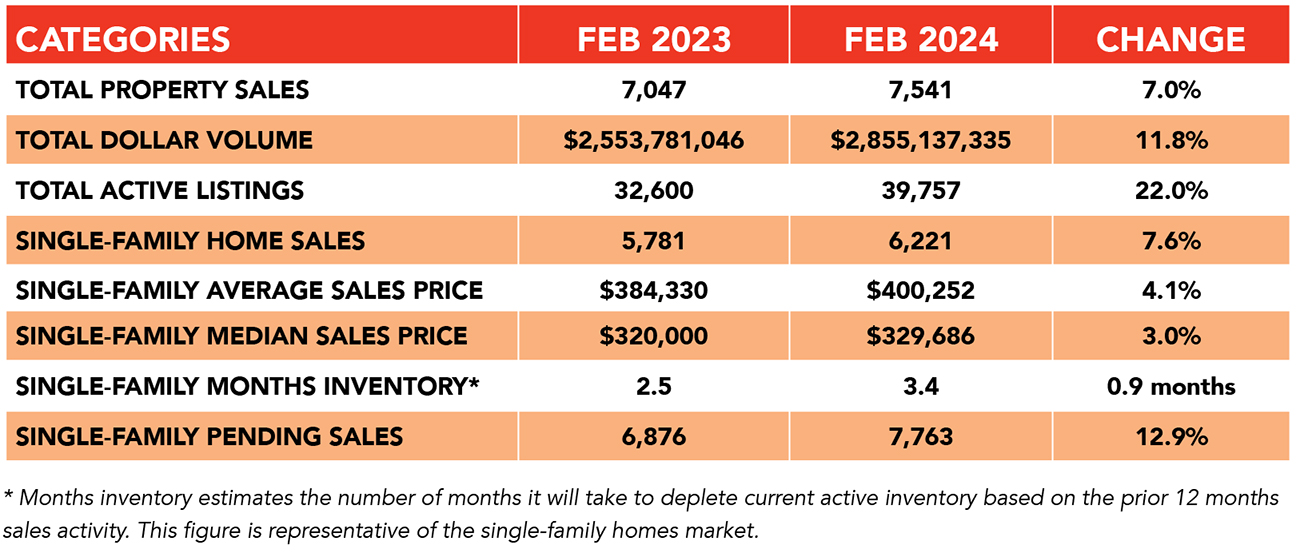

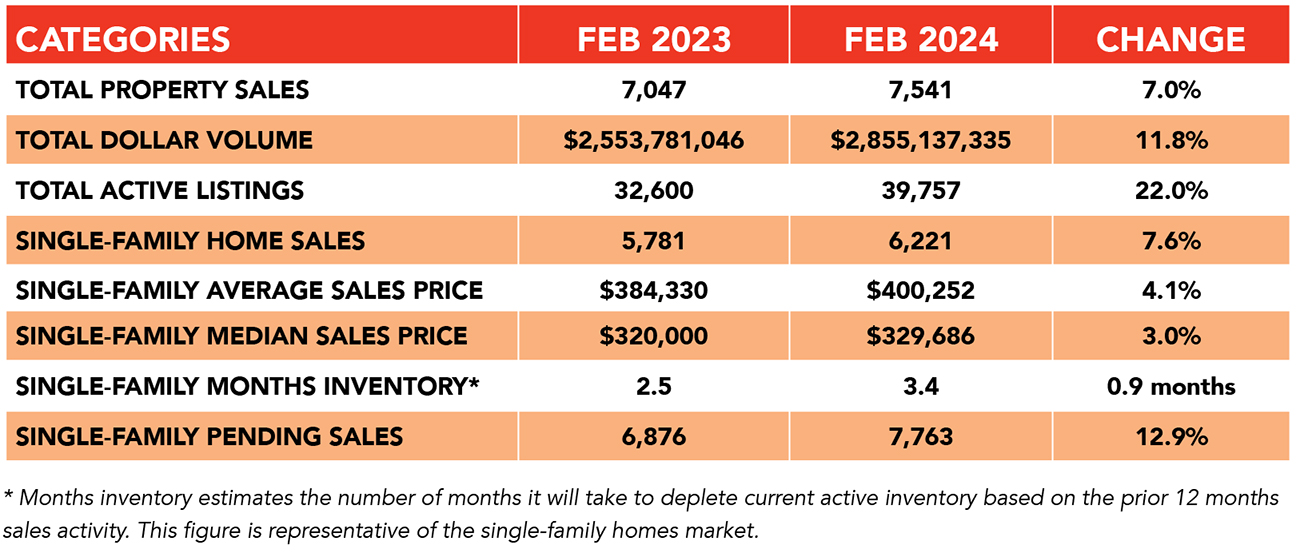

According to the Houston Association of Realtors' (HAR) February 2024 Market Update, single-family home sales across the Greater Houston area rose 7.6 percent. That is only the third increase in the past year....

The high end of the market saw the strongest performance in February. Home sales in the luxury segment ($1 million+), which represents just 3.5 percent of all homes on the market, surged 48.0 percent year-over-year. That was followed by the segment that consisted of homes priced between $500,000 and $1 million which rose 18.3 percent year-over-year. Only homes priced between $150,000 to $250,000 saw declines during the month. Rentals of single-family homes continued to hold strong in February....

"With pent-up demand, consumers appear to finally be pushing aside interest rate concerns and returning to the market, which bodes well for the spring homebuying season," said HAR Chair Thomas Mouton with Century 21 Exclusive. "The increase in home sales, slight appreciation in home prices and expanding inventory, creates opportunities for both buyers and sellers in the marketplace."

The Facts

- Mean/Median pricing up 4.1% / 3.0% year over year

- Inventory up 0.1 months from 3.3 to 3.4 from the last publication and up 0.9 months YOY

- Total property sales are up 7% YOY

- Active listings are up 22% YOY

- Interest rates are up in the high 6% to low 7% range again since the bad inflation reports published over the last week

- The 10 yr. treasury is sitting just about where it was last month, at 4.30% as of this morning

My Take

- It seems like buyers have come to terms with 6-7% interest rates. Conversely, when rates fall, I think the Houston market is going to go bananas. More on this later.

- There seems to be very little actual movable inventory in the "better" markets that most of my clients play in (Oak Forest, Memorial areas, Heights, etc.), and when something even somewhat acceptable gets posted, its moving fast. There is definitely inventory, but what isn't moving is generally either overpriced or needs significant repairs and is overpriced, or something to that effect.

- The majority of folks I see selling are for (1) Death or (2) Divorce or (3) Work Move or (4) Have kids and need more space ASAP.

- When I see major financial "whales" like Jamie Dimon (my favorite CEO, ha) and Ken Griffin say very similar things like this at around the same time, my take is that those comments are coordinated and coming from the Fed. Given this, I wouldn't expect rate cuts until at least the fed meeting on July 31. The CME Fedwatch Tool is showing that the market is pricing in a 50% chance of a 25 bps rate drop in June, but I think its not going to happen then, especially with all the bad inflation news we've gotten this past week. I do think we see rate cuts before the election.

https://www.har.com/content/department/newsroom?pid=2061

https://www.cnbc.com/quotes/US10Y

Sponsor Message: We Split Commissions. Full Service Agents in Austin, Bryan-College Station, Dallas-Fort Worth, Houston and San Antonio. Red Pear Realty