https://www.dailymail.co.uk/news/article-11677119/Tesla-says-4Q-profit-59-expects-strong-margins.html

Tesla is Finished

https://www.dailymail.co.uk/news/article-11677119/Tesla-says-4Q-profit-59-expects-strong-margins.html

It's over.Quote:

According to a new study from S&P Global Mobility, several popular car brands are struggling to retain customers who exhibit "nomadic" loyalty patterns, including Acura, Audi, Dodge, GMC, Mazda, Mercedes-Benz, Ram, and Volkswagen.

These brands may be able to attract buyers from rival companies but are unlikely to turn them into loyal customers, with many nomadic buyers moving on to other brands after their first purchase.

Tesla, however, stands out as the best at retaining first-time buyers, with an impressive 83% share of first-time owners and the lowest "one-and-done" rate of just 39%, according to the study. Other brands that performed well in the study include BMW, Hyundai, Kia, Jeep, and Subaru.

S&P 500 up 4.5%

Nasdaq up 7.5%

Damn those MEGA MAGA indexes! So much more righter than Elon!

nortex97 said:

Tesla leads at customer retention, 'conquest' customers.It's over.Quote:

According to a new study from S&P Global Mobility, several popular car brands are struggling to retain customers who exhibit "nomadic" loyalty patterns, including Acura, Audi, Dodge, GMC, Mazda, Mercedes-Benz, Ram, and Volkswagen.

These brands may be able to attract buyers from rival companies but are unlikely to turn them into loyal customers, with many nomadic buyers moving on to other brands after their first purchase.

Tesla, however, stands out as the best at retaining first-time buyers, with an impressive 83% share of first-time owners and the lowest "one-and-done" rate of just 39%, according to the study. Other brands that performed well in the study include BMW, Hyundai, Kia, Jeep, and Subaru.

They probably my have good retention because until very recently, there wasn't much completion if you were wanting an electric car.

hph6203 said:

Stock is up 14% since the tweet in the OP.

S&P 500 up 4.5%

Nasdaq up 7.5%

Damn those MEGA MAGA indexes! So much more righter than Elon!

Rest in Pepperoni OP.

Bury him next to "Two Teas" Lot Y and Mr "transitory inflation" Oldag2020 in the graveyard of ******ed predictions.

I don't mean this as a slight/snark toward you as I don't have any idea where you're coming from on this stuff but that is such a lazy take. The auto industry is exceptionally competitive and that measures nomad/conquest buyers in 2022 for all brands.TXAG 05 said:nortex97 said:

Tesla leads at customer retention, 'conquest' customers.It's over.Quote:

According to a new study from S&P Global Mobility, several popular car brands are struggling to retain customers who exhibit "nomadic" loyalty patterns, including Acura, Audi, Dodge, GMC, Mazda, Mercedes-Benz, Ram, and Volkswagen.

These brands may be able to attract buyers from rival companies but are unlikely to turn them into loyal customers, with many nomadic buyers moving on to other brands after their first purchase.

Tesla, however, stands out as the best at retaining first-time buyers, with an impressive 83% share of first-time owners and the lowest "one-and-done" rate of just 39%, according to the study. Other brands that performed well in the study include BMW, Hyundai, Kia, Jeep, and Subaru.

They probably my have good retention because until very recently, there wasn't much completion if you were wanting an electric car.

If decreasing buyer loyalty is a 'thing' that exists as more competitors shelve ICE models in favor of BEV's to compete with Tesla, show me the statistics/data. Tesla is selling every vehicle they can make, at a higher margin than their competitors, with a more loyal customer base despite the leftist drivel/freak out about Elon buying Twitter in the US. From a business perspective that's incredible to me; what they are on as a growth/brand trend line, and don't get me wrong I detest that BEV's are being more broadly adopted/pushed.

To be brief, if there is a market where 100 apples are bought, and 20 of them last month were granny smiths, yes, 15 of those granny smiths are tesla's. If next year 50 of those are granny smiths and Tesla sells 30 of those, sure, their market share in the segment went down, but sales are way up. (You mays guys can check my analyses on that).

They essentially have to lose market share in EV's as a percent of those sold, yet they will also grow market share overall in total vehicle's sold (including ICE), and very likely continue to dominate customer retention stats. They still utterly dominate the 'rich guy with a custom plate who can't wait to tell you about how great his tesla is, and maybe cross fit too' market for EV's, and will have a low end model in a short amount of time too.

IslanderAg04 said:

Made about 10k on Tesla the last few days. Thanks libs.

LOL thinking libs have anything to do w this.

LCE said:IslanderAg04 said:

Made about 10k on Tesla the last few days. Thanks libs.

LOL thinking libs have anything to do w this.

That's just my dig. Bought the dip, made some quick money.

dont forget boyd crowder said gas prices would go downBadMoonRisin said:hph6203 said:

Stock is up 14% since the tweet in the OP.

S&P 500 up 4.5%

Nasdaq up 7.5%

Damn those MEGA MAGA indexes! So much more righter than Elon!

Rest in Pepperoni OP.

Bury him next to "Two Teas" Lot Y and Mr "transitory inflation" Oldag2020 in the graveyard of ******ed predictions.

LCE said:

No you didn't.

How do you mean?

nortex97 said:I don't mean this as a slight/snark toward you as I don't have any idea where you're coming from on this stuff but that is such a lazy take. The auto industry is exceptionally competitive and that measures nomad/conquest buyers in 2022 for all brands.TXAG 05 said:nortex97 said:

Tesla leads at customer retention, 'conquest' customers.It's over.Quote:

According to a new study from S&P Global Mobility, several popular car brands are struggling to retain customers who exhibit "nomadic" loyalty patterns, including Acura, Audi, Dodge, GMC, Mazda, Mercedes-Benz, Ram, and Volkswagen.

These brands may be able to attract buyers from rival companies but are unlikely to turn them into loyal customers, with many nomadic buyers moving on to other brands after their first purchase.

Tesla, however, stands out as the best at retaining first-time buyers, with an impressive 83% share of first-time owners and the lowest "one-and-done" rate of just 39%, according to the study. Other brands that performed well in the study include BMW, Hyundai, Kia, Jeep, and Subaru.

They probably my have good retention because until very recently, there wasn't much completion if you were wanting an electric car.

If decreasing buyer loyalty is a 'thing' that exists as more competitors shelve ICE models in favor of BEV's to compete with Tesla, show me the statistics/data. Tesla is selling every vehicle they can make, at a higher margin than their competitors, with a more loyal customer base despite the leftist drivel/freak out about Elon buying Twitter in the US. From a business perspective that's incredible to me; what they are on as a growth/brand trend line, and don't get me wrong I detest that BEV's are being more broadly adopted/pushed.

To be brief, if there is a market where 100 apples are bought, and 20 of them last month were granny smiths, yes, 15 of those granny smiths are tesla's. If next year 50 of those are granny smiths and Tesla sells 30 of those, sure, their market share in the segment went down, but sales are way up. (You mays guys can check my analyses on that).

They essentially have to lose market share in EV's as a percent of those sold, yet they will also grow market share overall in total vehicle's sold (including ICE), and very likely continue to dominate customer retention stats. They still utterly dominate the 'rich guy with a custom plate who can't wait to tell you about how great his tesla is, and maybe cross fit too' market for EV's, and will have a low end model in a short amount of time too.

All I meant was, that for years, if you wanted a reliable electric car, your option was Tesla or Tesla, so their retention was naturally going to be good, because when it came time for a new car, if you wanted to stay electric, you pretty much had to get a Tesla. Now, almost every manufacturer has an electric option, there are a lot more choices.

LCE said:

No you didn't.

Sorry i made money.

So did you sell your Tesla stock positions in mid-December?aggievaulter07 said:Well, even back with $TSLA was skyrocketing, I had plenty of smart investors telling me that ELON was the risk for investing in $TSLA, not the company itself. Looks like their intuition was spot on.nortex97 said:This does not add credibility to your judgment/analytical abilities as context the way you think it does.aggievaulter07 said:

For Context: I used to be a borderline Elon fanboy. I own TWO Teslas, and 100% of mine, and my wife's IRA money is in $TSLA, and 90% of my Brokerage money is in $TSLA. I'm learning the obvious lesson of "Don't put all your eggs in one basket", the hard way.

I'm not surprised, though.

Shares of Tesla Inc up 1.3% at $175.64 premarket

— *Walter Bloomberg (@DeItaone) February 1, 2023

The EV maker plans to step up output at its Shanghai plant over the next two months to meet demand ignited by aggressive price cuts on its best-selling models, according to a planning memo seen by Reuters$TSLA

Does it warm your heart that of the (roughly) $30K in profit Tesla earned from your two vehicles (way more than competitors), probably around $5K-10K of that went to Elon?

nortex97 said:So did you sell your Tesla stock positions in mid-December?aggievaulter07 said:Well, even back with $TSLA was skyrocketing, I had plenty of smart investors telling me that ELON was the risk for investing in $TSLA, not the company itself. Looks like their intuition was spot on.nortex97 said:This does not add credibility to your judgment/analytical abilities as context the way you think it does.aggievaulter07 said:

For Context: I used to be a borderline Elon fanboy. I own TWO Teslas, and 100% of mine, and my wife's IRA money is in $TSLA, and 90% of my Brokerage money is in $TSLA. I'm learning the obvious lesson of "Don't put all your eggs in one basket", the hard way.

I'm not surprised, though.Shares of Tesla Inc up 1.3% at $175.64 premarket

— *Walter Bloomberg (@DeItaone) February 1, 2023

The EV maker plans to step up output at its Shanghai plant over the next two months to meet demand ignited by aggressive price cuts on its best-selling models, according to a planning memo seen by Reuters$TSLA

Does it warm your heart that of the (roughly) $30K in profit Tesla earned from your two vehicles (way more than competitors), probably around $5K-10K of that went to Elon?

No. I bought more at $120 a few weeks ago.

aggievaulter07 said:Well, Republicans have only won the popular vote a few times in my lifetime, and I'm almost 40.Quote:

You are truly the delusional one.

You think 50%+ are pissed off by his politics? Sheesh, you live in a false reality.

But, *I* am the delusional one...This is not a rational dude. Not right now, at least.Quote:

For every fragile, virtue signaling, lost soul, lefty that Elon loses by being rational, and a classic liberal, he gains at least one from the middle or middle right.Quote:

All stocks down recently, btw. Not specifically Tesla.

I'm not saying other stocks aren't also down, but...Tesla stock is now down 52% since Elon Musk offered to buy Twitter in April, losing over half a trillion dollars in market valuation.

— 🦀 Jon Schwarz 🦀 (@schwarz) December 14, 2022

In just the six and a half weeks since Musk took over Twitter on October 28, Tesla stock is down 31%, losing $225 billion in value. pic.twitter.com/W1ukdbpkte

Elon was a big part of Tesla stock pumping in 2020 and 2021, but he's also a huge part of it tanking right now.

For Context: I used to be a borderline Elon fanboy. I own TWO Teslas, and 100% of mine, and my wife's IRA money is in $TSLA, and 90% of my Brokerage money is in $TSLA. I'm learning the obvious lesson of "Don't put all your eggs in one basket", the hard way.

Rock solid proof that lefty's are incapable of learning.

C'mon, man!

nortex97 said:

The funniest thing to me is that he fell for my question, and claims now to have doubled/tripled down on not diversifying beyond Tesla stock, after the big slide last year, just last month.

C'mon, man!

I'm a glutton for punishment, I guess. Tesla's fundamentals and outlook blow the rest of that industry out of the water so, yeah, it still seems like a great long-term investment. I've got roughly 20 years before I retire, and I'm not a day-trader, so yeah… I bought more.

I also gained and lost half a mil in Crypto in 18 months, and had about $15k stolen by FTX, so…

…yeah, don't take investing advice from me.

aggievaulter07 said:nortex97 said:

The funniest thing to me is that he fell for my question, and claims now to have doubled/tripled down on not diversifying beyond Tesla stock, after the big slide last year, just last month.

C'mon, man!

I'm a glutton for punishment, I guess. Tesla's fundamentals and outlook blow the rest of that industry out of the water so, yeah, it still seems like a great long-term investment. I've got roughly 20 years before I retire, and I'm not a day-trader, so yeah… I bought more.

I also gained and lost half a mil in Crypto in 18 months, and had about $15k stolen by FTX, so…

…yeah, don't take investing advice from me.

JCE_02 said:Neehau said:

Mars would be a good bet to find extensive lithium deposits, given the extensive evidence that its surface was shaped by flowing water.

More lithium might be found in the icy outer Solar System, where there's plenty of water available to pull the metal out of rocks. Lithium could be present in low concentrations in the oceans beneath the icy surfaces of Jupiter's moon Europa and Saturn's Enceladus. The greatest lithium deposits (basically a limitless supply) can be found in seawater on Earth. However, we don't yet have a method for extracting dilute lithium from Earth's oceans, and Enceladus's alien seas could prove an even bigger challenge.

Am I the only one reading this? Their solution is to mine on mars?

Mars or Fantasyland, either one.

Mission to Mars is off the table until all sides can agree on DEI and environmental standards for mining of indigenous unicorn farts on the Martian soil.DTP02 said:JCE_02 said:Neehau said:

Mars would be a good bet to find extensive lithium deposits, given the extensive evidence that its surface was shaped by flowing water.

More lithium might be found in the icy outer Solar System, where there's plenty of water available to pull the metal out of rocks. Lithium could be present in low concentrations in the oceans beneath the icy surfaces of Jupiter's moon Europa and Saturn's Enceladus. The greatest lithium deposits (basically a limitless supply) can be found in seawater on Earth. However, we don't yet have a method for extracting dilute lithium from Earth's oceans, and Enceladus's alien seas could prove an even bigger challenge.

Am I the only one reading this? Their solution is to mine on mars?

Mars or Fantasyland, either one.

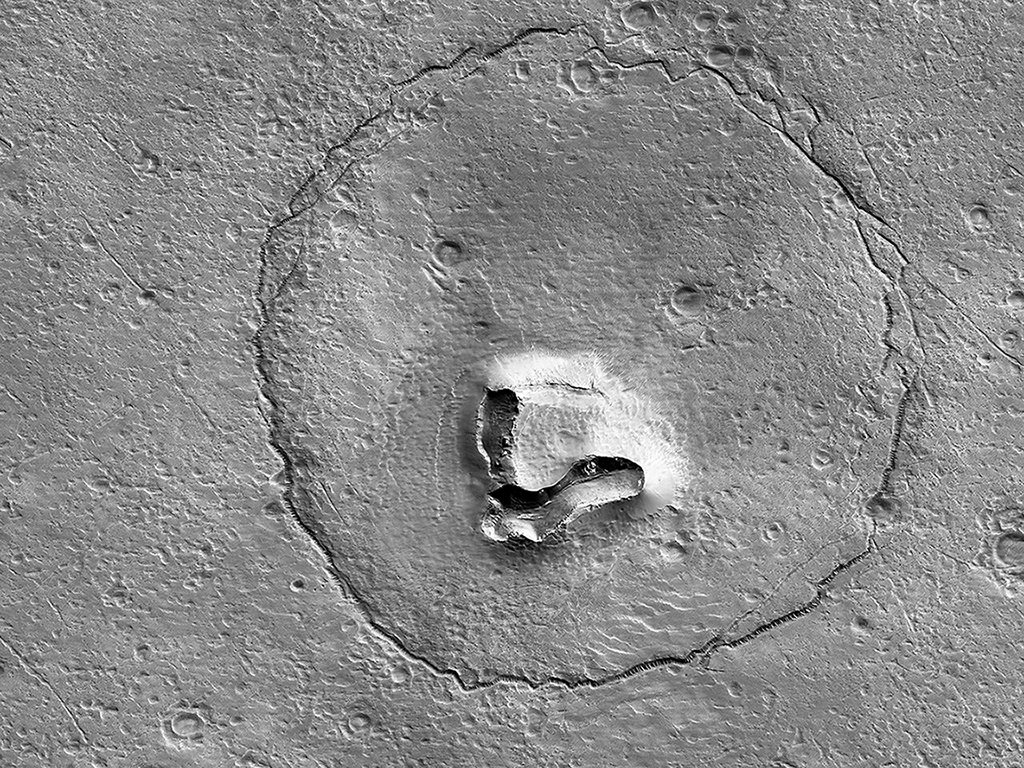

More disturbing is the picture this week showing the Russians have yet again beaten us to the bunch and staked our their claim using the well known signature of the Mother land:

"You can never go wrong by staying silent if there is nothing apt to say" -Walter Isaacson

What folks don't understand is that those "competitor" EV options are 10 years behind Tesla in technology and battery management systems. You could give Ford and GM the same exact batteries that Tesla uses in their cars and the range would not be as good, the battery life would not compare, and the acceleration/performance would not be there. It's all about the software. The motor is actually easier to copy than the software. Tesla already has a million mile model 3 and is still going strong. There's this narrative that you are going to have to turn in your EV because it needs a new battery pack after five years. False. Maybe with your legacy auto EV's but not Tesla.TXAG 05 said:nortex97 said:I don't mean this as a slight/snark toward you as I don't have any idea where you're coming from on this stuff but that is such a lazy take. The auto industry is exceptionally competitive and that measures nomad/conquest buyers in 2022 for all brands.TXAG 05 said:nortex97 said:

Tesla leads at customer retention, 'conquest' customers.It's over.Quote:

According to a new study from S&P Global Mobility, several popular car brands are struggling to retain customers who exhibit "nomadic" loyalty patterns, including Acura, Audi, Dodge, GMC, Mazda, Mercedes-Benz, Ram, and Volkswagen.

These brands may be able to attract buyers from rival companies but are unlikely to turn them into loyal customers, with many nomadic buyers moving on to other brands after their first purchase.

Tesla, however, stands out as the best at retaining first-time buyers, with an impressive 83% share of first-time owners and the lowest "one-and-done" rate of just 39%, according to the study. Other brands that performed well in the study include BMW, Hyundai, Kia, Jeep, and Subaru.

They probably my have good retention because until very recently, there wasn't much completion if you were wanting an electric car.

If decreasing buyer loyalty is a 'thing' that exists as more competitors shelve ICE models in favor of BEV's to compete with Tesla, show me the statistics/data. Tesla is selling every vehicle they can make, at a higher margin than their competitors, with a more loyal customer base despite the leftist drivel/freak out about Elon buying Twitter in the US. From a business perspective that's incredible to me; what they are on as a growth/brand trend line, and don't get me wrong I detest that BEV's are being more broadly adopted/pushed.

To be brief, if there is a market where 100 apples are bought, and 20 of them last month were granny smiths, yes, 15 of those granny smiths are tesla's. If next year 50 of those are granny smiths and Tesla sells 30 of those, sure, their market share in the segment went down, but sales are way up. (You mays guys can check my analyses on that).

They essentially have to lose market share in EV's as a percent of those sold, yet they will also grow market share overall in total vehicle's sold (including ICE), and very likely continue to dominate customer retention stats. They still utterly dominate the 'rich guy with a custom plate who can't wait to tell you about how great his tesla is, and maybe cross fit too' market for EV's, and will have a low end model in a short amount of time too.

All I meant was, that for years, if you wanted a reliable electric car, your option was Tesla or Tesla, so their retention was naturally going to be good, because when it came time for a new car, if you wanted to stay electric, you pretty much had to get a Tesla. Now, almost every manufacturer has an electric option, there are a lot more choices.

It's also not about Elon. It's the thousands of talented engineers that work there. Between SpaceX and Tesla we are talking about the best of the best in software engineering, manufacturing, mechanical and chemical engineering, metallurgy, electronics, and AI. Zero marketing. They would rather spend the money on engineering and advanced lab equipment.

I understand people that don't want to own an EV, but right now and in the next few years buying any EV other than a Tesla is just not wise. They are a bit pricey still but just save your money if you can't afford one. Wait for legacy EV technology to prove out. There's going to be a whole lot of recalls over the next couple of years. They won't be solved with an overnight download like Tesla's are 99% of the time either.

The only "real" competition right now is a Chinese company called BYD. Building a prototype EV that looks great but is not scalable or profitable is not competition. It's a path to bankruptcy.

Tesla's build quality had never been good and continues to get worse. They are going to get cleaned by the big auto makers

terradactylexpress said:

Lol ok Elon.

Tesla's build quality had never been good and continues to get worse. They are going to get cleaned by the big auto makers

I've seen the OP's other threads. It's the latter.aggievaulter07 said:

I still think that anyone who thinks "Tesla is finished" is either willfully ignorant, or stupid.