I think we might have a HUGE problem here. Anyone with more financial education want to weigh in?

indeed, starting just before the covid lockout seems like an odd choiceSwigAg11 said:

I think it's an issue, but I would also like to see the chart extended more than just 3 years.

EMY92 said:

Credit card loans are great with the low initial rates, then the hammer gets dropped on you.

I think people use them because they see the low initial rate and don't look any farther, they are also incredibly easy to get. There is no loan application or anything other "hoops" to jump through.

will25u said:

I think we might have a HUGE problem here. Anyone with more financial education want to weigh in?

That's the point of higher interest rates. Increase the cost and lower the speed (volatility) of money.Sea Speed said:EMY92 said:

Credit card loans are great with the low initial rates, then the hammer gets dropped on you.

I think people use them because they see the low initial rate and don't look any farther, they are also incredibly easy to get. There is no loan application or anything other "hoops" to jump through.

We wanted to float about 10 grand yesterday for my wife's business with a credit card and the fee was 5%, enough that we just used cash, so there is at least some barrier there, just for the sake of discussion. We would rather draw down some on our savings for a week than pay a $500 fee.

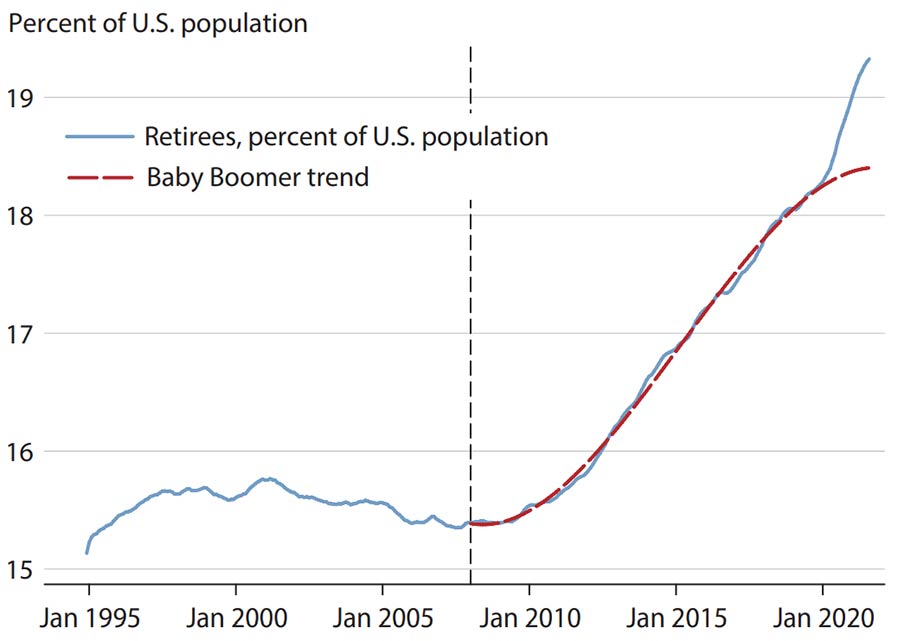

Boomers retiring and labor force participation decreasingTom Kazansky 2012 said:

Peep the dates and hang on fellas.

Recession inbound (already here)

tysker said:That's the point of higher interest rates. Increase the cost and lower the speed (volatility) of money.Sea Speed said:EMY92 said:

Credit card loans are great with the low initial rates, then the hammer gets dropped on you.

I think people use them because they see the low initial rate and don't look any farther, they are also incredibly easy to get. There is no loan application or anything other "hoops" to jump through.

We wanted to float about 10 grand yesterday for my wife's business with a credit card and the fee was 5%, enough that we just used cash, so there is at least some barrier there, just for the sake of discussion. We would rather draw down some on our savings for a week than pay a $500 fee.

They are effectively the same thing when you are getting a line of credit or collateralized loan.Sea Speed said:tysker said:That's the point of higher interest rates. Increase the cost and lower the speed (volatility) of money.Sea Speed said:EMY92 said:

Credit card loans are great with the low initial rates, then the hammer gets dropped on you.

I think people use them because they see the low initial rate and don't look any farther, they are also incredibly easy to get. There is no loan application or anything other "hoops" to jump through.

We wanted to float about 10 grand yesterday for my wife's business with a credit card and the fee was 5%, enough that we just used cash, so there is at least some barrier there, just for the sake of discussion. We would rather draw down some on our savings for a week than pay a $500 fee.

That wasn't an interest rate, it was a fee.

Several financial podcasts I listen mention that the market still hasn't really priced in the higher rates mostly because the lower spending has yet to really hit companies. It may take another 3-9 months depending on the business. Firms have been able to cutback on labor and overhead from covid, but as revenue continues to slow, especially in the face of raising labor and overhead costs, businesses are going to show decreasing profits YoY.MouthBQ98 said:

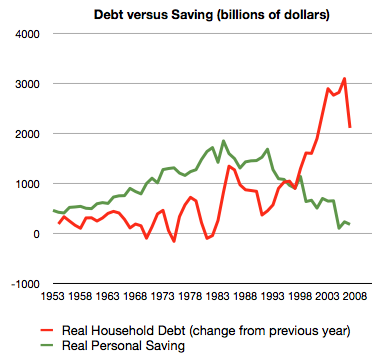

Those are people trying to sustain their consumption rates in the face of inflation. 84 month notes on near 6 figure rides, using credit to pay bills and mortgage payments, buy groceries, instead of cutting back consumption, which will finally slow inflation (and sharpen the recession). We're in for a pretty good reset when this credit bubble bursts as people become unable to keep juggling it.

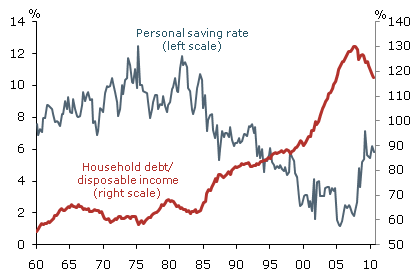

I would like to see a chart that compares number$ to number$, not number$ to %%. Also, show the last 20 years.SwigAg11 said:

I think it's an issue, but I would also like to see the chart extended more than just 3 years.

CDUB98 said:

Not all debt is bad. You have to know how to use it.For example: wife and I needed a new mattress. Ours was flat dead and uncomfortable. Mattress Firm was running a 0% interest for 5-years earlier this year. So, we bought a new mattress and were able to string that sucker out at 0%, HELL YES!! With today's inflation, that basically an 8% discount. But wait, there's more, we also got $300 dollars in freebies for in-store stuff, but wait, there's more, we also got some kind of $300 in-store credit on top of that for opening an account. So, we just "purchased" another mattress for our front bedroom because that cheap ass one had worn out as well from in-laws staying.Obviously, Mattress Firm will still make a positive gross margin on the product, but for us, THAT is using debt wisely. We're reducing our monthly real interest thanks to the Fed.

aTm2004 said:

The only reason I have the Apple Card is because we're in the Apple ecosystem and they do 12 months 0% when you buy Apple products. On top of that, you get 3% back instantly. I first got it when my wife and I got new phones in '19 and used it one other time when we bought the 2 older kids iPads. Because of this, even though I hate carrying debt, I didn't see a need to pay up front for any of those items. I'm sure Apple is making money off of it some how, but it seems like a good choice as long as you make your payments on time.

Average financing rates right now:

— CarDealershipGuy (@GuyDealership) November 2, 2022

New cars: 6.27%

Used cars: 10.33% !!!!

(source: Edmunds)

aggrad02 said:CDUB98 said:

Not all debt is bad. You have to know how to use it.For example: wife and I needed a new mattress. Ours was flat dead and uncomfortable. Mattress Firm was running a 0% interest for 5-years earlier this year. So, we bought a new mattress and were able to string that sucker out at 0%, HELL YES!! With today's inflation, that basically an 8% discount. But wait, there's more, we also got $300 dollars in freebies for in-store stuff, but wait, there's more, we also got some kind of $300 in-store credit on top of that for opening an account. So, we just "purchased" another mattress for our front bedroom because that cheap ass one had worn out as well from in-laws staying.Obviously, Mattress Firm will still make a positive gross margin on the product, but for us, THAT is using debt wisely. We're reducing our monthly real interest thanks to the Fed.

You do realize that the interest on that debt is hid in the upfront price of the mattress, right? Along with all the "freebies" you got.

aTm2004 said:

Would the price have changed if he paid cash up front (freebies aside)?

nortex97 said:

Yeah…inflation/costs are skyrocketing because Brandon is in office.Average financing rates right now:

— CarDealershipGuy (@GuyDealership) November 2, 2022

New cars: 6.27%

Used cars: 10.33% !!!!

(source: Edmunds)

Young people (who borrow more/make less) pay the price when the socialists win.

It's gotten so bad you see caravans of used cars going NORTH on I-35nortex97 said:

Yeah…inflation/costs are skyrocketing because Brandon is in office.Average financing rates right now:

— CarDealershipGuy (@GuyDealership) November 2, 2022

New cars: 6.27%

Used cars: 10.33% !!!!

(source: Edmunds)

Young people (who borrow more/make less) pay the price when the socialists win.

CDUB98 said:aTm2004 said:

Would the price have changed if he paid cash up front (freebies aside)?

No