I have been dabbling with leveraged (2x and 3x) ETFs for the last few months after first hearing about them, and they have been crushing it in my portfolio.

The most common strategy that I have seen written about is a combination (70/30, 60/40, 50/50, whatever) of UPRO/TMF. (UPRO = 3x S&P 500 and TMF = 3x 20+ year T-bills) Other combinations include subbing TQQQ (3x NASDAQ 100) for UPRO. You can run a backtest and see that these perform remarkably well, but the funds only go back to 2011 so the fact that they have only existed during a bull market.

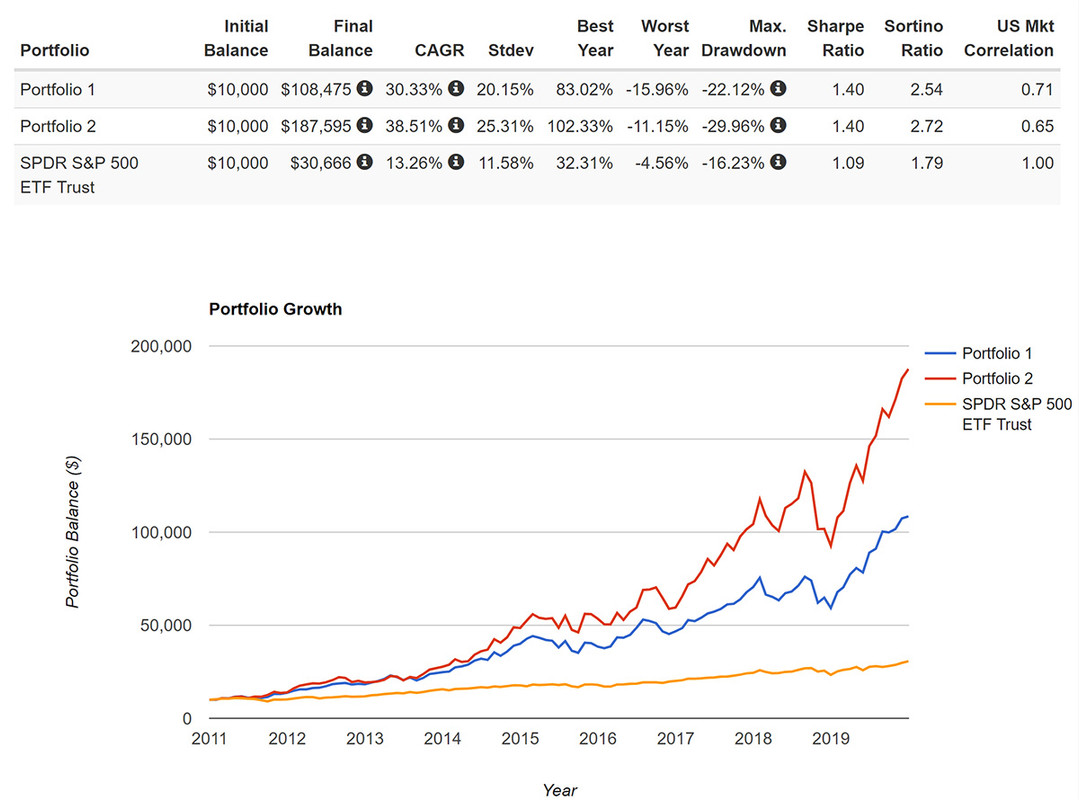

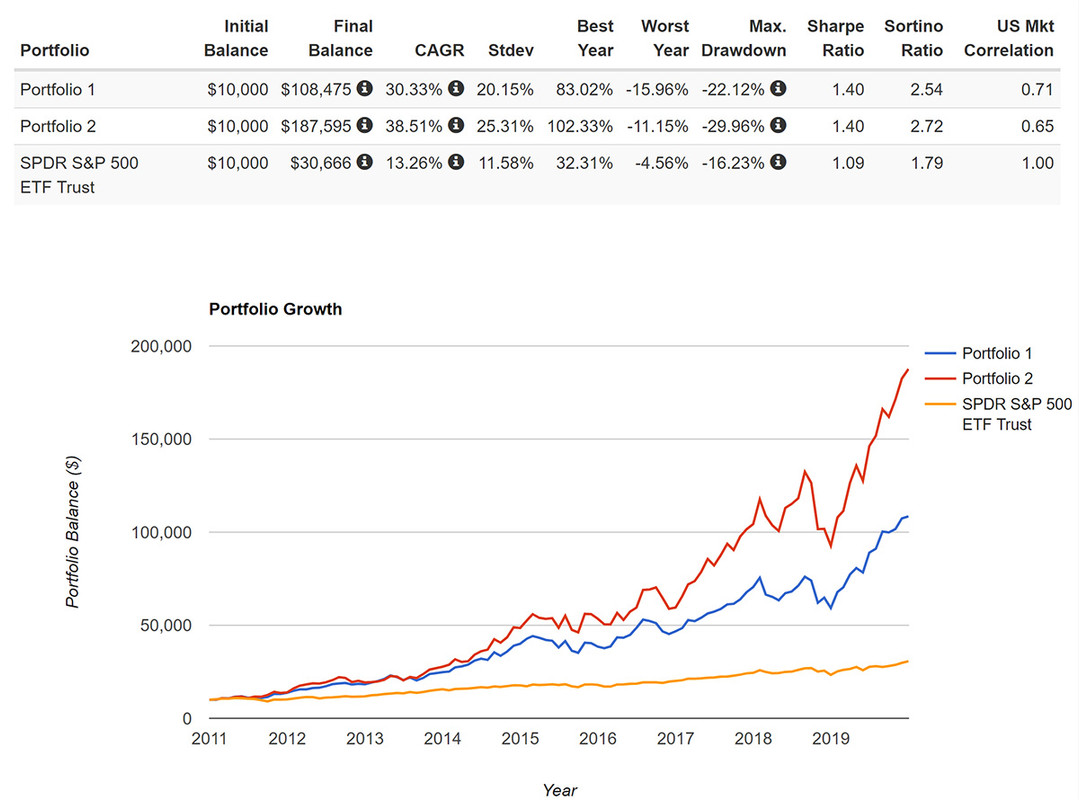

3x ETF Portfolio examples (link) with 60/40 UPRO/TMF (Portfolio 1) and 60/40 TQQQ/TMF (Portfolio 2)

One might wonder: Why not just hold UPRO or TQQQ and forget the TMF component? Well, the volatility goes way up when you do that, even if the returns go up. Also, just like in a traditional portfolio, where you want to hold bonds with stocks, it provides a counter-balance should the market crash in the future.

The first hurdles for me to get past were:

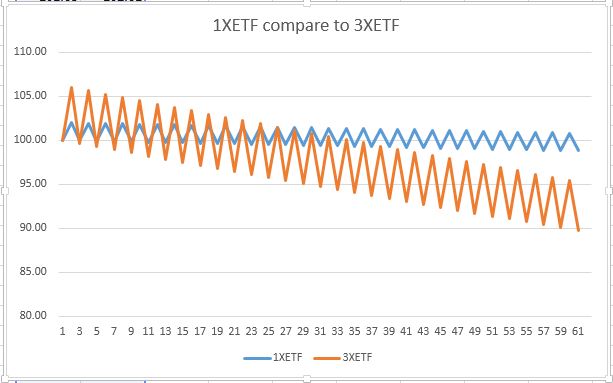

1) leveraged ETFs are good short-term holdings, but are bad long term due to decay, and

2) the funds have only existed during a long-term bull market, so who knows what happens when we get to an extended bear market?

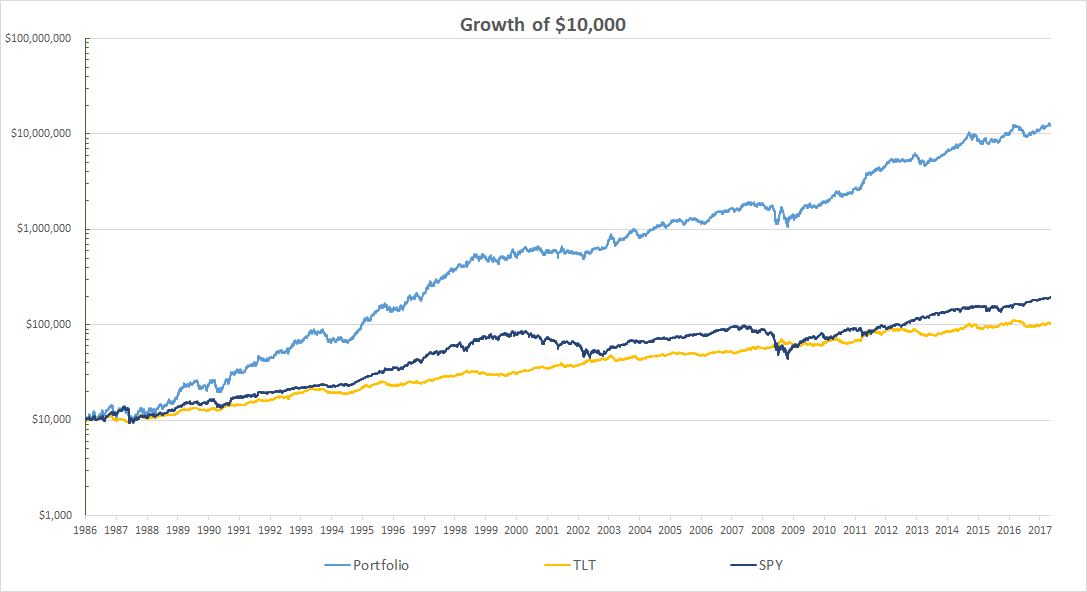

While these both seemed like valid concerns, upon reading more I found articles such as this one (link) which simulate the data back further back. (back to 1987 in the linked article) The results seem to indicate that holding the products for a long term in conjunction with each other can provide much better long term returns than anything by itself.

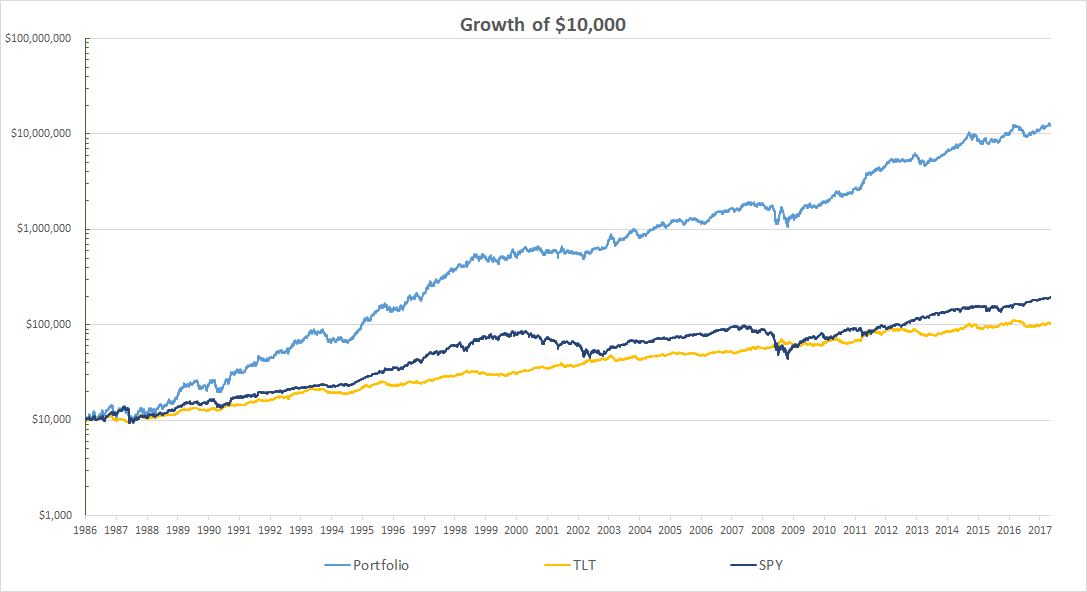

He simulated a 35/65 UPRO/TMF strategy back to 1987 which looks pretty good:

Also, after reading this article on leveraged ETF decay and understanding more what decay actually is and why it is not necessarily something to fear, I felt better about making the investments.

I am not sure if anyone else is even remotely as interested in this as I am, but if anyone is and wants to dig in further, I would suggest this 4-Part series titled "A Dead Simple 2-Asset Portfolio that Crushes the S&P500": Part 1, Part 2, Part 3, Part 4.

...and if you are REALLY interested, you can look at these threads on bogleheads.org: HEDGEFUNDIE's excellent adventure (warning: 68 pages) and the follow-up thread, HEDGEFUNDIE's excellent adventure Part II: The next journey (warning: currently 43 pages and growing)

If you read through them enough, you can see that some people use momentum strategies with these and other 3x ETFs (risk-parity, inverse volatility, etc.) to either increase returns, decrease volatility, or both. That is what I am most interested in now and coming up with strategies that maximize Sharpe and Sortino ratios is what I have been trying to do recently. Not sure if anyone is interested enough to have a discussion about more advanced strategies or not, so I will leave it there for the moment to see if there is any further interest.

Hope some others here are as interested in leveraged trading strategies as I am.

The most common strategy that I have seen written about is a combination (70/30, 60/40, 50/50, whatever) of UPRO/TMF. (UPRO = 3x S&P 500 and TMF = 3x 20+ year T-bills) Other combinations include subbing TQQQ (3x NASDAQ 100) for UPRO. You can run a backtest and see that these perform remarkably well, but the funds only go back to 2011 so the fact that they have only existed during a bull market.

3x ETF Portfolio examples (link) with 60/40 UPRO/TMF (Portfolio 1) and 60/40 TQQQ/TMF (Portfolio 2)

One might wonder: Why not just hold UPRO or TQQQ and forget the TMF component? Well, the volatility goes way up when you do that, even if the returns go up. Also, just like in a traditional portfolio, where you want to hold bonds with stocks, it provides a counter-balance should the market crash in the future.

The first hurdles for me to get past were:

1) leveraged ETFs are good short-term holdings, but are bad long term due to decay, and

2) the funds have only existed during a long-term bull market, so who knows what happens when we get to an extended bear market?

While these both seemed like valid concerns, upon reading more I found articles such as this one (link) which simulate the data back further back. (back to 1987 in the linked article) The results seem to indicate that holding the products for a long term in conjunction with each other can provide much better long term returns than anything by itself.

He simulated a 35/65 UPRO/TMF strategy back to 1987 which looks pretty good:

Also, after reading this article on leveraged ETF decay and understanding more what decay actually is and why it is not necessarily something to fear, I felt better about making the investments.

I am not sure if anyone else is even remotely as interested in this as I am, but if anyone is and wants to dig in further, I would suggest this 4-Part series titled "A Dead Simple 2-Asset Portfolio that Crushes the S&P500": Part 1, Part 2, Part 3, Part 4.

...and if you are REALLY interested, you can look at these threads on bogleheads.org: HEDGEFUNDIE's excellent adventure (warning: 68 pages) and the follow-up thread, HEDGEFUNDIE's excellent adventure Part II: The next journey (warning: currently 43 pages and growing)

If you read through them enough, you can see that some people use momentum strategies with these and other 3x ETFs (risk-parity, inverse volatility, etc.) to either increase returns, decrease volatility, or both. That is what I am most interested in now and coming up with strategies that maximize Sharpe and Sortino ratios is what I have been trying to do recently. Not sure if anyone is interested enough to have a discussion about more advanced strategies or not, so I will leave it there for the moment to see if there is any further interest.

Hope some others here are as interested in leveraged trading strategies as I am.

Hustle Harder