HOUSTON

We made it through 2023! What a crazy year it was!

THE FACTS

From HAR:

https://www.bls.gov/cpi/

https://www.har.com/content/department/mls?y=2024&m=01

MY TAKE

We made it through 2023! What a crazy year it was!

THE FACTS

From HAR:

Quote:

For the second year in a row, economic forces affecting the entire country caused its share of disruption to the Houston housing market. While 2023 saw significant growth in housing inventory and moderation in pricing, it was ultimately mortgage interest rates, which leapt to 20-year highs, that prompted many would-be buyers to scrap purchasing plans or pivot to rental housing in 2023. As 2024 gets underway, Houston's residential housing landscape is considered to be on solid footing if you factor out the uncertainty of what the Federal Reserve may do with interest rates and lingering consumer jitters over inflation.

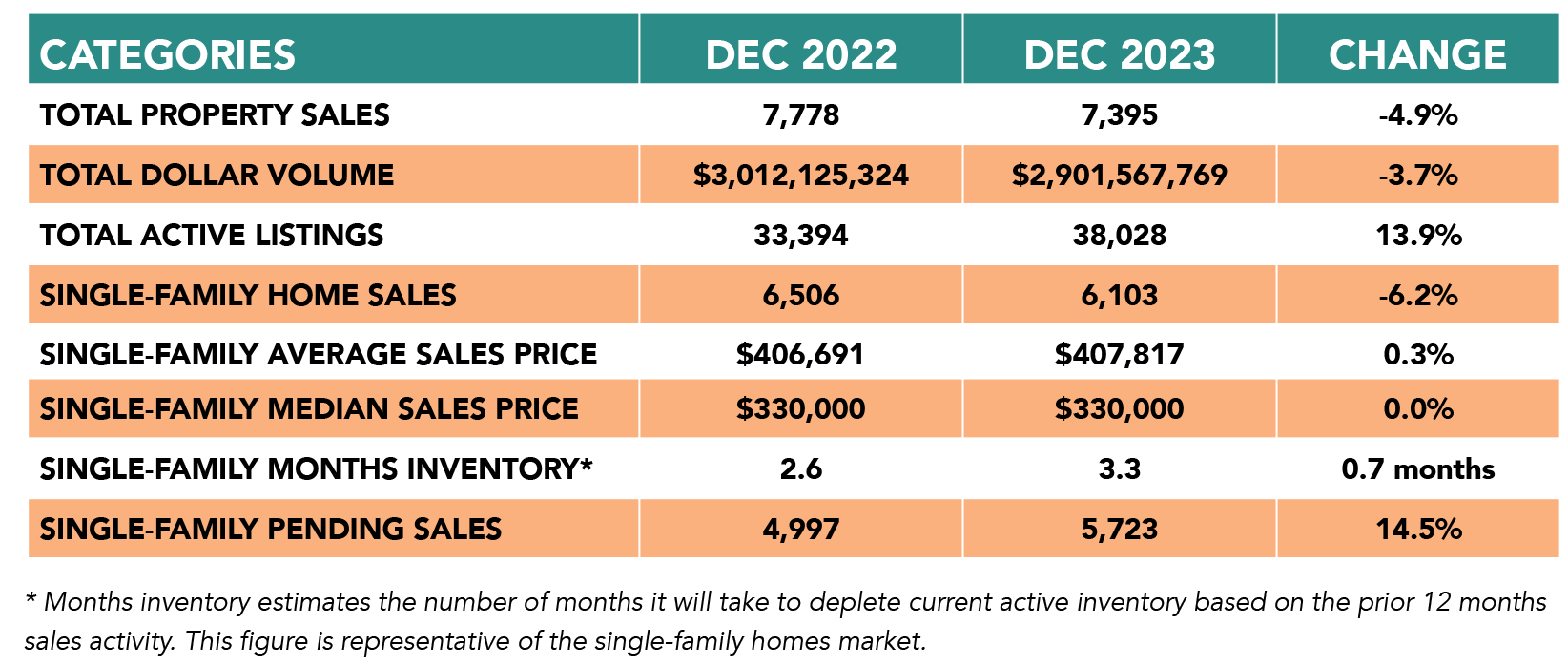

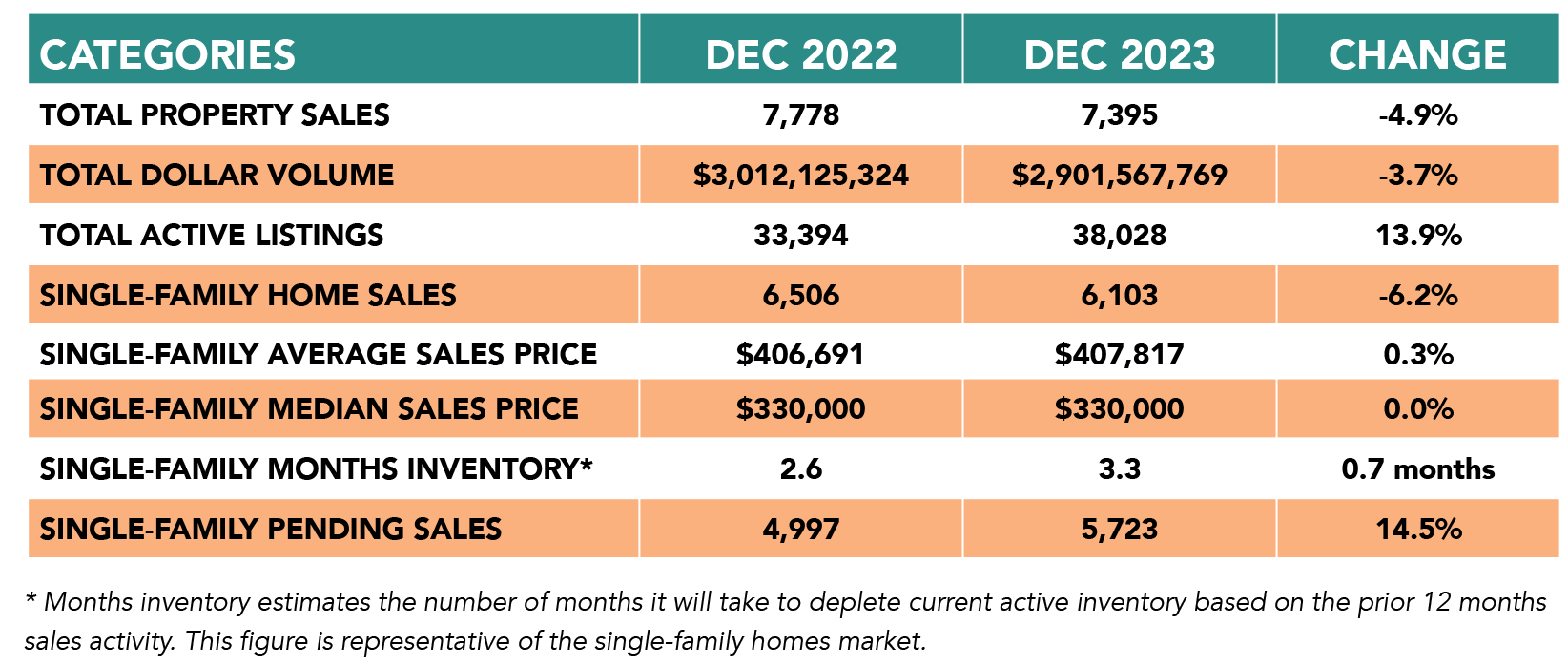

- Months inventory continued to fall month over month from 3.5 months to 3.3 months.

- Total sales fell very slightly MOM

- Average pricing is up 0.3% YOY and median pricing is flat (0.0%) YOY.

- The 10 year US treasury sits at 3.93% as of this moment, however, has been up and down after CPI data was released yesterday

- CPI numbers released yesterday were up 3.4% YOY and up 0.3% from November (greater than expected).

https://www.bls.gov/cpi/

https://www.har.com/content/department/mls?y=2024&m=01

MY TAKE

- This last month was a slower than normal December for me, but the month of January has been busy. Very busy. I had 5 past/current/future buyer clients call me on 1/1 and 1/2 to discuss immediate and future buying plans, and all referenced lower interest rates as well as trying to get ahead of the market in 2024. I've learned over the years that when I have such large amounts of conversations that all say the same thing in a short amount of time, it usually is indicative of a trend. It got busy enough one day that Felipe and I had to tag team showings in each others markets, which is abnormal.

- If rates fall to where the market believes they will (I'm not sure they will fall quite as fast as the market believes), I believe this will be a busy year, and prices will be driven up. Probably not 20% in a year like we saw in years past, but I believe they will be up market-wide (and not just in submarkets / pockets like we saw in 2023 in the Villages, Oak Forest, etc).

- CPI numbers came in higher than expected, which caused the 10 year to shoot up yesterday, but since then, it's DOWN. Core inflation was right at expectations, and I think this was the cause for the market pulling back from the ledge. It's definitely still something we should be watching.

- Has the Fed actually pulled off a soft landing? Have wee seen the end of inflation? Maybe just the slowing of disinflation? 2024 is going to be another interesting year, I'd say.

Sponsor Message: We Split Commissions. Full Service Agents in Austin, Bryan-College Station, Dallas-Fort Worth, Houston and San Antonio. Red Pear Realty