Houston

https://www.har.com/content/newsroom

https://www.har.com/content/newsroom

Quote:

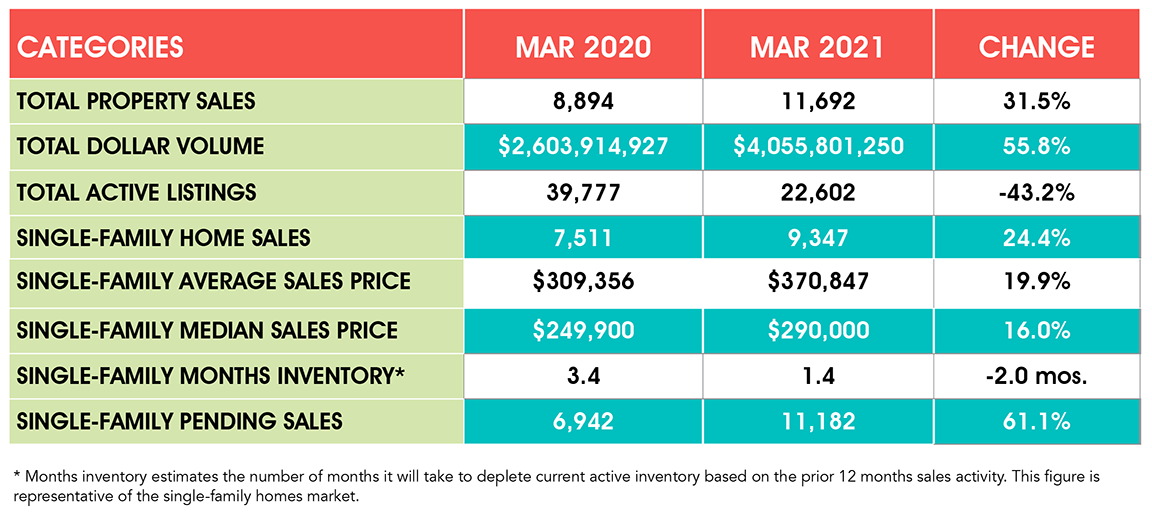

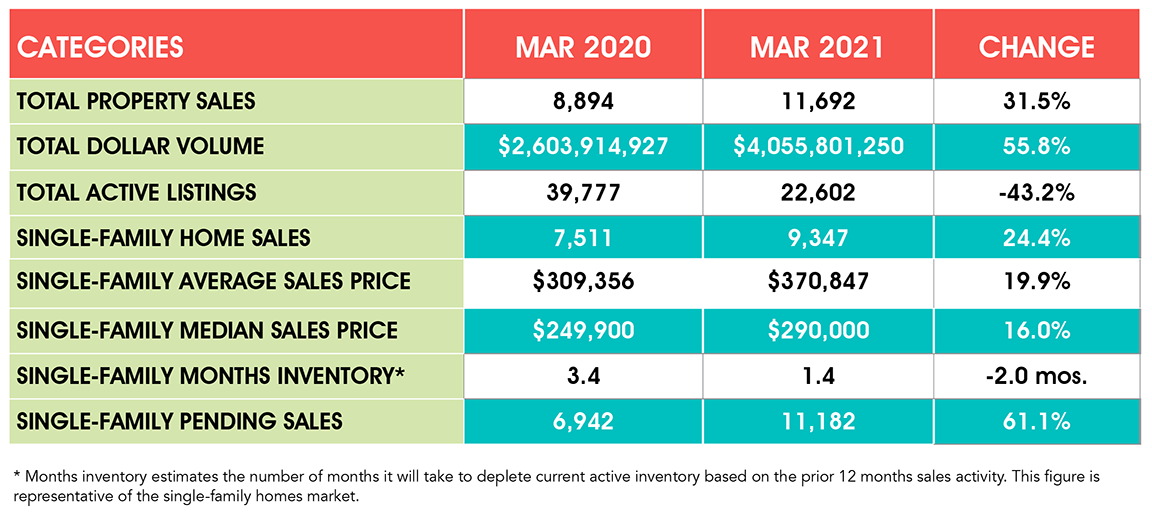

Homes priced between $500,000 and $750,000 led the way in sales volume in March with a 96.8 percent year-over-year surge. That was followed by the luxury segment ($750,000 and above), which soared 89.9 percent. With high-end home shopping dominating the market, pricing was pushed to historic highs. The single-family home average price climbed 19.9 percent to $370,847 and the median price increased 16.0 percent to $290,000.

Quote:

A 5.8 percent year-over-year decline in new listings combined with another strong month of sales drove single-family homes inventory down to a 1.4-months supply compared to 3.4 months a year earlier. That is the lowest inventory level of all time. Housing inventory nationally stands at a 2.0-months supply, according to the National Association of Realtors (NAR).

Sponsor Message: We Split Commissions. Full Service Agents in Austin, Bryan-College Station, Dallas-Fort Worth, Houston and San Antonio. Red Pear Realty